AIG and the Colonial Pipeline: Everything Wrong with Today's Economy in Microcosm

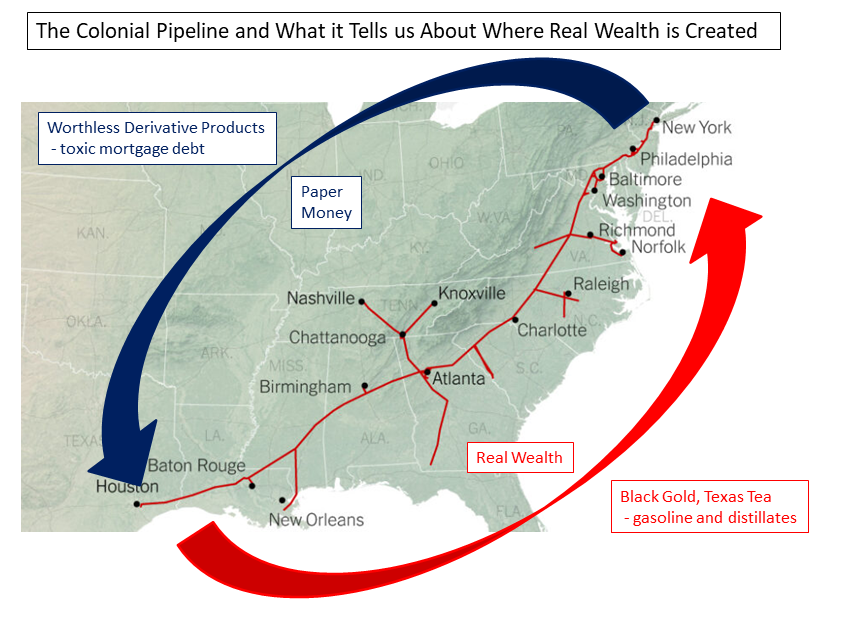

FIGURE 1: The Trade Made Possible by the Federal Reserve

SUMMARY:

- Despite no longer having a barter system, people still trade their production for the production of others.

- Money should allow this exchange to occur seamlessly and without transaction costs.

- Today's monetary system includes enormous transaction costs.

- These costs are a direct consequence of there no longer being a 'brake' on the creation of money, and the elevation of finance above all other sectors of the economy.

- The enormous damage caused by today's monetary system is laid bare by contrasting the enormous amount of money thrown at the AIG debacle with the revenue earned by th Colonial Pipeline.

- In complete secrecy, the NY Fed lavished tens of billions of dollars on AIG's credit default swap (CDS) counterparties, even though Wall Street's trade in mortgage derivatives was parasitic to the country's wealth producing capacity.

- The Colonial Pipeline might take in $2-billion in revenue each year.

- The contrast between the size of the AIG bailout and the revenues earned by the Colonial Pipeline stand in mute testimony to the enormous damage today's monetary system does to the country.

- Essentially, Texas and Louisiana trade valuable liquid fuels for worthless credit derivatives. (See Figure 1)

- A trade of such unequal value can only take place when the monetary system has been completely compromised.

MONEY:

One of the seminal achievements in human history was the widespread use of money. Transitioning from a system of barter - and the enormous transaction costs associated with barter - allowed for specialization, the division of labor and an explosion in productivity. (1) The reason the barter system could be supplanted was, of course, the rise of a common unit of exchange that everyone was willing to accept. That common unit of exchange was precious metals. The value of a currency wasn't determined by a central bank or interest rates. A currency's value was determined by one factor - how much precious metal it was worth. (2)

The use of money and the increased specialization of labor should not obscure the fact that as a member of an economy today, an individual is still trading their production for someone else's production. A 17th century German proverb held, "The world is like a shop stocked full of goods. They are on sale for work - toil may buy them." All the beneficial aspects of money - and they are considerable - hinge on the money being an honest store of value and the monetary system not favoring one type of producer at the expense of others. As expressed by Wilhelm Ropke, the most important pedal in the creation of money isn't the accelerator; its the brake;

"If in the production of goods the most important pedal is the accelerator, in the production of money it is the brake. To insure that this brake works automatically and independently of the whims of government and the pressure of parties and groups seeking "easy money," has been one of the main functions of the gold standard. That the liberal should prefer the automatic brake of gold to the whims of government in its role of trustee of a managed currency is understandable." (3)

Of course there is no longer any automatic brake on the creation of money, but what is the practical ramification of this? Does it really matter? Some insight into the answer to these questions can be obtained by contrasting AIG's business in mortgage CDS with the Colonial Pipeline.

AIG:

AIG's trade in mortgage CDS can be likened to insurance. Mortgage derivatives were essentially side bets on whether a particular mortgage bond would collapse. The parties to a mortgage derivative contract had no vested interest in the mortgage bond itself or any of the individual mortgages that made up the bond. Instead, the parties to a derivative contract placed a bet - via a financial derivative - on whether the mortgage bond would default or not. However, it was not an even money bet. Because mortgage bonds were considered so secure and so unlikely to default, a very small premium could be used to bet on a very large mortgage bond collapse. For example, for annual premium payments of approximately $25-million, a return of $1-billion could be earned if the mortgage bond collapsed.

As everyone now knows, AIG's business in mortgage CDS blew up in its face. (4) While numerous industrial companies have gone bankrupt, for some reason the Federal Reserve Bank of NY judged AIG's CDS business of national importance. Even though AIG's counterparties only had a few hundred million dollars worth of capital tied up in their mortgage CDS trade - it was AIG that was exposed to enormous amounts of leverage and tens of billions in losses - the NY Fed's Tim Geithner decided to bailout these counterparties. Geithner - in complete secrecy and at his discretion - paid them at 'par.' There have been a lot of crocodile tears sheds over the bailout of AIG, but this is a smokescreen. The AIG bailout had nothing to do with AIG, and everything to do with paying AIG's counterparites at par. These counterparties and the amount they received from the AIG bailout is listed below.

- Société General ($16.5-billion)

- Goldman Sachs ($14-billion)

- Deutsche Bank ($8.5-billion)

- Merrill Lynch ($6.2-billion)

- UBS ($3.8-billion).

COLONIAL PIPELINE:

The Colonial Pipeline is comprised of two lines - one 40-in in diameter and the other 36-in in diameter - and runs from the oil producing regions of Texas and Louisiana, through the southeast, and to the large eastern cities of Washington DC, Baltimore, Philadelphia and New York City. (See Figure 1) One line is dedicated to transporting gasoline and the other line is dedicated to moving distillates like jet fuel and diesel. The liquid products move through the pipeline at just 4-miles per hour (6-ft/sec). A gallon of gasoline from Houston takes over two weeks to get to New York!

Some perspective on the size of the pipeline's operation can be obtained with some simple calculations. For discussion purposes, lets say the 40-in line is used to move gasoline and the 36-in line is used to move distillates. At an average velocity of 6-fts per second, the 40-in line transports about 34-million gallons of gasoline per day and the 36-in line 27-million gallons of distillates per day. If we assume the liquid products are worth $2 per gallon and the pipeline operates for 350-days each year, then the total dollar amount of liquid petroleum products moved by the pipeline each year is just under $43-billion. If the pipeline charges 5% against the volume of the product being shipped, then the pipeline has an annual revenue of about $2-billion per year. (5)

The critical importance of this pipeline was demonstrated by the recent ransomware attack against the pipeline's operators. Immediately after the pipeline shut down, the price of gasoline and diesel along the pipeline route skyrocketed. Panic buying resulted in gasoline no longer being available at many retail outlets. Because the pipeline was only out of service for a few days, widespread shortages of fuel were not widespread. Had the pipeline remained out of service for weeks, rationing of transportation fuel throughout much of the east coast would have certainly taken place.

COMPARISON: AIG vs. the COLONIAL PIPELINE

The enormous flaws in today's monetary system are exposed by by contrasting the bailouts lavished on AIG's counterparties with Colonial Pipeline's annual revenue. The US would have been much better off if the entire market for mortgage derivatives never existed. It was mortgage derivatives that allowed what would have been a collapse in the housing market to metastasize into a world altering economic calamity. Not only was the trade in mortgage CDS completely unnecessary in any positive sense, it became destructive to the country's capital structure and wealth producing capacity. The parasitic nature of Wall Street's mortgage CDS trade notwithstanding, the Fed lavished tens of billions of dollars on the companies taking part in it.

On the other hand, the Colonial Pipeline provides a hugely important service to the country. Tens of millions of people rely on the Colonial Pipeline. Tens of millions of people would have their lives fundamentally altered if the Colonial Pipeline stopped operating for even just a few weeks. In spite of this, much more money was 'earned' by trading credit derivatives then by delivering billions of gallons of liquid fuels safely and efficiently. How could this be?

This transparently nonsensical result is not a natural consequence of capitalism, free market or the ebb and flow of supply and demand. Instead, it is an obvious manifestation of the enormous flaws in today's Fed dominated monetary system and the subsequent financialization of the economy Because of the Federal Reserve's stewardship of the monetary system, worthless credit derivatives can be traded for valuable transportation fuels. (See Figure 1)

Peter Schmidt

Sugar Land, TX

May 23, 2021

PS - As always, if you like what you read, please register with the site. It just takes an e-mail address and I don't share this e-mail address with anyone. The more people who register with the site, the better case I can make to a publisher to press on with publishing my book. Registering with the site will give you access to the entire Confederacy of Dunces list as well as the financial crisis timeline.

Help spread the word to anyone you know who might be interested in the site or my Twitter account. I can be found on Twitter @The92ers

ENDNOTES:

1. In a barter system, acquiring the goods you wanted required two steps; (1) determining who had the good you wanted, and, (2) finding out which of these people were willing to trade with you based on what you had to offer them.

2. When President Nixon closed the gold window in 1971, central banks - not US citizens by the way - could exchange $35 for one ounce of gold. For some perspective on this, gold closed at ~$1880 per ounce on Friday, a loss in purchasing value of 8.29% for fifty straight years. Thank your local central banker!

3. Wilhelm Ropke, Economics of a Free Society, Ludwig von Mises Institute, Auburn, AL 2008, p. 100

4. http://www.the92ers.com/blog/aig-debacle-created-lawrence-summers-ignored-tim-geithner-and-henry-paulson

5. The Colonial Pipeline is privately held and I don't believe they publish earning reports.