Chickens Coming Home to Roost - Greenspan and Bernanke Confront Market, Fold Like Origami - Part II

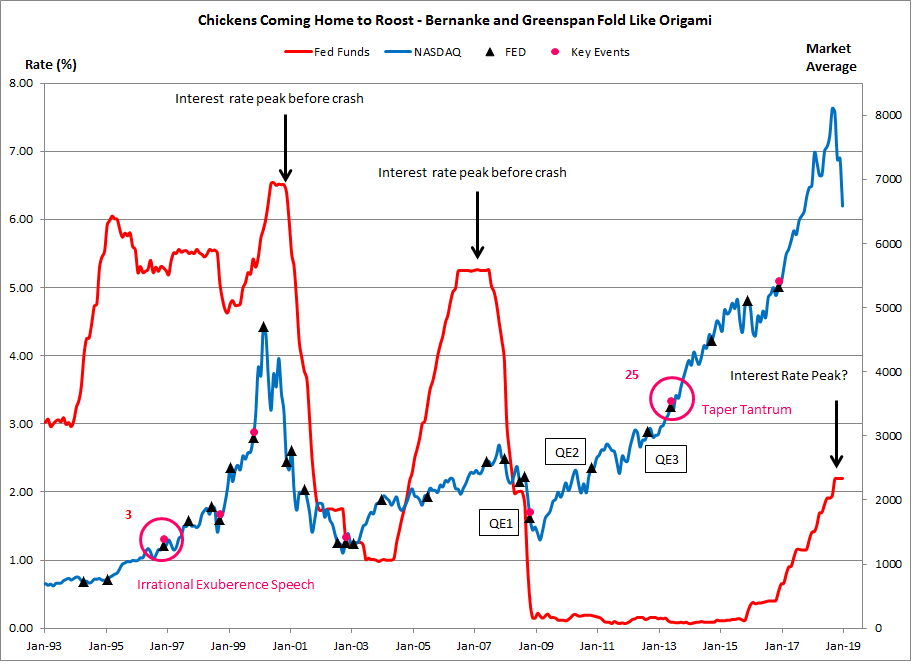

This week's blog post is a continuation from last week's. In last week's blog post Alan Greenspan's "irrational exuberance" speech from December 1996 was reviewed. The speech made it clear that Alan Greenspan attempted to perform the role of the sober chaperone recommended by former Fed chair William McChesney Martin. However, performing this role would have almost certainly cost Greenspan a considerable fraction of his by then burgeoning popularity. There is a central banking adage that holds a good central banker will always be unpopular, and Alan Greenspan showed no interest in being unpopular. Greenspan never followed through on the "irrational exuberance speech. Indeed, rather than confronting or challenging the market excesses raging all around him, Greenspan indulged them. He folded like origami and the market soared to unsustainable and unwarranted heights. When the crash finally came, it was epic.

One of the many ways the completely bogus science of economics differs from a real science like engineering is economists, unlike engineers, never learn from their mistakes. Engineers pour over failed designs, and scrutinize every decision made in the design process in the interest of finding out what went wrong. Of course, an outcome from this effort is all sorts of new knowledge and understanding is obtained. This knowledge and understanding becomes input into new designs, and rarely, if ever, are the same mistakes repeated twice.

As will be demonstrated here, Ben Bernanke clearly made the same mistake Alan Greenspan made in the wake of his "irrational exuberance" speech. Exactly like Greenspan, Bernanke attempted to instill some sobriety into the market and at the first sign of push-back from the market, he folded - just like origami.

The circumstances of Bernanke folding relate to the Quantitative Easing (QE) programs the Federal Reserve first implemented in November 2008, close to what would be the stock market lows. In its QE programs, the Federal Reserve created literally trillions of dollars out of thin air, and used this money to purchase all sorts of financial assets. There were a total of three rounds of QE and they proceeded as follows;

- QE1 (November 2008) - Fed to purchase up to $100-billion in Fannie Mae/Freddie Mac debt as well as $500-billion in mortgage securities

- QE2 (November 2010) - Fed to purchase at least $600 billion in Treasury securities (government debt)

- QE3 (September 2012) - Fed to purchase $40-billion in bonds and mortgage backed securities indefinitely. As part of QE3, the Fed also announced that interest rates would remain at 0% through 2015. In addition, in December 2012 the monthly asset purchases were increased to $85-billion.

Stripped of its Harvard and MIT pedigrees, Ben Bernanke's QE programs were purely a bailout of all the firms and individuals who helped cause the financial crisis in the first place. The bonds and mortgage securities that the Fed purchased with its QE programs were worth pennies on the dollar, and the Fed paid full-price for them. As shown in the chart, the QE programs had a significant impact on stock prices. Shortly after QE1 was implemented, the stock market took off. It would proceed on its longest uninterrupted advance in history and kept rising for years on end.

By June 2013, the NASDAQ was back above 3000. While this was down from the peak of the tech bubble mania, 5000, it was higher than the NASDAQ peak immediately before the housing crash. It was also in June 2013 that Ben Bernanke discussed "tapering" the Fed's asset purchases. Here is Bernanke in his own words;

"If the incoming data are broadly consistent with this forecast, the Committee currently anticipates that it would be appropriate to moderate the monthly pace of purchases later this year. And if the subsequent data remain broadly aligned with our current expectations for the economy, we would continue to reduce the pace of purchases in measured steps through the first half of next year ending, ending purchases around mid-year." (1)

Exactly as with Greenspan's irrational exuberance speech, Wall Street wasn't buying what Ben Bernanke was selling. Over the next few days of trading the stock market fell about 4%. Bernanke, like Greenspan before him, folded. He didn't follow through on his promise to begin tapering in 2013. Tapering wouldn't being until 2014 and asset purchases wouldn't end until October 2014. From June 2013 to October 2014, the NASDAQ went up over 30% and would never look back until it soared above 8000 in September 2018, a gain of 130% since the taper tantrum.

CONCLUDING REMARKS:

What happened in the wake of Greenspan failing to follow through on the irrational exuberance speech is a matter of historical record and can be seen in the chart above. What will happen as a result of Bernanke failing to follow through on his original plan to end the Fed's QE programs is not clear. However, the market would appear to be in a very tenuous position, and the prospect of the Fed being able to return interest rates to anything approaching "normal," is nil. Again the chart above makes this clear.

In spite of the fact the ramifications of Ben Bernanke failing to follow through on his initial tapering program are unknown, conclusions can still be drawn from the Greenspan/Bernanke Fed's record of constantly indulging the market. This conclusion was best made by Dr. Benjamin Anderson in Economics and the Public Welfare. Here Anderson was criticizing the Fed of the 1920's and its leader Benjamin Strong for an 'extreme ductility of mismanaged credit.' However, this criticism is directly applicable to Alan Greenspan and Ben Bernanke;

"In the United States, with our inelastic currency system, we had several unnecessary money panics....the panic of 1907 was almost purely a money panic....It is noteworthy, however, that the money panic of 1907 had nothing like the grave consequences of the collapse of 1929. The money stringency of 1907 pulled us up before the boom had gone to far. There was no such qualitative deterioration of credit preceding the panic of 1907 as there was before the panic of 1929. The very inelasticity of our prewar system made it safer than the extreme ductility of mismanaged credit under the Federal Reserve System." (2)

Anderson's example of "extreme ductility of mismanaged credit" causing an enormous deterioration of credit perfectly describes the Fed of the Greenspan/Bernanke era.

Peter Schmidt

27 JAN 2019

PS - As always if you like what you read, please consider registering with the site. It just takes an e-mail address, and I don't share this e-mail address with anyone. The more people who register with the site, the better case I can make to a publisher to press on with publishing my book! Registering with the site will give you access to the entire Confederacy of Dunces list as well as the Financial Crisis timeline. Both of these are a treasure trove of information on the crisis and the long-running problems that led to it.

ENDNOTES:

(1) Ben Bernanke press conference, June 19, 2013 (see page 5 of the pdf referenced here), https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20130619.pdf

(2) Benjamin M. Anderson, Economics and the Public Welfare - A Financial History of the United States, Liberty Press, Indianapolis, IN, 1979, p. 24