LTCM, Derivatives and the Flexible Use of the Term 'Crisis'

SUMMARY:

- In October 1998, the Federal Reserve and the Treasury Department took extraordinary actions as a result of Long-Term Capital Management's (LTCM) collapse; a collapse driven by highly leveraged derivative securities.

- These crisis responses notwithstanding, in November, 1999, the President's Working Group on Financial Markets - ignoring the still fresh example provided by LTCM and the enormous systemic risks posed by derivatives - proposed leaving derivatives unregulated.

- More amazingly, one year after that - in the dying days of the Clinton Administration - the government passed the Commodity Futures Modernization Action of 2000. The legislation provided 'legal certainty' to derivatives and left them unregulated.

- Finally, in November 2008 President-elect Obama nominated Lawrence Summers - a major driver in all this - to head his National Economic Council. Obama laughably claimed Summers would help develop policies to confront wealth inequality.

It is transparently obvious, that the LTCM crisis was used to provide a bailout to Wall Street and hedge funds. With the crisis then behind them, Wall Street and the financial powers that be conveniently forgot about LTCM and left derivatives unregulated. Moreover, the key drivers of the policy response - or lack thereof - to LTCM's collapse weren't forced to suffer any rebuke or criticism, even after the AIG debacle of November 2008. Instead of rebuke, they were praised as the people who were singularly capable of protecting the rest of society from the financial forces they had helped unleash.

DISCUSSION:

In May 1998, the Commodity Futures Trading Commission, CFTC, was led by Brooksley Born, a lawyer with lots of experience in the market for credit derivatives. 'Derivatives' are so named because they derive their value from other financial assets, and have no value in and of themselves. Instead, their value is a reflection of how some other 'real' financial asset - say a mortgage bond - is priced. In addition, derivatives involve enormous amounts of leverage and, because of their derivative nature, their pricing is often non-transparent and opaque. (Anyone who has seen the movie 'The Big Short' recalls a large part of the drama was the enormous time lag between the collapsing housing market and that reality being reflected in the price of derivatives tied to the housing market).

As a result of the concerns with leverage and transparency, Born's CFTC prepared a 'concept release' to consider regulating derivatives. The CFTC was attempting to use its authority to regulate futures contracts to regulate derivatives. Strictly speaking, this was may well have exceeded the CFTC's statutory authority. Hearings were soon arranged to consider the CFTC's proposal and these took place in July 1998.

It is obvious that the Clinton Administration - particularly Treasury Secretary Robert Rubin and his assistant, Lawrence Summers - were completely against regulating derivatives in any form or fashion. Their vociferous protests against the CFTC's proposal went far beyond questioning the CFTC's authority to regulate derivatives. That said, in his testimony, Summers - while glossing over many well-documented problems with derivatives - focused on the legal argument the CFTC didn't have the authority to regulate derivatives. In this testimony, Summers promised to study the merits of regulating derivatives as part of the President's Working Group on Financial Markets, (the Working Group). As facts would subsequently prove, Summers had no intention of even countenancing regulating derivatives, and we now know this because of what transpired in the wake of LTCM's collapse.

In the mid-1990s, LTCM had been an enormously successful hedge fund. The secret to its success was derivatives. Essentially, LTCM placed an enormous amounts of highly leverage bets that it believed were virtually certain to pay off. The source of this confidence were computer models created by an army of MIT PhDs in finance and economics. (1) However, stripped of its academic veneer, the business model of LTCM largely amounted to picking up pennies in front of speeding freight trains. In September 1998, the freight trains caught up and LTCM collapsed. There was concern that the forced selling precipitated by this collapse would lead to a widespread financial conflagration.

Of course, the Federal Reserve of Alan Greenspan didn't need to be cajoled into acting on behalf of Wall Street. After organizing the obligatory bailout of LTCM, (23 SEP 1998), the Greenspan Fed cut rates at the Fed's next meeting of the Open Market Committee, (29 SEP 1998). All this was merely the tip of the iceberg. Greenspan then called a special meeting of the Open Market Committee (OMC) on October 15. At this meeting, Greenspan wanted to cut interest rates again, before the Fed's next's OMC meeting. This is an exceedingly rare action and Greenspan face some resistance from Don Poole. Poole trenchantly asked, “Is there any chance the action today (cutting rates) could be viewed by some anyway as an effort to bail out the hedge funds?”

As it turned out, it was a 100% certainty that the emergency October rate cut would be viewed as an effort to bail out hedge funds. Speculators all over Wall Street became convinced that no matter how recklessly they acted, there was a limit to how bad things would get. If things started to even look like they might become bad, the Fed would bail them out. This mindset became known as the “Greenspan put.” A manic sense of “irrational exuberance” then engulfed Wall Street and sent the NASDAQ soaring.

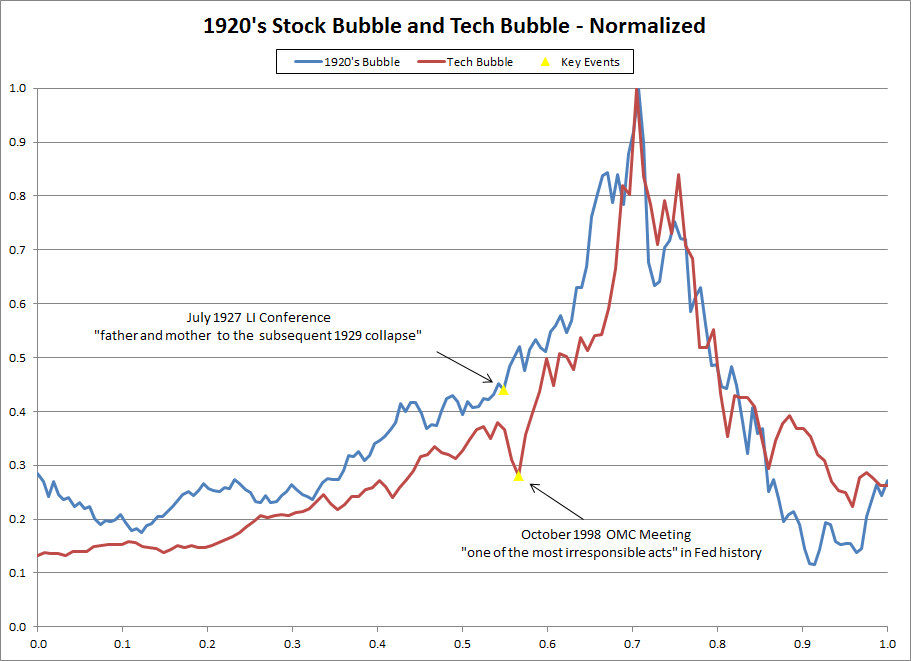

At the time of the surprise rate cut the NASDAQ was at 1611. In a little over a year, November 1999, the NASDAQ soared to 2967, a gain of 84%. In a final speculative blow-of the NASDAQ reached 5000 in March of 2000, a 70% rise in just the four months since November, or over 210% since the surprise rate cut sixteen-months earlier in October 1998. As Figure 1 makes clear, the Fed's emergency rate cut in October 1998 had the same effect on stocks as Ben Strong's rate cut after the July 1927 conference of central bankers. There is little doubt that the emergency rate cut of October 1998 sparked the tech bubble in stocks and all that would transpire after this bubble burst.

FIGURE 1:

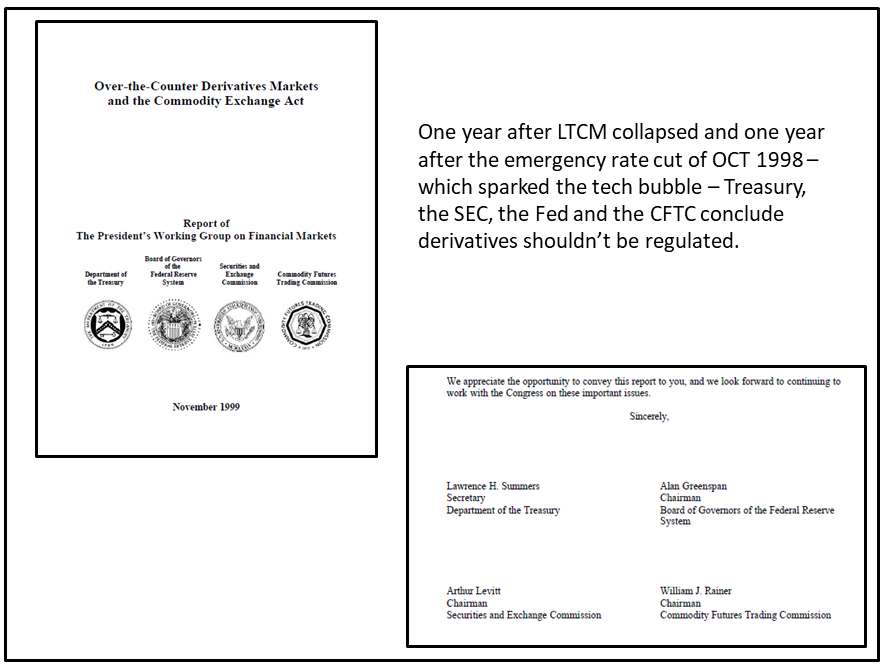

While the Greenspan Fed was intervening in markets to advance Wall Street interest, Lawrence Summers was still obligated to prepare his report on derivatives for the Working Group on Financial Markets. The report was released in November 1999. Given the enormity of the Fed's response to LTCM's collapse, it would make sense that LTCM's collapse would figure prominently in the Working Group report. Instead, LTCM is hardly even mentioned. Indeed, instead of recommending some sort of regulation to ensure something like LTCM didn't happen again, the report recommended providing derivative markets 'legal certainty' and removing 'legal obstacles' to the development of new derivative clearing systems. (2) Summers and the Working Group concluded the derivative market should remain as unregulated in the future as it had been in the past. The fact that these conclusions were made roughly one year after LTCM's spectacular collapse proves the Working Group's report was a total whitewash. While Summers prepared the report, it was also signed by Greenspan, (Federal Reserve), Arthur Levitt (SEC) and William Rainer (CFTC, Brooksley Born had been sacked many months before). See Figure 2.

FIGURE 2:

With the imprimatur provided by Treasury, the FED, the SEC and the CFTC, it was inevitable that the working groups recommendations would be acted upon by Congress. Indeed, in December 2000 - in the dying days of the Clinton administration and just before the start of the Christmas holidays - the Commodity Futures Modernization Act of 2000 was passed. It would prove to be everything Wall Street wanted and more - at least until November 2008 and the implosion of AIG.

CONCLUDING REMARKS:

The collapse of LTCM is a perfect example of 'not letting a crisis go to waste.' The spectacle of a looming financial crisis was used as justification for the extraordinary actions that were taken after LTCM collapsed. However, it would then stand to reason, that, with the crisis eventually safely behind the country, the powers that be would take actions to keep such a crisis from occurring again. As the example provided by the President's Working Group on Financial Markets report from November 1999 shows, this was not the case. Not only was LTCM no longer a crisis, it barely merited mention in the government's official position paper on derivatives.

This flexible definition of what a crisis is, and what a crisis isn't, allows the people at the center of these debacles to remain at the center of financial power in this country. There is no better example of this then Lawrence Summers, the lead author of the Working Group's November 1999 report. Shortly after being elected president, Barack Obama picked his economic 'dream team.' Not only did this dream team include the feckless Tim Geithner - fresh off his bailout of AIG counterparties - it also included, as director of the National Economic Council, Lawrence Summers. In announcing the selection of Geithner and Summers Obama said,

"I've sought leaders who could offer both sound judgement and fresh thinking, both a depth of experience and a wealth of bold, new ideas, and most of all who share my fundamental belief that we cannot have a thriving Wall Street without a thriving Main Street."

Of Summers specifically Obama said,

"As a thought leader, Larry has urged us to confront the problems of income inequality and the middle-class squeeze, consistently arguing that the key to a strong economy is a strong, vibrant, growing middle class. This idea is at the core of my own economy philosophy and will be the foundation of my economic policies." (3)

It should be transparently obvious by now, but we are being played.

Peter Schmidt

Sugar Land, TX

July 11, 2021

PS - As always if you like what you read, please consider registering with the site. It just takes an e-mail address, and I don't share this e-mail address with anyone. The more people who register with the site, the better case I can make to a publisher to press on with publishing my book! Registering with the site will give you access to the entire Confederacy of Dunces list as well as the Financial Crisis timeline. Both of these are a treasure trove of information on the crisis and the long-running problems that led to it.

Help spread the word to anyone you know who might be interested in the site or my Twitter account. I can be found on Twitter @The92ers

ENDNOTES:

(1) This article discusses the academic background of several LTCM partners;

http://www.the92ers.com/blog/computers-economists-disastrous-combination-part-i-ii

(2) Over-the-Counter Derivatives Markets and the Commodity Exchange Act, Report of the President's Working Group on Financial Markets, November 1999

https://home.treasury.gov/system/files/236/Over-the-Counter-Derivatives-Market-Commodity-Exchange-Act.pdf

(3) Obama Names His Economic Dream Team," November 24, 2008, CNN.com,

https://money.cnn.com/2008/11/24/news/economy/obama_economic_team/