Understanding the timeline

Perhaps counterintuitively, the timeline which traces the development of the financial crisis begins well before the peak of the crisis, September 2008, or even the peak of the housing bubble, April 2004. The timeline begins on August 15, 1971 – the day President Nixon temporarily suspended what remained of the gold exchange standard agreed upon at Bretton Woods in 1944. When Nixon removed the last vestiges of gold from the system of money and credit, he removed the one thing that could constrain the profligate central bankers at the Fed. Freed from the discipline of gold, the 1970s vintage central bankers/central planners at the Fed unleashed an inflationary firestorm. To combat the resulting high inflation, on October 6, 1979 Paul Volcker was forced to declare war on inflation. Volker’s war on inflation was successful, but among the many casualties was the Savings and Loan (S&L) industry. To help the S&Ls manage the high interest rates needed to defeat inflation, the Kemp-Roth tax plan of August 1981 included a massive tax break for the S&Ls. This tax break helped create an enormous market for mortgage securities on Wall Street. The resulting boom in mortgage “securitization” then played a major role in the financial crisis.

Another major contributor to the financial crisis that has its origins in the 1970s was a completely new way of thinking about economics. Historically, economics was always considered a social science. Because economics deals with the choices made by fully fallible human beings and not what uranium experiences during nuclear fission, this made perfect sense. Indeed, all the great economists of history - Adam Smith, David Ricardo and Carl Menger - were essentially moral philosophers, not mathematicians. Regrettably, Paul Samuelson of MIT considered economics a hard science like physics or engineering. As a hard science, economics required all sorts of complicated, obtuse mathematics. Samuelson – laughably it hardly needs to be said – believed that the same sort of mathematics that governs the orbit of the planets about the sun could be employed to describe economic transactions between human beings. The fallacy in all this is planets will always act the same way under the force of gravity. However, and in sharp contrast, human beings tend to walk into walls and put their shirts on backward for no obvious reason at all. The apparent – but mythical - mathematical precision of the “new” economics gave central bankers at the Fed and traders on Wall Street the confidence to use unprecedented amounts of financial leverage. The economic models developed at MIT, Harvard, Wharton and elsewhere worked until they didn’t. When they stopped working, the financial crisis started and the economy imploded.

How the Federal Reserve impacted the financial crisis

All the considerable stupidity of Ivy League economics departments and the Clinton administration, acting in concert with Wall Street’s duplicitous greed, could not have amounted to anything had it not been for the Federal Reserve of Alan Greenspan and Ben Bernanke. As far as their collective role in the crisis is concerned, Greenspan and Bernanke basically drove a dump truck full of burning nitroglycerine into an atomic bomb factory. It was their policy of unprecedentedly low rates that fueled the terminal stages of the housing bubble. As mortgage rates dropped in the early 2000s, prices for homes shot higher and higher. It became commonplace for people earning less than $50,000 per year to purchase homes for $500,000 or more. For a time – and because of the criminal irresponsibility of Greenspan and Bernanke – the absurd mortgage math made sense. The house could be purchased with almost no money down and a two-year teaser rate at some equally absurd rate of interest – say 1%. In two years, the house might appreciate by 15-20% and the homeowner could either refinance or sell the house for a profit. Everything worked until home prices simply stopped climbing. Once home prices stopped rising, the housing market – which had degenerated into little more than a Ponzi scheme on a national scale– and the United States were doomed.

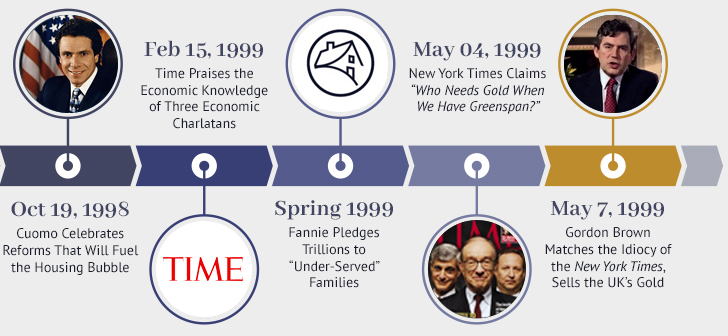

The timeline goes into all this and more

The timeline is rigorously documented and lays out in detail how the crisis developed and who caused the crisis to develop. It does not need to be read in chronological order and is perhaps best used as a reference. Indeed, a book has been written to accompany the timeline and it is entitled Elites in Name Only – the Financial Crisis. Feel free to download a copy of the timeline and review it at your leisure. If you would like to share the timeline with a friend or colleague, then please direct these people to the website and have them download a copy of the timeline for themselves. Hopefully, by demonstrating that a large number of people have downloaded the timeline – or the accompanying Confederacy of Dunces list – a publisher will become interested in publishing Elites in Name Only – the Financial Crisis.

In the meantime, continue to come back and visit the site. The site will be updated with articles related to the financial crisis or the continuing pernicious influence of Wall Street finance, Ivy League economics departments and the Federal Reserve. It won’t be hard to come up with article topics!

Peter Schmidt

Download a copy of the timeline

Meet the author