Great Depression Timeline: The Fed and the Bank of England Had a Baby, and They Called It the Great Depression

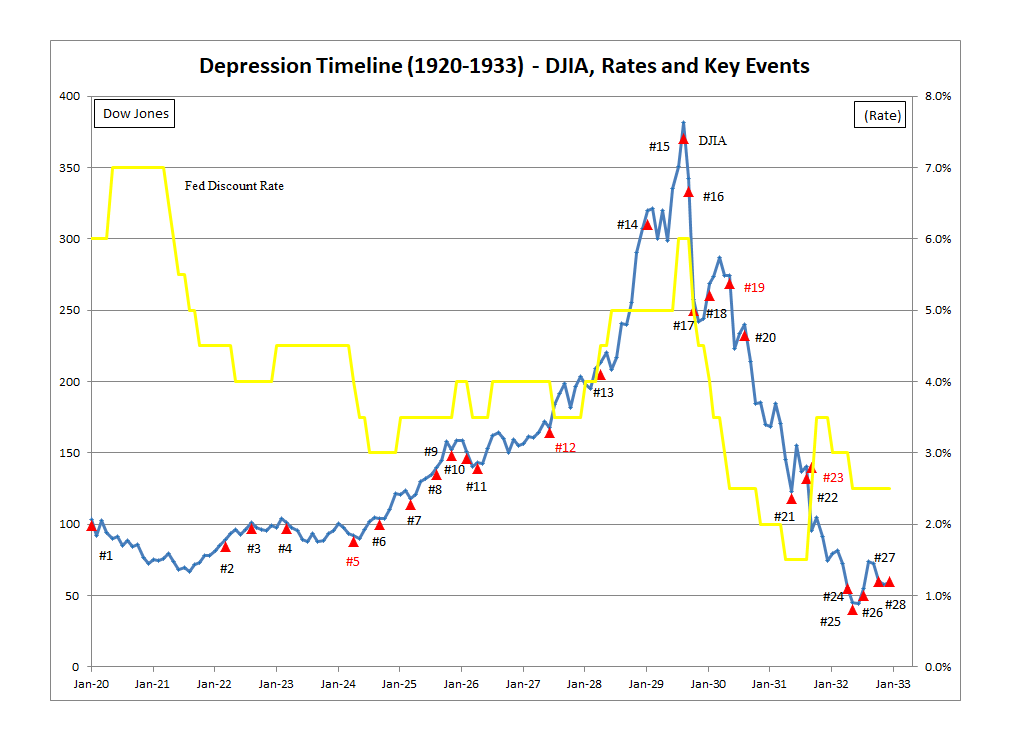

Arguably the greatest bluesman of them all - and one of the most influential popular musicians of the 20th century, Muddy Waters (born McKinley Morganfield) - recorded a song called, 'The Blues Had a Baby & They Called it Rock-&-Roll.' In this week's blog post there will be a brief discussion of how the Fed and the Bank of England got together, not to have a baby, but to cause the Great Depression. Referencing the chart below, the items discussed will be;

#5. Ben Strong admits to Andrew Mellon that loose money policy is to benefit Britain (MAY 1924)

#6 Montagu Norman encourages Strong to continued with easy money (OCT 1924)

#7 British Pound returns to its pre-war parity with the dollar (APR 1925)

#11 General Strike in the United Kingdom (MAY 1926)

#12 Long Island Conference of Central Bankers

The conventional wisdom around the Great Depression can be summarized as;

"...But the 1929 Crash did not have to lead directly to the Great Depression. It was not an inevitability. The vast loss of stock market wealth, the systemic shock, translated into an economic disaster only if it were not offset by some other source of liquidity. The market crash of 1929 only became a disaster in the real economy because of the inaction of the U.S. authorities, and especially the U.S. Federal Reserve in trying to offset the shock. (1)

The conventional wisdom is transparently wrong.

First, note the comment about the 'vast lost of stock market wealth.' What was lost, wasn't real wealth; these were purely paper gains! No real wealth in terms of productive capacity was lost. An earthquake hadn't wiped out a large urban center, nor did an important crop suffer some sort of massive failure. Indeed look at the chart; in January 1931 stocks were exactly where they were in January 1928. Is the US economy so highly-strung that it collapses if the stock market makes no gain over a three year period? Second - and of more fundamental importance to the discussion here - note the inherently illogical nature of this argument. It is argued that the Fed caused the Great Depression by not taking a variety of actions after stocks crashed. This begs the question, how could the explanation for the length and depth of the Depression be inadequate intervention by the Fed, when prior to 1913 there wasn't even a Fed to intervene as the Fed's modern critics insist it should have in the 1920s? In other words, if inaction by the Fed caused the Great Depression, how could the US have avoided anything remotely as bad as the Great Depression when the US didn't even have a Fed?

Rather than taking too little action and causing the Great Depression, it makes much more logical sense to search for actions the Fed took to cause the Depression. (In other words, it is no coincidence that we only had a Great Depression after we had a Federal Reserve!) It is a search that doesn't take much effort to bear fruit.

World War I was a colossal disaster, and set the world back in every way imaginable. The biggest strategic blunder the US ever made was to violate her longstanding neutrality and intervene on behalf of the Allies. On an economic front, this intervention was characterized by US banks loaning huge amounts money to Allied governments so these governments could purchase huge volumes of weapons from American companies. There is no quicker way to bankrupt a country than to borrow in a foreign currency to purchase weapons. The experience of the UK, France and Russia in 1918 was little different than that of Iraq in 1988. (2)

As a result, in the 1920s the UK economy was a total basketcase. The UK had greatly increased its currency in circulation to pay for the war, but all this spending didn't increase the UK's productive capacity. Indeed, in February 1920, well after Armistice Day, the pound still traded at $3.18 versus its pre-war parity of $4.88, a fall of 35%. There were two legitimate courses of action for the UK at this point - accept the pound's loss of value or raise interest rates to soak up all the extra pounds that had been created during the war. Both involved hard choices and honesty - two things central bankers and politicians are basically incapable of.

Instead of these two legitimate courses of action, Montagu Norman, the head of the Bank of England, came up with a third idea. Norman's idea was to have the US cut rates, and this would then eliminate the need for the UK to raise rates. (3) Norman's counterpart at the Federal Reserve Bank of New York, Benjamin Strong, agreed to work with Norman on this plan, and began goosing credit markets in the US to advance British interests. This was always going to be a difficult operation but two events occurred to take this already difficult plan deep into the realms of impossibility;

- The UK re-established the pre-war parity of the pound with the dollar on a fully fraudulent basis (APR 1925)

- The UK suffered its General Strike (MAY 1926)

Now that the pound was so richly valued, its exports suffered greatly. The UK was not nearly productive enough to have such a valuable currency. The general strike ground to a halt what little productive activity in the country was occurring, and greatly increased political uncertainty in a country whose greatest strength had been the solidity of its institutions.

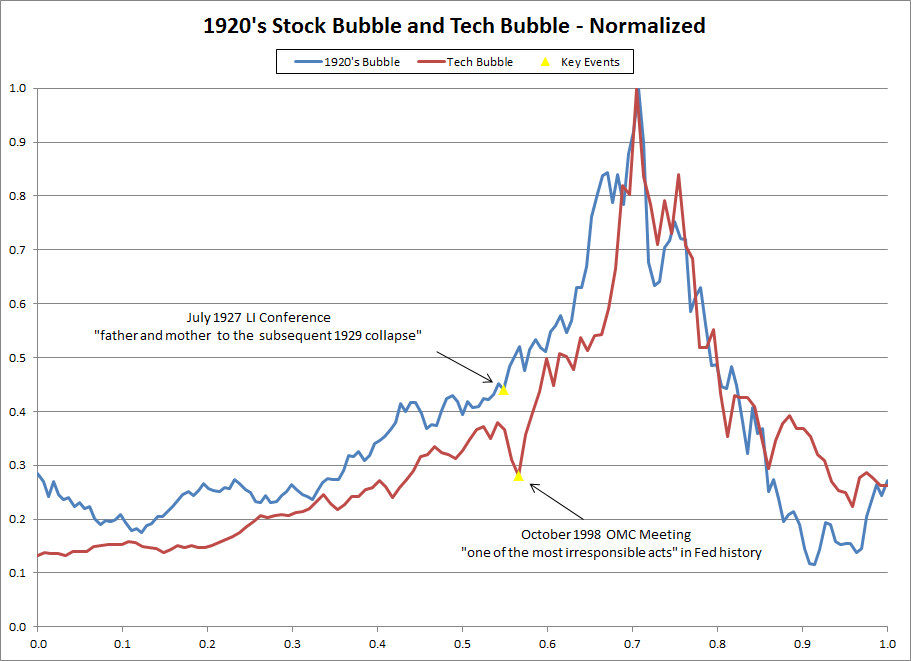

It was at this point that Benjamin Strong then took the extraordinary action of calling a meeting of the world's central bankers. The meeting was held in July 1927 on Long Island. The meeting had a single purpose - to coordinate a world-wide policy of "loose money" to advance the interests of England. The leaders of the central banks in France and Germany balked at the proposal, but Strong pursued a policy to benefit England with great vigor. The policy Strong implemented after the July 1927 meeting proved to be an enormous disaster and directly led to the Great Depression and World War II. In fact, Adolph Miller of the Federal Reserve and a contemporary of Strong's called the 1927 credit expansion engineered to benefit the Bank of England, "the father and mother to the subsequent 1929 collapse." (4) This can clearly be seen in the chart below.

As the chart shows, Ben Strong's blunder from July 1927 was equal to Alan Greenspan's blunder from October 1998. In October 1998 Greenspan cut rates between scheduled meetings of the FOMC because of his concerns about the collapse of LTCM. (5) These rate cuts - exactly like Strong's in July 1927 - fueled an enormous stock market bubble that was doomed to collapse.

In this brief discussion here it has been argued that the Fed's role in causing the Great Depression was not from being too passive as conventional wisdom argues. Instead, the Fed helped cause the Great Depression by actively interfering in credit markets to - unbelievable as it sounds - advance the interests of the Bank of England and its chief, Montagu Norman. Of course this explanation makes far more sense than the convention wisdom as it explains why we only had a Great Depression after the Fed was founded.

There is a tremendous amount of information here and it was only discussed in a very cursory way. I encourage everyone to read the items referenced in Endnotes 2, 3 and 5. This will really help to tie everything together. George Orwell said, correctly it hardly needs to be said, 'Whoever controls the present, controls the past; and whoever controls the past, controls the future.' Because the myth - and that is exactly what it is - that the Fed cause the Depression by being 'passive' has become so entrenched, the Fed has accumulated more and more power. A prerequisite to the Fed being reduced to its proper role in the economy is a better understanding of the past. Nowhere is this more important than in understanding that the Fed helped cause the Depression by being too active, not too passive.

Peter Schmidt

Sugar Land, TX

November 17, 2019

PS - As always, if you like what you read, please register with the site. It just takes an e-mail address and I don't share this e-mail address with anyone. The more people who register with the site, the better case I can make to a publisher to press on with publishing my book. Registering with the site will give you access to the entire Confederacy of Dunces list as well as the financial crisis timeline.

Help spread the word to anyone you know who might be interested in the site or my Twitter account. I can be found on Twitter @The92ers

ENDNOTES:

(1) Peter Hartcher, Bubble Man - Alan Greenspan and the Missing Seven Trillion Dollars, W.W. Norton and Company, 2006, p. 110

(2) http://www.the92ers.com/blog/cia-federal-reserves-equal-capitalizing-chaos-it-creates

The prime motivation for Saddam Hussein's invasion of Kuwait was economic. After nearly eight-years of war with Iran, his country was completely impoverished. (4) Iraq had borrowed heavily to finance its war with Iran, and among the countries it had borrowed from was Kuwait. Saddam argued he was doing the Arab gulf states a great favor by fighting Iran, and these gulf states should then forgive Iraq's debts. When Kuwait insisted that Iraq make good on its war debts, Iraq invaded Kuwait. With this being the case, there is a direct causal chain between the 1953 coup, the 9/11 attacks, and the subsequent invasions of Iraq and Afghanistan.

(3) http://www.the92ers.com/blog/federal-reserve-and-fatal-conceit-economics-necessary-and-sufficient-conditions-cause-enormous See this article for details into Items 5, 6, 7 and 11.

(4) William Greider, Secrets of the Temple - How the Federal Reserve Runs the Country, Touchstone Books, New York, 1987, p. 297

(5) http://www.the92ers.com/dunce/alan-greenspan