Ben Bernanke - Central Banks, an Important Source of the Great Moderation(!!?)

On February 20, 2004 Ben Bernanke gave one of the most remarkable speeches of his lengthy Fed career; he served at the Fed from 2002-2005 and 2006-2014. He claimed "improvements in monetary policy, though certainly not the only factor, have probably been an important source of the Great Moderation." (1) The Great Moderation was a term economists and central bankers came up with to explain the purported - and completely mythical - claim that modern economies, controlled as they are by central banks, were benefiting from reduced economic volatility. In others, words, economies weren't subject to the huge swings between booms and busts that they had been, and central banks were a large contributor to this salutary benefit.

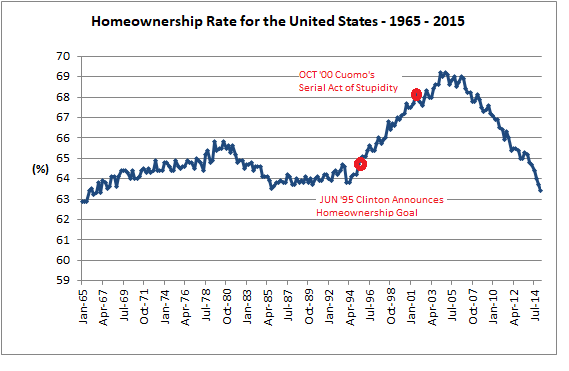

It was a remarkable time for Ben Bernanke to pass himself off as some sort of economic savant or soothsayer, particularly so when it came to the beneficial impact of central banks. While Bernanke was taking credit for all the great things central banks were doing to economies around the world, the housing bubble that Bernanke and his Fed colleagues were laboring day and night to blow up, was two months from reaching its zenith! In terms of homeownership, the housing bubble peaked in April 2004 - just two months after the Great Moderation speech was given!

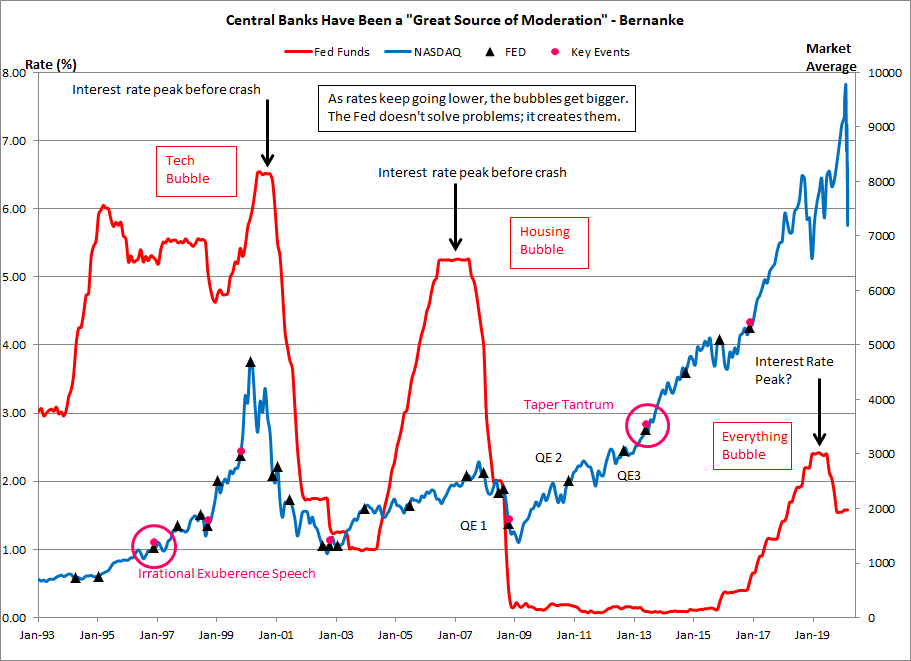

More generally, the disastrous impact the Federal Reserve has had on the US economy can be seen in the chart below. It is useful to recall that the US went approximately 70-years with a bubble to speak of. Prior to 2000, the last bubble of any consequence in the US was the 1929 stock bubble, and, of course, the Fed had a leading role in that debacle. (2) However, since the year 2000, the US has suffered from three enormous bubbles - tech stocks, housing and 'everything.' More significantly, each bubble was much larger than the one which preceded it; the housing bubble dwarfed the tech bubble, and today's everything bubble dwarfs the housing bubble. As the chart makes clear, what drove the bubbles higher and higher was the Federal Reserve driving rates lower and lower.

Fed apologists, will claim that today's market chaos is only the result of the Corona virus. The Corona virus is merely the pin that pricked the latest of the three enormous Fed fueled bubbles. It is interesting to note that the December 2018 sell-off - which proved to be a harbinger of things to come - occurred before anyone had heard of the Corona virus or the Wuhan Institute of Virology. (3) Moreover, the Corona virus hardly explains why the Fed intervention associated with today's 'everything' bubble collapsing will completely dwarf the interventions that followed in the wake of the 2008 debacle.

The fundamental question remains; how could the Fed be performing a positive economic role when crises are occurring with an unprecedented frequency while become increasingly more severe This chart makes it clear; Ben Bernanke was completely wrong when he claimed the Fed was a major source of the "Great Moderation.' Instead, this chart makes it clear that the Fed is the primary driver of all the economic chaos of the past twenty-five years.

This is just getting started.

Peter Schmidt

Sugar Land, TX

March 15, 2020

PS - As always, if you like what you read, please register with the site. It just takes an e-mail address and I don't share this e-mail address with anyone. The more people who register with the site, the better case I can make to a publisher to press on with publishing my book. Registering with the site will give you access to the entire Confederacy of Dunces list as well as the financial crisis timeline.

Help spread the word to anyone you know who might be interested in the site or my Twitter account. I can be found on Twitter @The92ers

ENDNOTES

1. "The Great Moderation," Remarks by Ben Bernanke at the Eastern Economic Association, Washington, DC, February 20, 2004 https://www.federalreserve.gov/boarddocs/speeches/2004/20040220/

2. Great Depression Timeline: The Fed and the Bank of England Had a Baby and They Called it the Great Depression." http://www.the92ers.com/blog/great-depression-timeline-fed-and-bank-england-had-baby-and-they-called-it-great-depression

3. "Chickens Coming Home to Roost," http://www.the92ers.com/blog/chickens-coming-home-roost-fed-and-25-years-price-supression