Economic Performance: One of the Many Things an MIT PhD Knows Nothing About

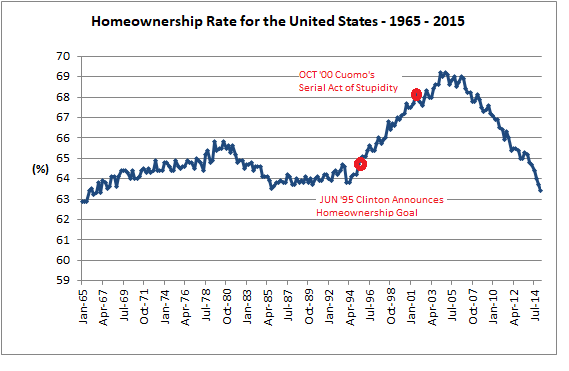

One of the signature moments of the Federal Reserve's complete ignorance of the enormous housing and credit bubble that was metastasizing under its collective nose was an interview Ben Bernanke gave in July 2005. At the time, people had already started to discuss the possibility of a housing bubble. Indeed, housing, in terms of homeownership, peaked over one year earlier, in April 2004. (See Chart below). CNBC's Maria Bartiromo asked Bernanke what the worst case of a housing bubble bursting would be. Bernanke answered,

"Well, I don't buy your premise. It's a pretty unlikely possibility. We've never had a decline in housing prices on a nationwide basis, so what I think is more likely is house prices will slow, maybe stabilize, might slow consumption spending a bit. I don't think it will drive the economy from its full employment path." (1)

Even though this interview has been used to encapsulate the ignorance the Federal Reserve was rife with during the housing bubble, Ben Bernanke was not serving the Fed in any capacity when he gave this interview. Bernanke served as a member of the FOMC from 2002 - 2005 and as Fed Chair from 2006 - 2014. In December 2015, Bernanke would attribute his obvious error of analysis to the fact he was a member of the Bush administration when the interview was made. In an interview with the 'Freakanomics' podcast Bernanke said, "Well, it was partly the result of the fact that I was representing the administration. And you really don't want to go out and say, 'Run for the hills,' right?" (2)

In Bernanke's answer he is claiming that as a member of a presidential administration he can't be completely honest, and has to consider what the reaction to a particularly hard truth might be. That is not a completely unreasonable position, and Bernanke can be given the benefit of the doubt on this issue. Given this, perhaps a better understanding of Ben Bernanke's thoughts on the economy can be gleaned from the transcripts of Federal Reserve meetings. These transcripts are published five-years after the meeting took place. Consequently, no one can argue that the consequences of any economic hard truths discussed in these meetings need to be kept from the public a full five-years later.

Ben Bernanke became Fed chair on February 01, 2006. A review of Fed meetings from 2006 reveal that Bernanke's clueless expressed in the July 2005 interview with CNBC was completely representative of his thinking more than one year later. Here is a sample of Fed Chair Ben Bernanke's perspective of the economy circa 2006;

- "The economy appears to be quite strong....Perhaps the leading source of uncertainty on the output side is the housing market, but I was reassured to hear that most participants think that a decline in housing will be cushioned by strong fundamentals...I agree with most of the commentary that the strong fundamentals support a relatively soft landing in housing." (March 27-28, 2006; first FOMC meeting chaired by Bernanke)

- So far we are seeing, at worst, an orderly decline in the housing market." (May 10, 2006)

- "...But I agree that the economy, except for housing and autos, is still pretty strong and we do not yet see any significant spillover from housing." (September 20, 2006)

Besides being such a long-standing member of the Fed, Bernanke also stands in the vanguard of the entire modern economics movement. Namely, the notion that economists can mathematically model, with great accuracy, all the minor disturbances and perturbations a modern economy goes through. Anyone who stops to think about this notion should immediately dismiss it as both absurd and completely inconsistent with the development of economics as a unique - (and heretofore, valuable) - field of study. The great economic thinkers of the past - Smith, Ricardo, Ropke et.al. - didn't litter their books with all sorts of equations and graphs. More trenchantly, the obvious failures of the Ben Bernanke's of the world to foresee the housing debacle even when it was staring them in the face conclusively prove the rather obvious limits to this numerically intense method of economic analysis.

The economist Vela Velupillai has written about the limits of mathematically modeling economies. In Computable Foundations for Economics, Velupillai contrasts the success of classical economics to provide useful insights into economic behavior with the 'pseudo-numerical phantoms' created by the Ben Bernanke's of the world;

"....All this forgets, of course that perfectly sensible quantitative policy proposes were made by our great classical predecessors without using the framework of the formalists; that to the extent econometric and economic theoretic formalization proceeds along the path traced out by the formalists, it is also seriously deficient in numerical meaning and content; and, thus, the policy proposals are, in fact, pseudo-numerical phantoms." (3)

The failure of the Ben Bernanke's of the world - and their useless equations - to predict the housing crash even after it had already started to manifest itself is evidence that Velupillai's criticism is accurate. What did the Fed's models of the economy produce other than pseudo-numerical phantoms? In the real sciences like physics and engineering, the failure of a mathematical model to produce a result that matches real world behavior would immediately lead to an in-depth analysis of exactly what went wrong. (4) Of course, economics - its mathematical prentensions notwithstanding - is not a real science, and economists didn't revisit the by now obviously bogus basis of their economic models.

While this might explain how economists generally shirked their collective responsibility to examine what went wrong with their models, it doesn't explain how individual economists shirked their individual responsibility to understand what went wrong with their thinking. In next week's blog post the individual failure of Ben Bernanke to examine his rather obvious failures in the housing debacle will be discussed. This discussion will show that among the many things a person might learn at so-called elite schools like Harvard and MIT, admitting a mistake isn't one of them.

Peter Schmidt

Sugar Land, TX

February 16, 2020

PS - As always, if you like what you read, please register with the site. It just takes an e-mail address and I don't share this e-mail address with anyone. The more people who register with the site, the better case I can make to a publisher to press on with publishing my book. Registering with the site will give you access to the entire Confederacy of Dunces list as well as the financial crisis timeline.

Help spread the word to anyone you know who might be interested in the site or my Twitter account. I can be found on Twitter @The92ers

ENDNOTES:

1. CNBC Interview from July 2005; https://www.youtube.com/watch?v=u5A4Gw20dcw

2. "Ben Bernanke Gives Himself a Grade," December 03, 2015; http://freakonomics.com/podcast/ben-bernanke-gives-himself-a-grade-a-new-freakonomics-radio-podcast/

3. Vela Velupillai, Computable Foundations for Economics

4, http://www.the92ers.com/blog/sure-economists-have-sunk-world-just-be-happy-they-dont-design-airplanes