The Fed: A Century of Looking at Deflation Through a Magnifying Glass - Part I

SUMMARY:

- Nothing scares economists or central bankers more than deflation, which they define as 'falling prices.'

- However, prices can fall for two reasons - a debt deflation or improved productivity.

- In spite of the two different causes of falling prices, economists and central bankers fight falling prices, regardless of the reason they are falling.

- More fundamentally, the fear of falling prices is completely misplaced.

- Falling prices are never a cause of an economic slump; they are always an effect.

- The recent examples of Japan and the Great Depression prove this.

DISCUSSION:

Last week's article introduced an observation Wilhelm Ropke made of economists, namely that "They look at inflation through the wrong end of the telescope and deflation through a magnifying glass." In last week's article the penchant of economists to view inflation through the wrong end of the telescope was discussed. In this week's article, it will be seen how economists look at deflation through a magnifying glass.

Good evidence of the focus today's economists have on falling prices is provided by one of the first speeches Ben Bernanke gave as a member of the Fed's Open Market Committee, (FOMC). On November 21, 2001, Bernanke discussed the case of Japan, and their experience with falling prices. In his Japan speech of, Bernanke said,

"That this concern (with falling prices) is not purely hypothetical is brought home to us whenever we read newspaper reports about Japan, where what seems to be a relatively moderate deflation - a decline in consumer prices of about 1% per year - has been associated with years of painfully slow growth, rising joblessness and apparently intractable financial problems in the banking and corporate sectors. While it is difficult to sort out cause from effect, the consensus view is deflation has been an important negative factor in the Japanese slump." (1)

The falling prices in Japan were not the cause of anything; they were merely an effect. Japan suffered a spectacular asset bubble collapse in the late 1980s - a collapse that dwarfed even the Fed fueled US tech bubble collapse in March 2000. After the Japanese bubble collapsed, the Fed's Japanese counterpart - the Bank of Japan - initiated a wide range of programs design to ameliorate the impact of the credit bubble collapsing. Included in these programs was Quantitative Easing, (QE) - the creation of money out of thin air to purchase assets from financial companies.

John Hicks, the first Englishman to win the Nobel prize in economics defined "really catastrophic depressions" as those depressions "where the 'rot in the financial structure goes very deep." As a result of its massive credit bubble collapsing, the Japanese economy was riddled with bad debts - loans that could never be paid back at full value. When a loan goes bad, it rarely becomes worthless. It is at this point where creditors and borrowers need to establish new terms for the loan that better reflect the current economic environment, and not the conditions prevailing when the loan was made. Undoubtedly some losses will be incurred, but after a period of adjustment - which will involve some unavoidable short term pain as these adjustments work their way through the economy - the economy will recover. However, the programs initiated by the Bank of Japan served to perpetuate the bad debts in the banking system. As a result, more than ten years after the asset bubble burst, an enormous amount of bad debt hung over the Japanese economy like the sword of Damocles.

When a company borrows money, it is - in essence - betting on the future. A company forecasts increased demand in the future, and needs to borrow money now to make the necessary investments to meet that future demand. Obviously, when a company is unsure of the future or isn't confident in its predictions for the future, it won't borrow money. In the case of Japan, the credit bubble had fueled all sorts of redundant capacity. However, the Bank of Japan's programs had prevented that excess capacity from being rationalized to better reflect the post-bubble environment. With all the redundant capacity from the bubble years still in existence more than ten years after the collapse, even the healthy companies weren't interested in borrowing money. Moreover, all that redundant capacity kept a lid on prices. What company could raise prices in an atmosphere distinguished by so much surplus capacity?

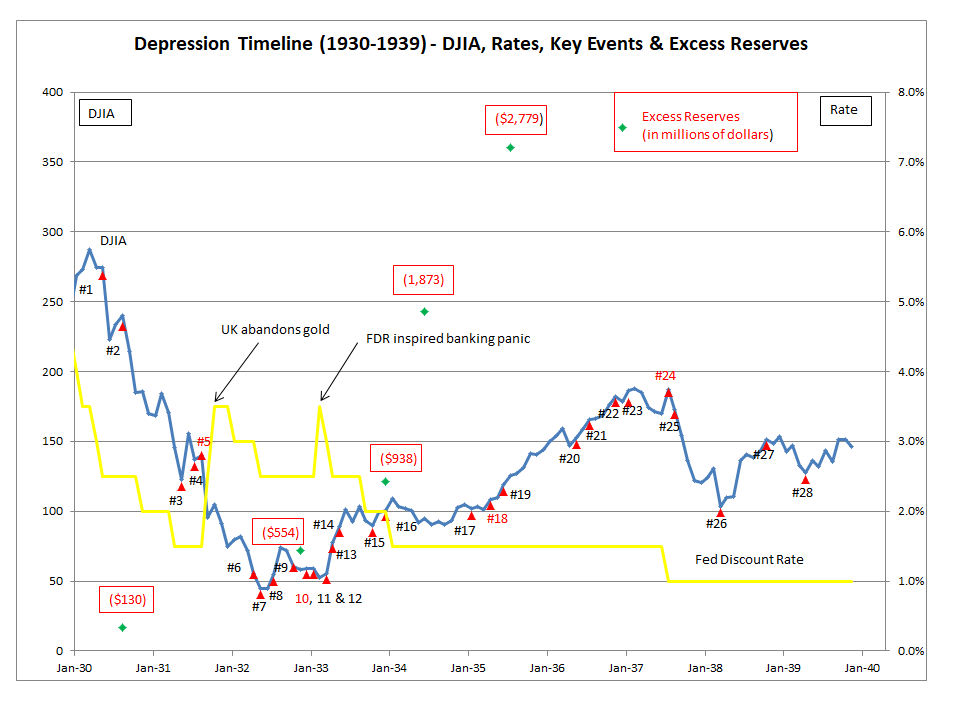

The US experience in the Great Depression shares some similarities with Japan's experience after its credit bubble collapsed, particularly as it relates to prices. Falling prices during the Depression era were not a cause of the poor economy; they were an effect of the poor economy. Ben Bernanke and all central bankers today excoriate the Depression era Fed for allowing prices to collapse. However, what could the Fed do? See the chart below and note excess reserves soaring to unprecedented heights. Through a variety of programs the Fed had greatly increased the reserves in the banking system. In fact, by 1935, excess reserves exceeded the total pre-Depression reserves of the banking system! Should the Fed have created even more excess reserves? The simple fact of the matter is the money supply in the US collapsed - and took prices with it - because businesses refused to take out loans. There was nothing the Fed could do about the reluctance of private industry to take out loans.

CONCLUDING REMARK:

Writing in the 1930's, Lionel Robbins criticized the conclusion that 'deflation' - here, he meant a fall in the money supply - or falling prices caused the Great Depression. Robbins correctly identified deflation and falling prices as an effect, and that some other prior cause must exist;

"There can be no denying the existence of deflation in this sense in this period. But here as in the case of all theories...the diagnosis reveals not a solution, but a problem. Why was there deflation in this sense? Why did people tend to leave their money on idle deposit, rather than invest it in business. Surely, we cannot regard such a phenomenon as a spontaneous evil. Under capitalism there are permanent influences tending in the opposite direction. Under capitalism he who hoards is punished - punished by a loss of interest. If therefore people incur this punishment we are entitled to assume that something has gone wrong - that some other disturbance is the prior cause of the depression. To appeal to deflation as the ultimate explanation is only one degree less superficial than to appeal to the mere fact of the fall in prices. A monetary explanation which is to command respect must show why deflation takes places at all." (2)

The notion of falling prices as a cause of economic calamities like those experienced in Japan after its asset bubble collapsed, or in the US during the Great Depression don't command respect.

Peter Schmidt

Sugar Land, Texas

June 20, 2021 - Father's Day

PS - As always if you like what you read, please consider registering with the site. It just takes an e-mail address, and I don't share this e-mail address with anyone. The more people who register with the site, the better case I can make to a publisher to press on with publishing my book! Registering with the site will give you access to the entire Confederacy of Dunces list as well as the Financial Crisis timeline. Both of these are a treasure trove of information on the crisis and the long-running problems that led to it.

Follow me on Twitter @The92ers

ENDNOTES:

1. "Deflation - Making Sure it Doesn't Happen Here," Speech by Ben Bernanke, November 21, 2002

https://www.federalreserve.gov/boarddocs/speeches/2002/20021121/default.htm

2. Lionel Robbins, The Great Depression, Transaction Publishers, New Brunswick, NJ, 2009 p. 43