Chickens Coming Home to Roost - the Fed and 25-years of Price Supression

PREFACE:

This week's blog post - along with several others to follow - will examine how today's precarious market condition is the inevitable result of over twenty-five years of the Federal Reserve's price suppression efforts and active interference in the economy.

DISCUSSION:

With the recent market turmoil, it seemed like a good time to revisit the notion of the past always being prologue, particularly in markets. In spite of the constant "new era" thinking that has accompanied nearly all previous market excesses, there is almost nothing "new" in financial markets. The reason for this is markets are made up of people, and the people of today - in spite of all technological progress - still have the same failings they have always had. In particular, at extremes markets are dominated by two of the most primal emotions - greed and fear. In manias, pure greed causes otherwise sober people to throw caution to the wind in the hope of capitalizing on the seemingly irresistible momentum sending asset prices higher and higher. The recent tech stock bubble (2000) and housing bubble (2008) are classic examples of this. As a result of the enormous influence human failings and emotion have on markets, the best market advice remains, "to be greedy when others are fearful, and to be fearful when others are greedy."

To be sure, computer technology has greatly increased market volatility, especially so at market extremes. In the past, there was a physical limit on how many shares could trade in a given amount of time. Today, with the advent of computerized trading and algorithms ("algos") autonomously executing trades - even trades of enormous volume - market moves are now greatly exaggerated. As computer programs sense the market rising, huge buy orders are placed. As these same programs detect selling, huge sell orders are placed. Of course, this is exactly what was seen on October 19, 1987 when Mark Rubinstein and Hayne Leland of UC-Berkeley unleashed "portfolio insurance" on an unsuspecting Wall Street, and thus played a major role in causing the market to fall 22% in a single day! (1)

As will be described in the chart and associated timeline below, the Federal Reserve of the Greenspan, Bernanke and Yellen era has greatly exacerbated the already volatile market mixture of human emotions and computerized trading. The pernicious impact of Fed policies during this era can be seen by simply recognizing that the US economy has been subject to its two largest financial manias in just the past fourteen years. (This doesn't account for the "everything bubble" that may now be unwinding.) A variety of analogies can be used to describe the disastrous impact the Fed has had on markets and the attendant contributions it has then made to the resulting societal and economic chaos emerging from these markets collapsing. Two of my favorites are analogies that liken the Fed to;

- A kindergarten teacher providing her students unlimited supplies of Red Bull energy drink and Pixie Stix, leaving her class for an hour and being surprised to return to a classroom full of chaos.

- A madman driving a dump-truck loaded with nitroglycerin through an atomic bomb factory

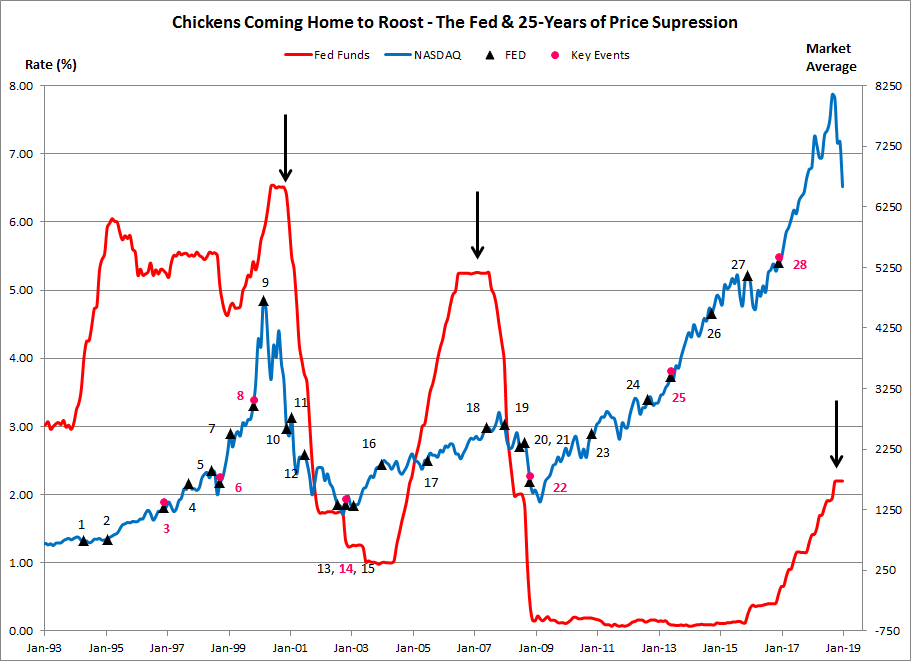

The chart plots the Federal Funds Interest rate, data from the St. Louis Fed, and the NASDAQ for the period January 1, 1993 to the present. The three vertical black arrows highlight the peak interest rate seen with the tech stock bubble, housing bubble and today's "everything" bubble respectively. Note in particular, in 2007-2008 the Fed was unable to return interest rates to the highs seen during the tech bubble era without the housing bubble first collapsing. As the chart makes clear it will be virtually impossible for the Fed to "normalize" interest rates now without the stock market collapsing first. (2)

Also shown on the chart are twenty-eight events related to Fed policies. These events are captured on the chart with the black triangles. Of these twenty-eight events, six are particularly important and are highlighted in pink. These events are as follows;

- MAY 94 - Greenspan takes credit for diffusing the stock bubble

- FEB 95 - Greenspan & Robert Rubin bailout Mexican bondholders

- DEC 96 - Greensan's "irrational exuberance" speech (KEY)

- OCT 97 - Greenspan claims "ideas" more important than production

- JUL 98 - Greenspan, Rubin & Lawrence Summers (all dunces) fight to keep the market for derivatives deregulated

- OCT 98 - "Most irresponsible act" in Fed history - Greenspan engineers a between meeting rate cut after hedge fund LTCM collapses (KEY)

- FEB 99 - Time magazine calls dunces Greenspan, Rubin, and Summers "the committee to save the world"

- NOV 99 - portions of Glass-Steagall repealed (KEY)

- MAR 00 - Greenspan speaks at Boston College, extols "new era" economy days before NASDAQ peaks

- DEC 00 - speaking for most other economic PhDs, Paul Krugman (Dunce #31) claims economy can almost always be controlled by manipulating interest rates alone

- FEB 01 - a senior Fed officials claims the post-tech bubble hangover can be cured if enough people "go out & buy an SUV."

- JUL 01 - Greenspan confuses rapidly escalating home prices with real wealth

- AUG 02 - Greenspan speaks at Jackson Hole, WY and disavows any responsibility for the tech bubble

- NOV 02 - Ben Bernanke delivers his "helicopter speech" and claims financial system is "well-regulated" (KEY)

- FEB 03 - w/ interest rates at historic lows, Greenspan recommends homeowners use adjustable rate mortgages (ARMs)

- NOV 04 - Bernanke claims the Fed's monetary policy has led to a "great moderation" of reduced economic volatility

- JUL 05 - Bernanke dismisses prospect of a housing bubble

- JUN 07 - Bernanke clams the "mortgage debacle" won't negatively impact the economy

- JAN 08 - Bernanke claims the economy is in the process of "healing itself"

- JUL 08 - Bernanke claims the two mortgage giants, Fannie Mae and Freddie Mac, will "make it through the storm"

- SEP 08 - acting on its own volition, the Fed initiates a $100-billion bailout of AIG (really a gift to AIG's trading partners)

- NOV 08 - Fed launches its first round of quantitative easing (QE1) (KEY)

- NOV 10 - Fed launches QE2

- SEP 12 - Fed launches QE3

- JUN 13 - Fed threatens to "taper" QE, market throws a "taper tantrum" (KEY)

- OCT 14 - Fed halts QE

- DEC 15 - in the only interest rate hike of the Obama presidency, the Fed raises rates (0.25%) for the first time since the crisis

- DEC 16 - perhaps not coincidentally, after the election of Donald Trump the Fed initiates a series of interest rate hikes; soon after the market begins to stagger (KEY)

Additional details on all these events - including references - can be found in the financial crisis timeline. The timeline is available here;

http://www.the92ers.com/content/timeline

The timeline is a comprehensive chronological review of how the financial crisis came about. The information contained in the timeline is the foundation upon which my book, Elites in Name Only - the Financial Crisis, is based. Over the next few blog posts the chart introduced here will be reviewed and specific aspects of the Fed's enormous interference in the proper functioning of markets will be discussed. Until then, there is plenty to review in this article alone!

Peter Schmidt

30 DEC 2018

PS - As always if you like what you read, please consider registering with the site. It just takes an e-mail address, and I don't share this e-mail address with anyone. The more people who register with the site, the better case I can make to a publisher to press on with publishing my book! Registering with the site will give you access to the entire Confederacy of Dunces list as well as the Financial Crisis timeline. Both of these are a treasure trove of information on the crisis and the long-running problems that led to it.

ENDNOTES:

(1) See the Dunce biography of Mark Rubinstein (Dunce #42) for details. Also see Gary Gorton (Dunce #27) for another college professor who labored under the false notion that computer programs could flawlessly execute trades in markets where human emotions play an enormous role.

http://www.the92ers.com/dunce/mark-rubinstein

http://www.the92ers.com/dunce/gary-gorton

(2) People who want to credit the Fed - particularly Bernanke and Yellen - for "saving" the economy through its programs of Quantitative Easing (QE) and zero interest rate policy (ZIRP) fail to acknowledge that completing these programs includes returning rates to "normal." The simple fact of the matter is the US economy is still trapped in the experiments of the Fed's mad monetary scientists!