"You're Only as Smart as Your Dumbest Nobel Laureate Economist:" Paul Krugman and the Housing Bubble - Part II

In last week's article, Paul Krugman's argument that the government's two enormous government sponsored enterprises, (GSEs), Fannie Mae and Freddie Mac, had little to do with the housing crisis was introduced, (1). As a preliminary to discussing whether this argument makes any sense, last week's article also introduced the following two items;

- Gordon Bethune's observation of the airline industry; "You're only as smart as your dumbest competitor."

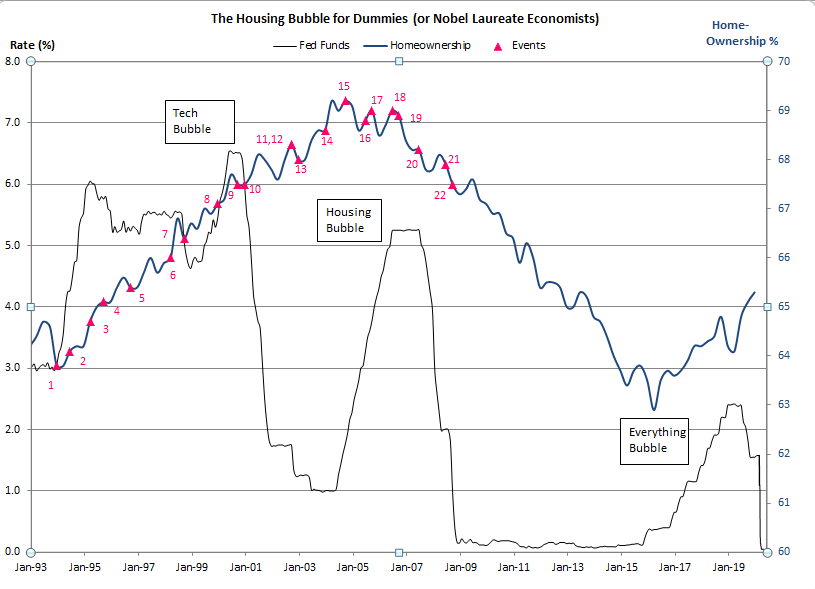

- A summary timeline of some of the key government and Federal Reserve actions that fueled the housing bubble. These actions were then superimposed on a chart that tracks homeownership and interest rates versus time for the years 1993 - 2020. (See Figure 1 below)

FIGURE 1:

In his argument that concludes the GSEs had little to do with the housing debacle, Krugman identifies the peak of the bubble - what he calls the 'point of maximum inflation' as the middle of what he calls the "naughties." Krugman then sites data, see Figure 2, that shows GSE market share in mortgage securitization had been falling because of 'congressional oversight,' and by 2005 private label mortgage securitization exceeded that of the GSEs. It naturally follows then - at least according to Paul Krugman - that the GSEs couldn't have been driving the housing debacle because when the bubble was at its worst, 2005, mortgage marketshare of the GSEs was at a multiyear low.

FIGURE 2:

Paul Krugman's argument - the MIT and Yale degrees of its progenitor notwithstanding - is laughable. For starters, Paul Krugman never explains the reason GSE market share had fallen. It had fallen because of a massive, ($6-billion) accounting scandal at Fannie Mae that forced Franklin Raines to resign, (#15). After ignoring this rather important fact, Paul Krugman would then have people believe that all the extraordinary interventions associated with President Clinton's plan to increase homeownership, coupled with the impact these interventions had on the GSEs had nothing to do with an enormous housing bubble. In other words, it was a mere coincidence that a huge bubble blew up in housing in the immediate aftermath of extraordinary government intervention in the housing and mortgage markets. Here is a summary of just some of the interventions that Paul Krugman believes had minimal impact on an enormous bubble blowing up in housing.

- Mortgage banks signing 'best practices agreements' to lend in a manner that the Department of Housing and Urban Development (HUD) approved of. (#2)

- President Clinton establishing a strategy to increase homeownership to 67.5%. (#3)

- HUD Secretary Cisneros increasing the percentage of GSE mortgages that must go to low and moderate income borrowers from roughly 30% to 42%. (#4, the 'affordable housing mandate)

- HUD Secretary Cuomo suing Accubanc Mortgage for discrimination and admitting that the settlement will lead to higher loan losses. (#6)

- Fannie CEO Franklin Raines states that a 50% affordable housing goal from HUD will force Fannie to be "a major presence in the sub-prime market.' (#8)

- Fannie Mae Vice-Chair - Jamie Gorelick - pleads with bankers to make 'tough loans' because Fannie needs to buy these loans to meet their affordable housing mandate. (#9)

- HUD Secretary Cuomo increases the percentage of GSE mortgages that must go to low and moderate income borrowers to 50%. This edit seals the fate of the United States. (#9, see also #4 and #8 above)

- Barney Frank cavalierly dismisses the prospect of a housing bubble and promises to continue to 'push for homeownership. (#16) (2)

Even the cursory review here - which only scratches the surface of what the Clinton Administration did to advance its homeownership goals via the GSEs - shows a clear connection between the government's 'goal' of increasing homeownership to the magical figure of 67.5% and the housing debacle which followed immediately after.

The timeline here notwithstanding, a simple understanding of how markets work, and how one company can impact its competitors easily proves the enormous role the government, (generally),and the GSEs, (specifically), had in causing the housing crisis. Paul Krugman thinks a box can be drawn around the GSEs and their lending practices. As Gordon Bethune's comment on the airline industry states, in many industries it is impossible to 'quarantine' one company's business practices from those of its competitors. As it turned out, securitization of mortgages was an industry where it was impossible to isolate the influence of one company from the other firms in the market.

Indeed, Bethune's description of the airline industry proved especially apt in describing the market for mortgage securitization. The reason being, mortgages that were considered 'conforming' to GSE standards were the easiest to securitize. As the GSEs moved further and further out on the risk curve, their private label competitors simply followed them. As long as the mortgages issued by the GSEs or their competitors were considered conforming, the mortgages could be securitized. Krugman's conclusion that the GSEs had little to do with the housing debacle rests on - among other things - isolating GSE lending standards and practices from the private label mortgage companies. As shown here, this isolation simply did not exist.

CONCLUDING REMARKS:

The great Dr. Benjamin Anderson said in his classic survey of American economic history, Economics and the Public Welfare, "The substitution of government policy in credit matters for the free exercise of banking judgment is one of the most dangerous things that can come to a country." (3) This simple observation completely describes the government's and the government's housing Trojan horse - the GSEs - had in bringing the US to its economic knees. Paul Krugman's contention that the GSEs didn't have a leading role in the housing debacle is laughable. The fact that Paul Krugman enjoys such a sterling reputation and people constantly seek his council is an indictment of the entire economics profession today. After all, how could Krugman get away with such a transparently false conclusion over such an important issue, and maintain his reputation among other economists unless something was completely defective in the study of economics overall? This isn't merely an academic issue. It is the failure to understand the bubbles of the recent past that allows new and even larger bubbles to be inflated in their aftermath. Until a final reckoning is made and the reputation of people like Paul Krugman is irrevocably shattered, the US will continue to suffer one economic calamity after another.

Peter Schmidt

Sugar Land, TX

August 09, 2020

PS - As always if you like what you read, please consider registering with the site. It just takes an e-mail address, and I don't share this e-mail address with anyone. The more people who register with the site, the better case I can make to a publisher to press on with publishing my book! Registering with the site will give you access to the entire Confederacy of Dunces list as well as the Financial Crisis timeline. Both of these are a treasure trove of information on the crisis and the long-running problems that led to it.

Help spread the word to anyone you know who might be interested in the site or my Twitter account. I can be found on Twitter @The92ers

ENDNOTES:

1. "You're Only as Smart as Your Dumbest Nobel Laureate Economist:" Paul Krugman and the Housing Bubble - Part I. http://www.the92ers.com/blog/youre-only-smart-your-dumbest-nobel-laureate-economist-paul-krugman-and-housing-bubble-part-i

2. https://twitter.com/The92ers/status/1283003732087775237

3. Dr. Benjamin Anderson, Economics and the Public Welfare, Liberty Press, Indianapolis, 1979, p. 176