Alan Greenspan, Jackson Hole and the Fed's Intellectual Bankruptcy

From its March 2000 peak to its October 2002 bottom, the NASDAQ declined almost 80%. In a speech at Jackson Hole on August 30, 2002 Greenspan offered the following defense for his role in the stock bubble and the Fed's failure to do anything about it;

"The struggle to understand developments in the economy and financial markets since the mid-1990s has been particularly challenging for monetary policy makers. We were confronted with forces that none of us had personally experienced. Aside from the then recent experience of Japan, only history books and musty archives gave us clues to the appropriate stance for policy. We at the Federal Reserve considered a number of issues related to asset bubbles - that is, surges in prices of assets to unsustainable levels. As events evolved, we recognized that, despite our suspicions, it was very difficult to definitively identify a bubble until after the fact - that is, when it's bursting confirmed its existence."

Later, in January 2004, Greenspan would congratulate himself on the apparent success of this strategy - allowing the tech bubble to grow, burst and then deal with the aftereffects - in a speech to the American Economic Association. In doing so, he would expose both the Fed's enormous role in creating the far more ruinous housing bubble and his own economic ignorance.

"There appears to be enough evidence, at least tentatively, to conclude that our strategy of addressing the bubble's consequences rather than the bubble itself has been successful. Despite the stock market plunge, terrorist attacks, corporate scandals, and wars in Afghanistan and Iraq, we experienced an exceptionally mild recession - even milder than that of a decade earlier. As I discuss later, much of the ability of the US economy to absorb these sequences of shocks resulted from notably improved structural flexibility. But highly aggressive monetary ease was doubtless also a significant contributor to stability." (2)

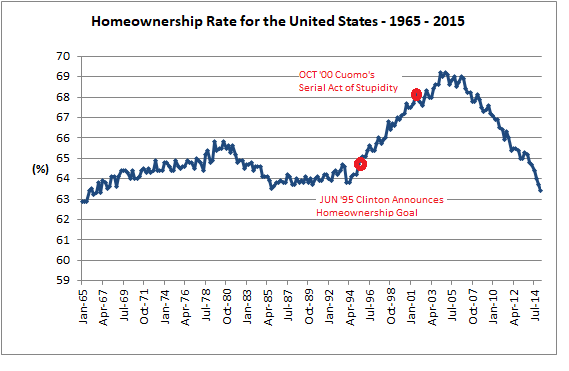

The "monetary ease" which Greenspan is taking credit for here, was not producing an 'exceptionally mild recession,' as Greenspan claimed. Instead, the monetary ease Greenspan is congratulating himself for is still in the process of distorting the US and world economies via a gigantic bubble in housing. Home ownership will peak just a few months after this speech, in April 2004, and prices soon after; then the cataclysmic deluge of the housing bubble collapsing. See the chart immediately below and note the two highlighted events - Bill Clinton announcing his home ownership goal and Andrew Cuomo directing the GSEs to issue 50% of their mortgages to low and moderate income borrowers. Note also that the peak in home ownership came well before the crisis reached its peak in September 2008.

As the quotes above show, the Fed's "official" position on bubbles is they can only be seen after they pop. Given the enormous economic dislocations generated by the collapse of the tech bubble and the housing bubble later, this is not some trivial position for the Federal Reserve to take. Instead, it should animate every action of the Fed and - to use the 'parlance of our time' - be part of the Fed's proverbial DNA. In the quotes below we will see that Greenspan's Jackson Hole speech was little more than a half-baked excuse for the Fed's massive contribution to the tech stock bubble and the Fed is intellectually bankrupt to the core.

- In a CNBC interview from July 2005, and in his capacity as head of the president's council of economic advisors, Ben Bernanke was asked if there was a housing bubble. He does not answer by saying bubbles can't be seen until after the burst. Instead, he replied, "Well, I guess I don't buy your premise. It's a pretty unlikely possibility. We've never had a decline in housing prices on a nationwide basis, so what I think is more likely is house prices will slow, maybe stabilize, might slow consumption spending a bit. I don't think it will drive the economy from its full employment path." (3)

- Also in 2005, researchers with the Federal Reserve Bank of NY investigated to see if there was a housing bubble. They conclude prices are "high but not yet out of line." (4) Obviously if bubbles can only be seen after they burst, it would be a fool's errand to attempt to determine if a bubble existed before it burst.

- Most tellingly, there were two interviews given by James Bullard of the St. Louis Fed. In a September 20, 2013 interview on Bloomberg, Bullard said "the bubbles we had in the past were gigantic and obvious." (5) Shortly later, in a November 2013 interview on CNBC, Bullard said the tech and housing bubbles were "blindingly obvious." (6)

- Finally - and not too terribly surprisingly given his garrulous nature - Alan Greenspan's position on bubbles, publicly declared at Jackson Hole in August 2002, would be contradicted by Alan Greenspan. In a cozy CNBC interview - where his acolytes still obsequiously fawn over him and lovingly call him "Mr. Chairman," Greenspan said of the Lehman Brothers collapse, "We missed the timing badly on September 15, 2008. All of us knew there was a bubble." (7)

As this brief synopsis shows, Alan Greenspan's excuse for ignoring the tech bubble has been shown to be the economic equivalent of some slacker, attempting to pass Algebra II for the third time, explaining why he doesn't have his homework. Given the enormous impacts financial bubbles have had on the US, the Fed's position on bubbles should be clear and not subject to any uncertainty. As all the mutually contradictory statements show - including one from Greenspan himself - Greenspan's August 2002 Jackson Hole speech should be seen for what it clearly was - a desperate attempt by the Fed to maintain credibility - and, with it - the enormous power the Fed wields over the economy. It shouldn't have taken the Fed's dereliction of duty as manifested in the tech bubble or housing bubble to demonstrate the Fed doesn't deserve a fraction of the power it has. That said - and given the enormous impact bubbles have had on the US and world economies - Greenspan's August 2002 speech and the Fed's obvious contradictions with the injunctions demanded by the speech are clear signs the Fed is both intellectually bankrupt and long overdue for a complete overhaul.

Peter C. Schmidt

Sugar Land, TX

August 25, 2019

PS - As always, if you like what you read, please register with the site. It just takes an e-mail address and I don't share this e-mail address with anyone. The more people who register with the site, the better case I can make to a publisher to press on with publishing my book. Registering with the site will give you access to the entire Confederacy of Dunces list as well as the financial crisis timeline.

Help spread the word to anyone you know who might be interested in the site or my Twitter account. I can be found on Twitter @The92ers

ENDNOTES

(1) Remarks by Chairman Alan Greenspan - Economic Volatility, Federal Reserve Bank of Kansas City Symposium, Jackson Hole, WY, August 30, 2002 https://www.federalreserve.gov/BOARDDOCS/SPEECHES/2002/20020830/default.htm

(2) "Risk and Uncertainly in Monetary Policy," Remarks by Chairman Alan Greenspan at the Meetings of the American Economic Association, San Diego, CA January 03, 2004 https://www.federalreserve.gov/boarddocs/speeches/2004/20040103/default.htm

(3) https://www.youtube.com/watch?v=u5A4Gw20dcw

(4) Jonathan McCarthy and Richard W. Peach, "Is there a bubble in the housing market now?" Federal Reserve Bank of New York, 2005 https://papers.ssrn.com/sol3/papers.cfm?abstract_id=923867

(5) Steven C. Johnson, "Fed Need Not Rush to Taper While Inflation is Low," September 20, 2013, Reuters https://www.reuters.com/article/us-usa-fed-bullard/fed-need-not-rush-to-taper-while-inflation-is-low-bullard-idUSBRE98J0BI20130920?feedType=RSS&feedName=politicsNews

(6) Matthew J. Belvedere, "Fed's Bullard: $1-trillion a year QE pace torrid," https://www.cnbc.com/2013/11/04/feds-bullard-weve-made-substantial-progress-in-us-labor-markets.html

(7) Matthew J. Belvedere, "Bubbles and leverage cause crisis: Alan Greenspan," October 23, 2013 https://www.cnbc.com/2013/10/23/something-fundamentally-wrong-with-the-way-i-look-at-the-economy-alan-greenspan.html