The Federal Reserve - All Hat and No Cattle

The phrase "all hat and not cattle" perfectly describes the Fed of the post-2008 crisis era. For those that don't know, the phrase describes someone who looks the part of a cowboy and talks like a cowboy, but, when push comes to shove, is incapable of performing any of the difficult tasks traditionally performed by a cowboy.

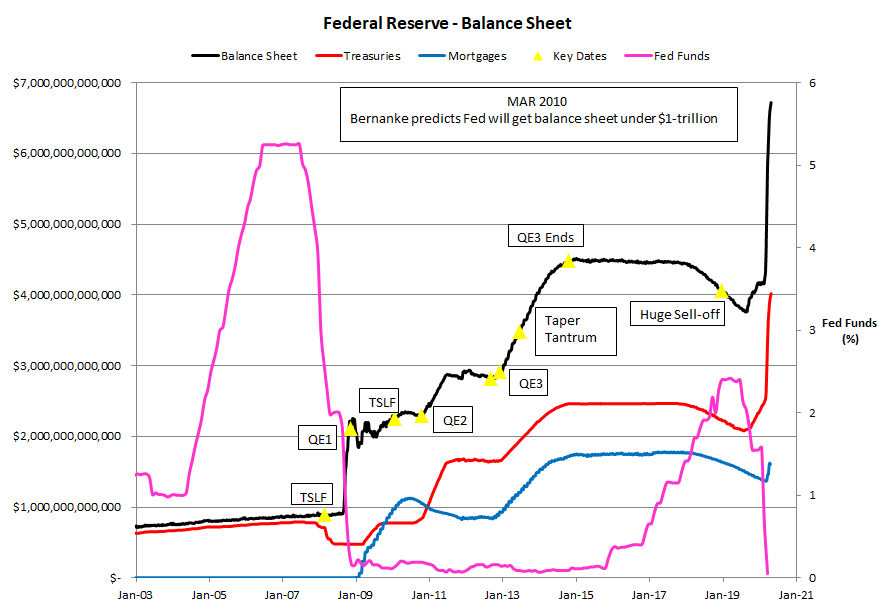

In the aftermath of the financial crisis peaking, universally reckoned to be the collapse of Lehman Brothers in September 2008, the Fed implemented an unprecedented campaign of quantitative easing, (QE). Though the product of MIT PhD economists, QE was quite simple. QE required the Fed to greatly expand its balance sheet. The Fed did this by creating money - trillions of dollars worth - out of thin air. The Fed then used the money it created to purchase all sorts of distressed assets from banks, primarily mortgage securities, and treasury debt. The mortgage securities and treasury debt it purchased became assets to the Fed, while the money the Fed created became a liability to the Fed and a reserve in the banking system.

The theory was, with all these reserves in the banking system, credit would be readily available to business. With all this credit available, business would borrow and the economy would recover. As the economy recovered, the Fed would then be able sell all the assets it had acquired through QE back to the banking system. As these assets were sold back, they would come off the Fed's balance sheet and the Fed's balance sheet would return to pre-crisis levels. What could be simpler?

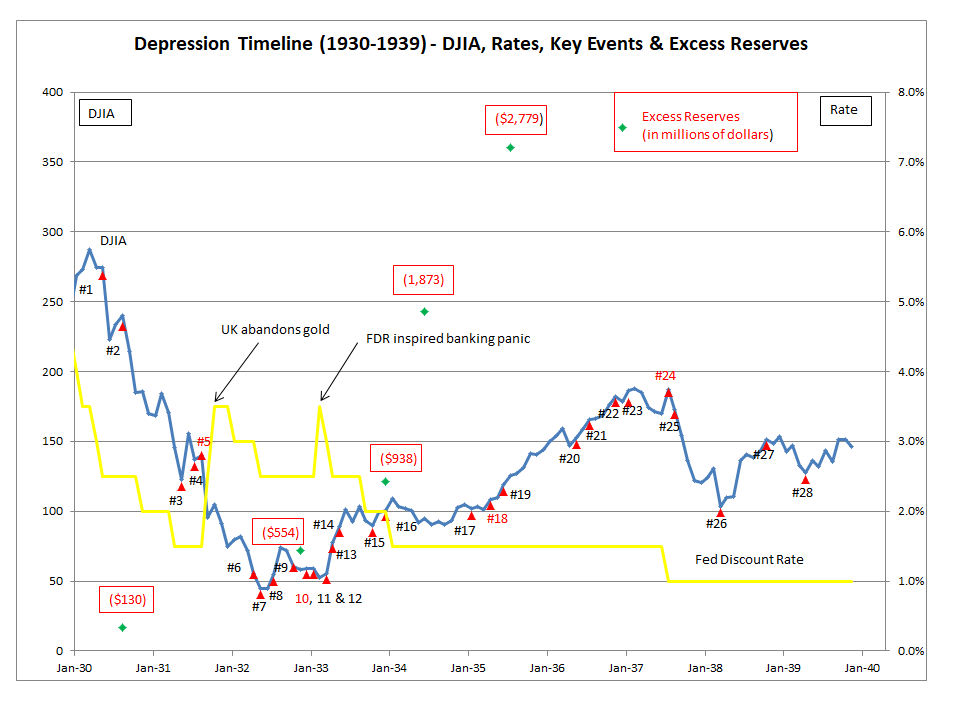

Before getting into the 'all hat and no cattle' aspects of the Fed, it is worth noting that the entire QE program was deeply flawed and incapable of working as the Fed believed it would. Ben Bernanke - largely by his own reckoning - is considered an expert on the Great Depression. Bernanke's implementation of QE proves he knows almost nothing of value about it. Ben Bernanke concludes that the Great Depression was caused by a collapse in the money supply. In reality, the collapse in money supply during the Great Depression was an effect, and a cause of nothing. The money supply collapsed not because the banking system didn't have reserves to lend; the money supply collapsed because no one was willing to borrow money! See the chart below and excess reserves soaring during the Depression era. By the mid-1930s, excess reserves in the banking system exceeded total reserves in the pre-1929 banking system!

Given his conclusion that an effect of the Depression - the collapsing money supply - was actually a cause, it shouldn't be surprising that QE didn't go as Bernanke planned. After a brief review of how the Fed blew up its balance sheet - the "all hat" part of QE, the "no cattle" part of QE will be demonstrated by both statements from Fed officials as well as three interest rate decisions. In these statements, Fed officials promise to reduce the balance sheet to pre-crisis levels and dismiss any concerns related to reducing its balance sheet. However, all these statements are ultimately proven to be so much hot air in the wake of the huge DEC 2018 sell-off in stocks.

The Fed can blow up its balance sheet. (All Hat)

KEY Dates:

- 11 MAR 2008: Term Securities Lending Facility (TSLF) - Fed trades Treasuries for toxic debt

- 24 NOV 2008: QE 1 Begins - Fed purchases hundreds of billions of mortgage securities

- 01 FEB 2010: TSLF Ends - with large scale asset purchases underway, TSLF is redundant

- 01 NOV 2010: QE2 Begins - Fed to purchase at least $600-billion of Treasury securities

- 13 SEP 2012: QE3 Begins - Fed to purchase $40-billion in bonds per month, w/ no end date

- 12 DEC 2012: QE3 Expands - Fed expands monthly purchases to $85-billion per month

- 29 JUN 2013: Taper Tantrum - Treasury rates soar as Fed hints at tapering asset purchases

- 29 OCT 2014: QE3 Ends

- 01 JAN 2019: Nasdaq Bottoms

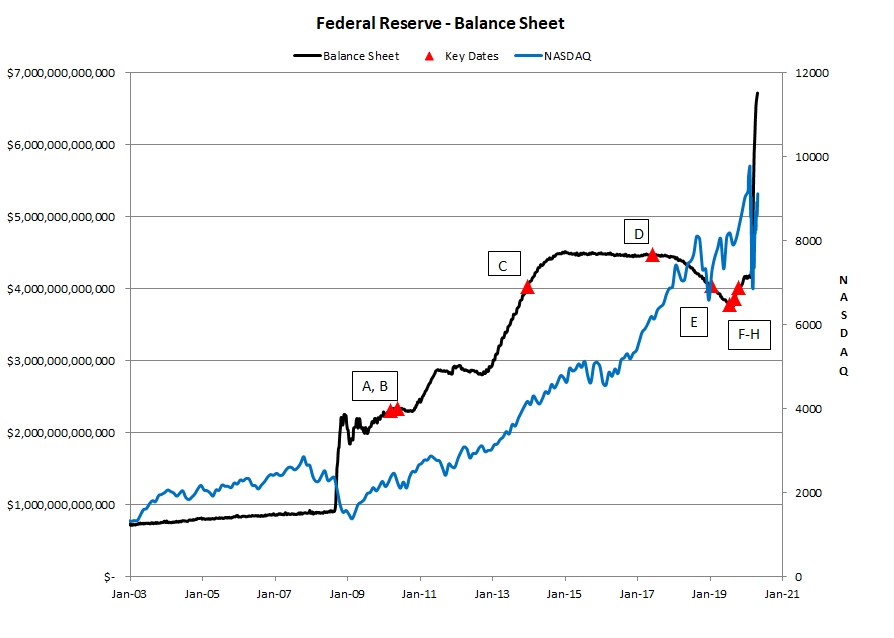

The Fed can't reduce its balance sheet (No Cattle)

Key Dates

- (A) 25 MAR 2010: Ben Bernanke promises to get the balance sheet under $1-trillion. (1)

- (B) June 2010: James Bullard of the St. Louis Fed describes the Fed's QE programs as "temporary in nature" and "always meant to be temporary in nature." (See #2, p. 156)

- (C) 01 JUN 2014: St. Louis Fed states, "The FOMC has stipulated that the expansion of the Fed balance sheet is temporary (emphasis in the original) and that holdings will return to normal as the recovery progresses." (3)

- (D) 14 JUN 2017: Janet Yellen cavalierly dismisses any concerns with the Fed reducing its balance sheet and compares the process to "watching paint dry." (4)

- (E) 30 JAN 2019: Powell states, "The case for raising rates has weakened somewhat." The stock market collapse from December 2018 has caused the Fed to blink. (5)

- (F) 01 AUG 2019: Fed cuts rates, 0.25%

- (G) 19 SEP 2019: Fed cuts rates, 0.25%

- (H) 31 OCT 2019: Fed cuts rates, 0.25%

CLOSING REMARKS:

It is widely held throughout the financial media that QE 'worked' and the Fed should be praised for its heroic action. It is further argued that somehow the government made money by its massive bailout programs. What ridiculous arguments! How can anyone argue QE worked with the Fed's balance sheet swollen to obscene levels? A necessary prerequisite for any argument that QE was a 'success' would require the Fed to return its balance sheet to something approaching pre-crisis levels. Because that never happened, there is no basis for judging QE a success. All that can be said of QE at this point is that it was a massive bailout for the banks and institutions (Fannie and Freddie) that brought the country to its knees. Hardly a cause for celebration.

Of course, the Corona virus now gives the Fed a perfect excuse to further expand its balance sheet. However, as shown here, the Federal Reserve's failure to make any serious inroads at reducing its post-crisis balance sheet has nothing to do with the Corona virus. Long before the virus became an issue, the Fed had started to increase its balance sheet and cut rates. By 31 OCT 2019, the Fed's balance sheet was back above $4-trillion. Given what happened after 2008, it is a foregone conclusion that the Fed will be full of all sorts of brave talk about how they are going to unwind the enormous balance sheet expansion prompted by the Corona virus. My advice - don't believe a word of it.

Peter Schmidt

Sugar Land, TX

May 17, 2020

PS - As always, if you like what you read, please register with the site. It just takes an e-mail address and I don't share this e-mail address with anyone. The more people who register with the site, the better case I can make to a publisher to press on with publishing my book. Registering with the site will give you access to the entire Confederacy of Dunces list as well as the financial crisis timeline.

Help spread the word to anyone you know who might be interested in the site or my Twitter account. I can be found on Twitter @The92ers

ENDNOTES:

1. See the video, starting around the 1:04 mark;

https://www.youtube.com/watch?v=v4He1m2a5jg

2. James Bullard, "The Lessons for Monetary Policy from the Panic of 2008," Federal Reserve Bank of St. Louis Review, May/June 2010, pp. 155-163

https://files.stlouisfed.org/files/htdocs/publications/review/10/05/Bullard.pdf

3. Christoper J. Waller and Lowell J. Ricketts, "The Rise and (Eventual) Fall of the Fed's Balance Sheet," Federal Reserve Bank of St. Louis, January 1, 2014

https://www.stlouisfed.org/publications/regional-economist/january-2014/the-rise-and-eventual-fall-in-the-feds-balance-sheet

4. Yellen said, "My hope and expectation is that when we decide to go forward with this plan, (reducing the balance sheet), there will be very little reaction to it, that's how we intend to proceed, and that this is something that will just run quietly in the background over a number of years, leading to a reduction in the size of our balance sheet and in the outstanding stock of reserves, and this is something that the Committee will not be reconsidering from time to time. We think this is a workable plan, and it will as one of my colleagues, President Harker described it, it will be like watching paint dry." See page 17 of the link. https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20170614.pdf

5. Jeff Cox, "Fed Chair Jerome Powell Says the Case for Raising Rates Has Weakened,'" January 30, 2019,

https://www.cnbc.com/2019/01/30/fed-chair-jerome-powell-says-the-case-for-raising-interest-rates-has-weakened.html