Active versus Passive: Economists, Engineers, Nuclear Power Plants and Central Banks

SUMMARY:

- Historically, central banks were completely passive and acted in accordance with 'Bagehot's Dictum:' to lend freely in a crisis but only against good collateral and only at a penalty rate of interest.'

- Ben Bernanke rejects 'passive' central banks & favors 'aggressive & unconventional' central bank policies.

- The engineering of complex systems conclusively demonstrates the superiority of passive control to active control. (Chernobyl disaster)

- The contrast between the Panic of 1907 and the Great Depression also demonstrates the superiority of passive control to active control.

- The contrast between the Panic of 1907 and the Great Depression also demonstrates that Ben Bernanke, supposedly an 'expert on the Great Depression, actually knows nothing about it.

DISCUSSION:

An Englishman of the Victorian era, Walter Bagehot, famously described central banking as 'to lend freely in a crisis but only against good collateral and only at high rates of interest.' In this version of central banking - which guided the Bank of England over centuries of successful operation - central banks do not actively engage in credit markets. There is no 'monetary policy' and no purchasing of government securities with banking reserves created out of thin air to increase the money supply. Instead, central banks are purely passive. Only in the case of a financial panic or money becoming 'tight,' does a central bank of the Bagehot type spring to life. Once awoken from its slumber, all a central bank of this type will do is provide credit to sound businesses to prevent sound assets from being sold at fire-sale prices.

In his post-crisis memoir, Bernanke blasts passive central banking of the Bagehot type.

- "...For a time, the appropriately named Benjamin Strong, the head of the Federal Reserve Bank of New York, provided effective leadership. But no one of equal stature stepped up after Strong's death in 1928. The Fed proved far too passive during the Depression." (1)

- "She (Christina Romer, chair of President Obama's Council of Economic Advisors) knew that passive, orthodox policymaking greatly worsened the Great Depression, and like me, she tended to favor aggressive, unconventional policies in the face of dire threats to financial and economic stability." (2)

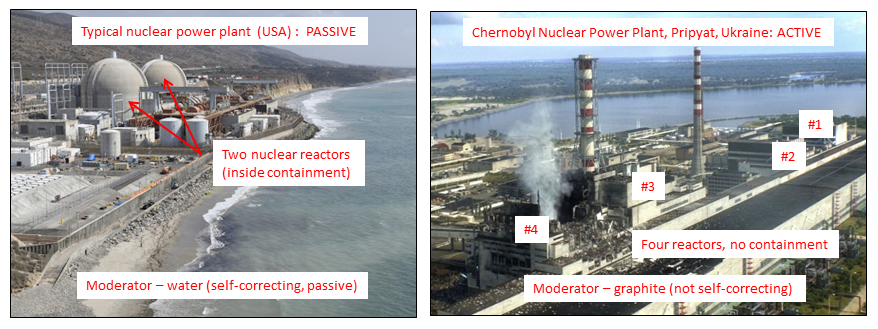

Before discussing Ben Bernanke's belief in the superiority of 'active' central banking relative to passive central banking of the Bagehot type, a brief discussion of the engineering of complex systems will show that passive systems are inherently more stable and almost always preferred to active systems. (3) The best example of the superiority of passive engineered systems to active engineered systems is provided by a nuclear power plant and the nuclear catastrophe suffered by Reactor #4 at the Chernobyl nuclear power plant.

Active versus Passive - Nuclear Power Plant (Chernobyl)

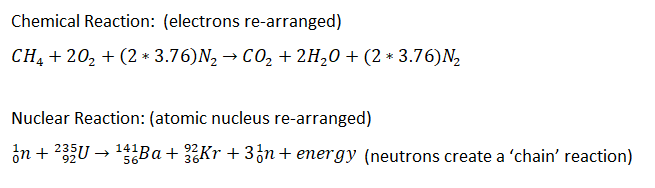

A nuclear reaction is fundamentally different than a chemical reaction. In a chemical reaction, the electrons of the participating molecules are rearranged, but the participating elements remain the same. In the chemical reaction shown below - which describes burning natural gas in air - the mass of the reactants equals the mass of the products. The same amounts of carbon, hydrogen, oxygen and nitrogen are found on both sides of the equation. A nuclear reaction on the other hand is fundamentally different - the elements taking part in a nuclear reaction are changed. This change is driven by changes to the nucleus of the various molecules. The energy released by the rearrangement of the atomic nuclei is staggering, and defined by the famous equation E=mc2.

What allows a nuclear reaction of the type used in nuclear power plants to perpetuate itself are neutrons. As each atom of uranium-235 breaks apart (fission) neutrons are released. These neutrons can then cause others atoms of uranium to break apart and a self-sustaining 'chain reaction' can then take place.

While the fuel used in a nuclear power plant is not sufficiently enriched to allow a nuclear power plant to explode like an atomic bomb, control over the neutrons is a major part of controlling a nuclear reaction, harnessing the enormous heat energy released in a nuclear reactor and converting this heat to electricity. One of the primary ways of controlling neutrons in a nuclear reactor is with a 'moderator.' The neutrons that leave a fission reaction are traveling much to quickly to perpetuate a chain reaction; the neutrons need to have their speed reduced or 'moderated.' In most reactor designs the 'moderator' is water. However, the reactor design at Chernobyl used graphite as a moderator, and this played a major role in the subsequent catastrophe.

When water is used as a moderator, a reactor that begins to generate too much power has a self-correcting feature that a graphite moderated reactor design does not. With water as a moderator, when a reactors starts to generate too much power, the reactor loses the benefit provided by the moderator. The water turns to steam and steam does not have the same 'moderating' capability as water. A reactor design of this type is self-correcting and 'passive' in nature. In contrast, when graphite is used as a moderator and the reactor begins to generate too much energy, the moderator is no longer self-correcting. The graphite moderator is completely unaffected by the increased power being generated by the reactor and the reactor power can continue to climb, eventually leading to a 'runaway' reaction.

As the recent Chernobyl miniseries makes clear, the April 1986 disaster was precipitated by reckless decisions made in the control room. As reckless as these decisions were, it is likely that the disaster would have been significantly reduced if the reactors were moderated with water (passive) instead of graphite (active). Of course, another feature not enjoyed by Soviet reactors was a containment structure. A containment structure is another example of passive control.

Active versus Passive - The Panic of 1907 versus the Great Depression

As mentioned above, Ben Bernanke - along with most of the other leading lights of the economics community - blames a passive Fed for causing the Great Depression. Its an argument that makes no sense whatsoever. If a passive central bank caused the Depression, then why did the US only suffer a Great Depression after we had a central bank!? The Fed was founded in 1913 and, while the US had some rather significant economic recessions or 'Panics' as they were called, nothing pre-1913 can compare with the economic calamity of the Great Depression. This fact alone completely undermines Bernanke's argument that a passive Fed caused the Great Depression. (4)

Don't take my word for it. One of the best economic historians is Benjamin Anderson and his book, Economics and the Public Welfare, is worth its weight in gold. In this book, Anderson contrasts the economic impact from the Panic of 1907 with that of the Great Depression. The Panic of 1907 is universally considered as the providing the rationale behind the Fed's founding, yet the economic damage wrought by it was much more mild than that caused by the Great Depression. Anderson explains why;

"In the United States, with our inelastic currency system, we had several unnecessary money panics. The panics of 1873 and 1893 were complicated by many factors, but the panic of 1907 was almost purely a money panic. Our Federal Reserve legislation of 1913 was designed to prevent phenomena of this kind, and, wisely handled, could have been wholly (beneficial). It is noteworthy however, that the money panic of 1907 had nothing like the grave consequences of the collapse of 1929. The money stringency of 1907 pulled us up before the boom had gone too far. There was no such qualitative deterioration of credit preceding the panic of 1907 as there was preceding the panic of 1929. The very inelasticity of our pre-war system made it safer than the extreme ductility of mismanaged credit under the Federal Reserve System in the period since early 1924." (5)

As Anderson clearly describes, what made the Great Depression so much worse than the Panic of 1907 was the active control of credit by the Fed in the 1920s. Given the inherently passive system that existed before 1907, imbalances could only become so large before they would self-correct. (think water as a moderator in a reactor). In contrast, because of the Fed's attempt to micromanage the supply of credit in the 1920s, imbalances could - and did - grow larger and larger. (think graphite as a moderator in a reactor, See (4) for more details)

CONCLUDING REMARKS

Ben Bernanke's believes a passive Fed caused the Depression and is a proponent of an active, (aggressive is his word), central bank to keep crises from spiraling out of control. These two beliefs are in conflict with how complex engineered systems, (Reactor #4 at Chernobyl) behave. These two beliefs are also contradicted by the fact that the economic consequences that followed the Great Depression were far worse than those which followed the Panic of 1907.

Ben Bernanke is supposed to be an expert on the Great Depression. It would appear he knows nothing about it.

Peter Schmidt

January 10, 2021

Sugar Land, TX

P.S. - As always, if you like what you read, please consider registering with the site. It just takes an e-mail address, and I don't share this e-mail address with anyone. The more people who register with the site, the better case I can make to a publisher to press on with publishing my book! Registering with the site will give you access to the entire Confederacy of Dunces list as well as the Financial Crisis timeline. Both of these are a treasure trove of information on the financial crisis and the long-running problems that led to it.

Help spread the word to anyone you know who might be interested in the site or my Twitter account. I can be found on Twitter @The92ers

ENDNOTES:

1. Ben Bernanke, The Courage to Act, W.W. Norton, New York, 2015, p. 47

2. The Courage to Act, p. 382

3. Certain engineered systems - racing cars and fighter planes immediately spring to mind - require the system to be inherently unstable and thus rely on some sort of active control system. Outside of these systems, a system that corrects itself without outside input is always preferable to a system that requires constant monitoring and fine-tuning.

4. Rather than being too passive, the Fed of the 1920s was far too active and this is what sparked the Depression. The Fed's activism was designed to benefit the UK, the Bank of England and Montagu Norman. More on this can be found in this article;

http://www.the92ers.com/blog/great-depression-timeline-fed-and-bank-england-had-baby-and-they-called-it-great-depression

5. Benjamin M. Anderson, Economics and the Public Welfare - A Financial History of the United States, 1914-1946, Liberty Press, Indianapolis, 1979, p. 24