The Fed: A Century of Looking at Deflation Through a Magnifying Glass - Part II

SUMMARY:

- Improved productivity is doing more with less.

- Capital investments and technical advances lead to improved productivity.

- A natural consequence of improved productivity - which is doing more with less - is lower prices.

- Economic history is unequivocal, a healthy economy - by virtue of productivity enhancing capital investments - produces lower prices.

- Today, the Federal Reserve and academic economists are convinced that in order for today's economy to get healthy, prices first need to rise!

- There is no better evidence of the moral and intellectual bankruptcy of modern economics than the fear economists have of falling prices.

DISCUSSION:

It is hard to hear an economist speak without the subject of 'productivity' coming up. Productivity is simply how efficiently limited economic inputs like land, natural resources and labor, can be turned into goods. A good example of improved productivity can be seen with agriculture. For a variety or reasons, not the least of which is nitrogen based fertilizers, (1), agricultural yields have exploded. As agricultural yields have exploded, the same amount of land can produce a much larger amount of crops.

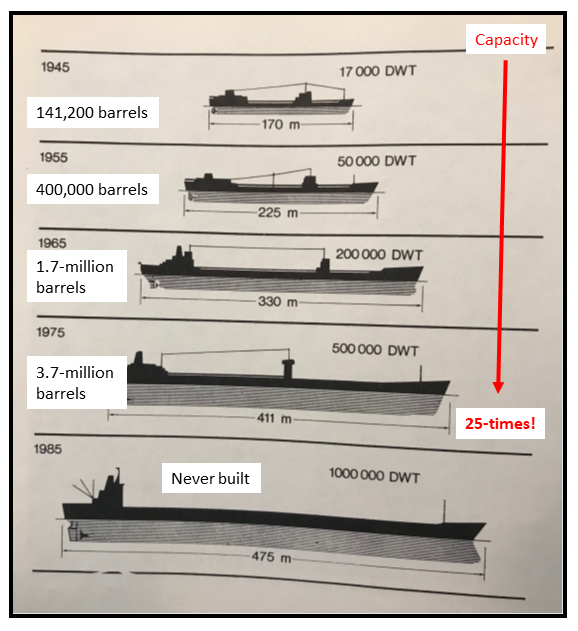

This mechanism of high productivity - doing more with less - can be seen throughout any modern economy. Indeed, latent in all the technical advances of the last century is doing more with less. This can even be seen in the humble ship. Figure 1 shows the evolution of oil tankers. These ships take oil from where it is, to where it is needed. In this way, ships are analogous to the circulation system in a human body. Rather than delivering oxygen to muscles, these ships deliver energy to economies. Look at the enormous increase in the size of these ships! In the space of thirty-years, the capacity of these ships went up twenty-five times!

FIGURE 1: Oil Tanker Deflation

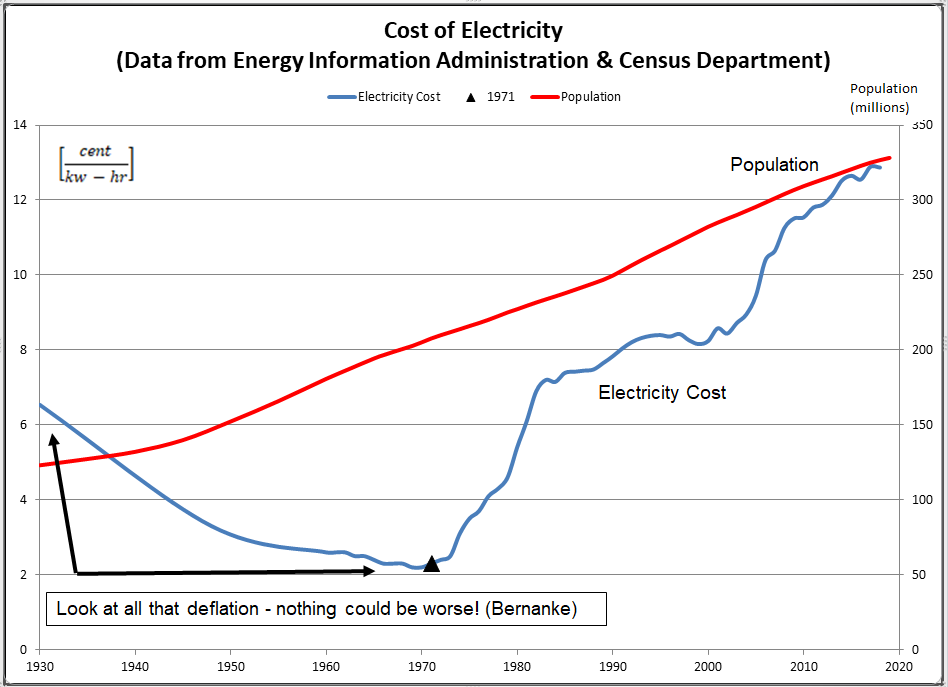

The examples provided by agriculture and oil tankers merely discuss increased productivity generally, but haven't addressed what increased productivity can do to prices. The relationship between higher productivity and prices is demonstrated in Figure 2. (2) Figure 2 plots the price of electricity in kilowatt-hours, (kw-hr), for the years 1930-2018. Electricity isn't merely another price; it is the most important price in any modern economy. Without affordable electricity, society as we know it would be radically altered. In addition, electricity is one of the most capital intensive industries in any modern economy. The generating plants, the transmission lines and the resource development needed to generate electricity represent one of the largest capital investment in the United States; (though you would never know this from the stock market or CNBC).

FIGURE 2: Electricity Deflation and Inflation

For the years 1930-1971 the price of electricity fell, and not by a small amount. (3) The price fell from just over 6-cents per kw-hr to just over 2-cents per kw-hr, a decline of 67%! The price of electricity fell even as its use soared and the population of the United States grew by leaps and bounds. What generated these lower prices? The same types of productivity improvements that increased agricultural yields and increased the amount of oil that could be carried by a single ship.

These technical advances and the enormous impact they had on the price of electricity for the years 1930-1971 carry little weight with the likes of Ben Bernanke, the Federal Reserve or PhD economists more generally. Nothing frightens them more than falling prices - which they call 'deflation.' As demonstrated here, a healthy economy should produce falling prices. Indeed, how can an economy and a society become more productive without this productivity manifesting itself, at least in part, by falling prices? There are many things that demonstrate the moral and intellectual bankruptcy of modern economics. However, the best evidence of this bankruptcy is the tremendous fear economists have of falling prices, a fear which is prompted by their looking at deflation through a magnifying glass.

Peter Schmidt

Sugar Land, TX

June 21, 2021

PS - As always, if you like what you read, please register with the site. It just takes an e-mail address and I don't share this e-mail address with anyone. The more people who register with the site, the better case I can make to a publisher to press on with publishing my book. Registering with the site will give you access to the entire Confederacy of Dunces list as well as the financial crisis timeline.

Help spread the word to anyone you know who might be interested in the site or my Twitter account. I can be found on Twitter @The92ers

ENDNOTES:

1. The Haber-Bosch process was developed just before World War I. At the time, fertilizers were largely made from bat guano. In Germany, Fritz Haber developed a way of synthesizing nitrogen from the air, and combining it with hydrogen extracted from natural gas to manufacture ammonia. Carl Bosch, then took this fiendishly complex process - which involved pressures and temperatures far beyond any used elsewhere in industry - and developed the process technologies necessary to manufacture ammonia on an industrial scale. The subsequent fixation of nitrogen into the top soil led to an explosion in agricultural yields.

2. Electricity prices were obtained from three sources that cover the time period in question, 1930 - 2018;

Daniel Pope, Nuclear Implosions - The Rise and Fall of the Washington Public Power System, Cambridge University Press, New York, p. 25. Pope cites the Census Bureau's "Statistical History of the United States from Colonial Times to the Present (1970). Pope gives electricity prices as follows, per kwh-hr; 6.03-cents in 1930, 3.01-cents in 1948 and 2.12-cents in 1968

The remaining data was obtained from the U.S. Energy Information Administration (EIA);

For 1960 - 2011, see https://www.eia.gov/totalenergy/data/annual/showtext.php?t=ptb0810

For 2011 - 2018, see https://www.eia.gov/electricity/annual/html/epa_01_02.html

3. There is a reason prices stopped falling in 1971; it was the year President Nixon closed the gold window. With the last brake on the creation of money removed, money was created like never before. Soon the inflation genie was out of the bottle and prices for everything soared. Its no coincidence that as prices soared, wealth became more and more concentrated.

http://www.the92ers.com/blog/august-15-1971-nixon-temporarily-closes-gold-window-opens-door-inflationary-chaos-and-wealth-0