No Jerome, low inflation isn't - and has never been - 'one of the major challenges of our time'

SUMMARY:

In October 2019 Fed chair Jerome Powell lamented 'low inflation' and called it "one of the major challenges of our time." Even before the government's (woefully inaccurate) measurement of inflation soared straight up it was an absurd statement. In this article prices and incomes from two eras, 1967 and 2020 are reviewed. It will be shown that rather than having been too low, inflation has completely undermined the US economy! The most obvious manifestation of this is the how much more expensive goods have become to the median worker and the median household.

DISCUSSION:

When currency was backed by gold, a central bank's main function was to maintain the value of the issued currency in terms of gold. For example, if a central bank created too much money against the gold reserves in the banking system, an increasing number of people would begin to exchange their currency for gold. These people would do this out of concern that the increased money supply would reduce the money's value. (Gold would maintain its value but the depreciating currency wouldn't.) To combat this, a central bank would be forced to raise interest rates and reduce the money supply. The higher interest rates would incentivize people to exchange gold for larger bank savings on deposit that earn interest. Banking reserves - gold - would return to the banking system and the economy would return to balance.

The prime reason for insisting on defining currency in terms of a precious metal was to provide a self-correcting braking mechanism to the creation of money. As expressed by the great Wilhelm Ropke;

"If in the production of goods the most important pedal is the accelerator, in the production of money it is the brake. To insure that this brake works automatically and independently of the whims of government and the pressure of parties and groups seeking 'easy money' has been one of the main functions of the gold standard. That the liberal should prefer the automatic brake of gold to the whims of government in its role of trustee of managed currency is understandable." (1)

The US dollar was backed by gold as recently as 1971. However, on August 15, 1971 - and blaming it on the 'gnomes of Zurich' - President Nixon temporarily broke the dollar's last link with gold. Nixon closed the gold window and reneged on the promise to exchange an ounce of gold for $35. Since then, the system of credit in the US has been under the Fed's complete control. Unsurprisingly, without the natural braking action provided by gold, the value of the dollar has collapsed, and the ensuing 50-years are the most crisis-ridden period in American economic history. (2)

The case against modern central bank policy - and the fallacy-riddled economic theories that provide the theoretical basis of modern central banking - can be made in a number of ways. One method is to use economic statistics from two eras, 1967 and 2020 and this is done in Table 1 below.

TABLE 1: Prices and Incomes from 1967 and 2020

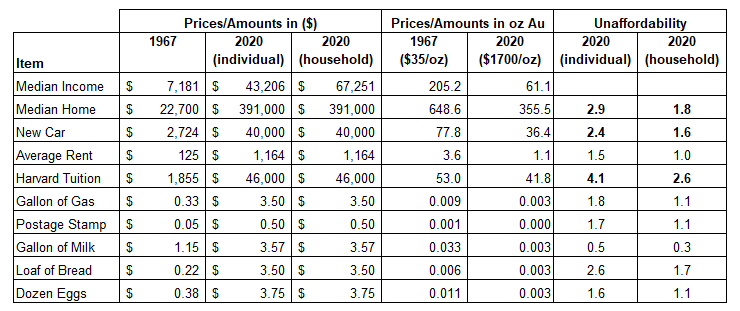

The chart lists prices for several common items (3), as well as median incomes (4, 5) and home prices (6) for the years 1967 and 2020. In addition, to defining prices and incomes in dollars, prices and incomes are defined in their equivalent amounts measured in ounces of gold. The equivalent "ounces of gold" are simply determined by taking the price in dollars and dividing it by the prevailing price of gold for the time period under review.

As a result of the collapsing value of the dollar - it has lost 97.9% of its 1971 value when measured against gold - it is not completely straightforward to compare economic performance in 1967 with the performance today. When prices and incomes are measured in dollars they appear to be soaring - annual incomes have risen from $7,181 per year to $67,251 (household). However, when these same incomes are measured in ounces of gold, they appear to be collapsing - falling from 205.2-ounces per year to just 61.1. What is going on?

Because money - whether it manifests itself as a paper currency issued by a central bank or a constitutionally proscribed amount of precious metal - is merely a store of wealth and a means of exchange, the impact of monetary policy is best demonstrated by comparing what the median worker or the median household could purchase with their salary in 2020 versus 1967. The last two columns in Table 1 measure how much more unaffordable everyday items have become to either the median worker or the median household. Table 1 does so without using dollars or gold. Instead, these two columns compute the cost of an item on the basis of the median incomes for 2020 and 1967. A ratio of these two costs is then taken with the 2020 cost in the numerator. Any ratio greater than 1.0 indicates that the item has become more expensive to the average worker since 1967.

For example, let's examine home prices and how they compare to household income. In 2020, a house cost the average household 5.8-times its annual income (391,000/67,251). In contrast, in 1967 the median house cost the average worker just 3.16-times their average annual income (22,700/7,181). Measured, against the median household income, today's house costs 1.8-times more than its 1967 equivalent (5.8/3.16)! Of course, measured against the lower median worker's income, homes have become even for unaffordable. With the exception of a gallon of milk, every item in the chart has become more expensive to both the median household and the median worker since 1967. Note that nothing has become more unaffordable to the average working person than the cost of a private college education. Think about that the next time you hear a Harvard economics professor bemoan inequality.

CONCLUDING REMARKS:

In conclusion and as shown here, when prices of goods are measured relative to incomes, we can see that today's incomes purchase much less than they used to. The clearly demonstrated fact that the median worker and the median household - the backbone of not just the economy, but society as a whole - have been falling behind for decades on end shows the problems with the US economy are deep, systemic and long-running. (7) The data presented here, which uses data from 2020 - before the current price inflation that even the government has been forced to recognize - proves that Jerome Powell's conclusion that 'too low' inflation was a "contemporary challenge" was completely absurd.

Peter Schmidt

Sugar Land, TX

July 31, 2022

P.S. - As always, if you like what you read, please consider registering with the site. It just takes an e-mail address, and I don't share this e-mail address with anyone. The more people who register with the site, the better case I can make to a publisher to press on with publishing my book! Registering with the site will give you access to the entire Confederacy of Dunces list as well as the Financial Crisis timeline. Both of these are a treasure trove of information on the financial crisis and the long-running problems that led to it.

ENDNOTES:

1. Wilhelm Ropke, Economics of a Free Society, Ludwig von Mises Institute, Auburn, AL, 2008, p. 100

2. August 15, 1971 was a watershed event in the United States; the future direction of the country was fundamentally - and catastrophically - altered on that day. See two blog posts for additional details;

http://www.the92ers.com/blog/august-15-1971-nixon-temporarily-closes-gold-window-opens-door-inflationary-chaos-and-wealth

http://www.the92ers.com/blog/august-15-1971-nixon-temporarily-closes-gold-window-opens-door-inflationary-chaos-and-wealth-0

3. Average new car price crosses $40,000 in 2020 and that's nuts - CNET

4. US Department of Commerce, Bureau of Census, "Household Income in 1967 and Selected Social and Economic Characteristics of Households," Series P-60, #62, July 15, 1969 https://www2.census.gov/prod2/popscan/p60-062.pdf

5. 2020 Average Income by State plus Median, Top 1%, and All Income Percentiles (dqydj.com)

6. • Average new home sales price in the U.S. 2021 | Statista

7. In 1958, of the nearly 59-million tax returns filed in the United States, only 236 showed incomes of $1-million or more, and only 115,000 tax returns showed incomes in excess of 50,000. Fifty-eight years later the median household income in the United States over $60,000 and yet the average working family has never been under more financial stress.