Take it From Ben Bernanke, Ben Bernanke Knows Nothing About the Depression

SUMMARY:

- The explanation for the Great Depression seized upon by the economic establishment confuses an effect of the Depression - the collapse of the money supply - with its cause.

- Data from the Depression era shows banks had plenty of reserves to lend. What caused the money supply to collapse was a lack of willing borrowers.

- A corollary to the economic establishment's theory on the Depression is the Fed is to blame for 'allowing' the money supply to collapse.

- This corollary further exposes the intellectual bankruptcy of this theory. After all, what then explains the fact that the Depression occurred after we had a Fed, not before!

DISCUSSION:

On November 08, 2002, Ben Bernanke gave a speech where he outlined his - and Milton Friedman's - analysis of the Great Depression. (It was Friedman's 90th birthday.) Before discussing the contents of this speech, it is important to develop some context for the time time the speech was made. In November 2002 the housing bubble was still expanding, and home ownership would peak in just 18-months, April 2004. Ben Bernanke was serving on the FOMC and he was ignorant of the huge housing bubble blowing up all around him. This makes November 2002 an ironic time for Ben Bernanke to give a speech as a (self-styled) expert on the Great Depression and economics!

Milton Friedman - though an ardent and eloquent defender of the free market system - didn't believe in a free market when it came to money. Instead of a passive role for government or the government's economic Trojan horse, central banks - Friedman believed money had to be dominated by a central authority. Given the dominant role he ascribed to money, it shouldn't be too surprising that Friedman concluded the Depression was caused by a monetary dislocation. Friedman - along with his co-author, Ana Schwartz - poured through economic data and concluded the Great Depression can "reasonably be described as having been caused by monetary factors." In other words, changes in the money supply almost exclusively drove changes in the economy. When the money supply increased, the economy grew; when the money supply collapsed, so did the economy. Friedman then blames the Fed for causing the Depression because the Fed allowed the money supply to collapse.

A review of banking reserve data from the Depression era - and some simple common sense - will show the so-called 'monetarist' explanation of the Great Depression makes no sense. In fact, rather than being a cause of the Great Depression, the collapse in the money supply of the 1930s was clearly an effect of the Great Depression. The fall in the money supply that Friedman and Bernanke identify as the cause of the Great Depression was not the consequence of an insufficiently active central bank. Instead the collapse in the money supply was a result of the economic chaos produced by all the 'bold experiments' of Hoover, FDR, Rex "the Red" Tugwell and others.

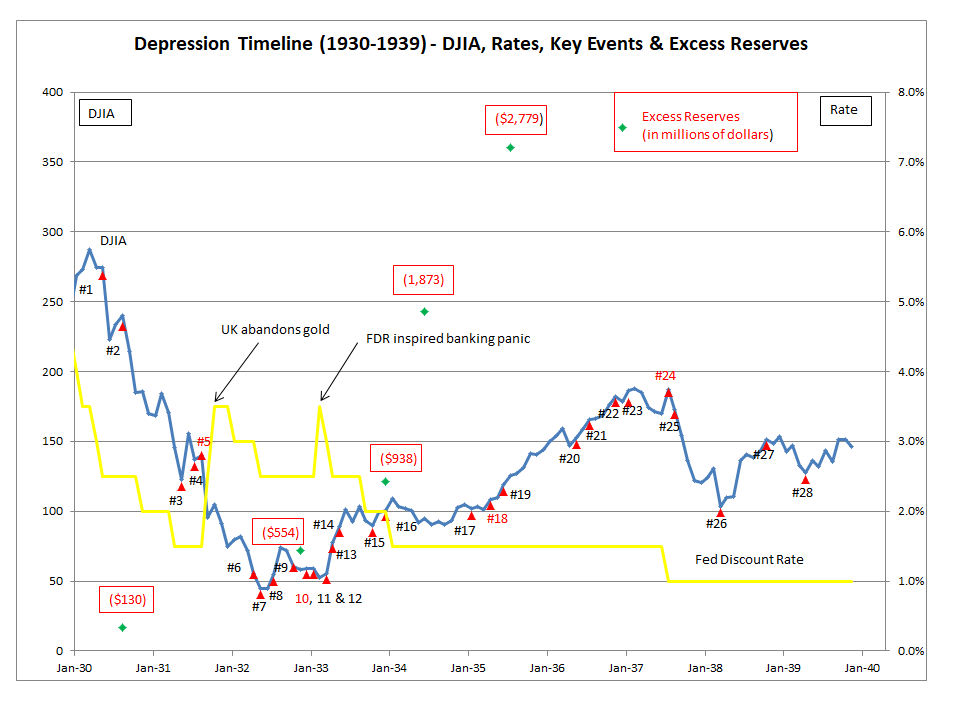

Evidence of this is provided by Figure 1. Figure 1 plots the Fed Funds Rate and the Dow Jones average. Also plotted - albeit without a curve - are 'excess reserves.' Excess reserves soared during the Depression era. In fact, In August 1935, when excess reserves soared to over $2,779-million, (1), they exceeded the total reserves of the pre-Depression banking system. (2) So, the data is clear, banks had plenty of reserves to lend. The collapse in the money supply had nothing to do with an insufficiently active Fed. The collapse in the money supply was the result of no willing borrowers!

FIGURE 1

When a company borrows money, it is - in essence - betting on the future. A company forecasts increased demand in the future, and needs to borrow money now to make the necessary investments to meet that future demand. Obviously, when a company is unsure of the future or isn't confident in its predictions for the future, it won't borrow money. Ben Bernanke believes FDR's 'bold experiments' worked and helped end the Depression. (3) Nothing could be further from the truth! These bold experiments made it difficult for companies to have any certainty for the future and they simply stopped borrowing as a result. The collapse in the money supply wasn't a cause; it was an effect!

At the conclusion of his speech, Ben Bernanke famously said of the Fed and its role in the Depression, "We did it. We're very sorry. But thanks to you, (Friedman & Schwartz), we won't do it again." The point being, the Fed didn't take the necessary action to keep the money supply from collapsing and this was an enormous mistake. This notion makes no logical sense. Indeed, if the Friedman and Bernanke analysis of the Great Depression is correct and the Fed caused the Great Depression by not taking a variety of actions after stocks crashed, then how could the explanation for the length and depth of the Depression be inadequate intervention by the Fed, when prior to 1913 there wasn't even a Fed to intervene as the Fed's modern critics insist it should have in the 1920s? Stated another way, if a passive central bank can cause an enormous economic collapse, then how was the US able to avoid an economic calamity like the Depression when we didn't even have a central bank? Certainly, the Fed has a lot to answer for in the Depression era, but primarily for things that happened before October 1929, not after. (4)

CONCLUDING REMARK:

The Friedman/Bernanke analysis of the Great Depression is about as enlightening as an aerospace engineer blaming the crash of a commercial airliner on gravity. What happened to the money supply was clearly a consequence of what was going on in the economy; it wasn't the other way around and the excess reserve data proves that. The corollary that there was some action the Fed could have taken to arrest the collapse in the money supply is just as wrong. How could an inactive Fed have played a role in the Depression when the US only suffered a collapse of this magnitude after we had the Fed!

Writing in the 1930's, Lionel Robbins criticized what would become the Friedman/Bernanke theory of the Great Depression;

"There can be no denying the existence of deflation in this sense in this period. But here as in the case of all theories...the diagnosis reveals not a solution, but a problem. Why was there deflation in this sense? Why did people tend to leave their money on idle deposit, rather than invest it in business. Surely, we cannot regard such a phenomenon as a spontaneous evil. Under capitalism there are permanent influences tending in the opposite direction. Under capitalism he who hoards is punished - punished by a loss of interest. If therefore people incur this punishment we are entitled to assume that something has gone wrong - that some other disturbance is the prior cause of the depression. To appeal to deflation as the ultimate explanation is only one degree less superficial than to appeal to the mere fact of the fall in prices. A monetary explanation which is to command respect mush show why deflation takes places at all." (5)

Peter Schmidt

Sugar Land, TX

February 14, 2021

PS - As always, if you like what you read, please register with the site. It just takes an e-mail address and I don't share this e-mail address with anyone. The more people who register with the site, the better case I can make to a publisher to press on with publishing my book. Registering with the site will give you access to the entire Confederacy of Dunces list as well as the financial crisis timeline.

Help spread the word to anyone you know who might be interested in the site or my Twitter account. I can be found on Twitter @The92ers

ENDNOTES:

1. The Depression occurred before the Fed unleashed an inflationary firestorm on the United States. Terms like billions and trillions - which are commonly used today - were unheard of back then. Billions were still written as thousands of millions. In fact, the term billions wasn't even used! Instead 1,000-million was called a milliard.

2. Benjamin Anderson, Economics and the Public Welfare, Liberty Press, Indianapolis, 1979, pp. 403-404

Anderson's data shows that the total banking reserves of 'member banks' was 2,325-million in September 1929.

3. Ben Bernanke praises FDR for all the ad hoc and indiscriminate policy experiments he enacted during the New Deal era. These didn't help the economy grow and recover; they stifled the economy and strangled it!

http://www.the92ers.com/blog/take-if-kosher-chickens-ben-bernanke-knows-nothing-about-depression

4. Bernanke's speech was very long, yet he never mentioned what the Fed did to expand credit in the US to benefit the UK's financial position. It was this goosing of credit that directly led to the October 1929 collapse.

http://www.the92ers.com/blog/great-depression-timeline-fed-and-bank-england-had-baby-and-they-called-it-great-depression

5. Lionel Robbins, The Great Depression, Transaction Publishers, New Brunswick, NJ, 2009 p. 43