The Most Dangerous Thing that Can Come to a Country - A Brief Timeline Courtesy of Messrs. Clinton, Cisneros & Cuomo

Last week's blog post centered on Dr. Benjamin Anderson's identification of the 'most dangerous thing that can come to a country.' Namely, "the substitution of government policy in credit matters for the free exercise of banking judgement." (1) This week's blog post will be a bulleted list of some of the key events that describe how just three men, Bill Clinton (Dunce #12), Henry Cisneros (Dunce #11) and Andrew Cuomo (Dunce #16) helped bring the United States to its financial knees via the Department of Housing and Urban Development (HUD).

(Note for more details on these various events, download the timeline from the site)

- October 28, 1992 - Congress passes the Federal Housing Enterprises Financial Safety and Soundness Act. This act gives HUD the power to establish legally binding 'goals' for the percentage of mortgages the two enormous GSEs, Fannie Mae and Freddie Mac, must issue to low and moderate income borrowers. At the time this act was passed, only about 30% or so of GSE mortgages went to low and moderate income borrowers. After Andrew Cuomo's reign (of financial terror) at HUD, the percentage would soar past 50% and help doom the US to an enormous credit collapse and economic crisis.

- September 1994 - Mortgage banks sign best practices agreements with HUD. HUD Secretary Cisneros brokers deals with large mortgage banks to have them implement lending policies that would support President Clinton's soon to be announced 'strategy' to increase home ownership. Countrywide was the first mortgage bank to sign one of these agreements.

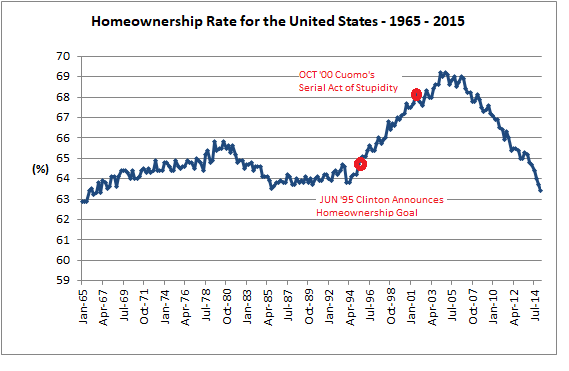

- November 05, 1994 - President Clinton calls for a national effort to increase home ownership to an all-time high by the end of the century. President Clinton's goal was to increase home ownership to 67.5%, considerably higher than it had ever been.

- May 02, 1995 - President Clinton announces his 'National Home Ownership Strategy.' The 'strategy' includes a program with one-hundred 'steps' to increase home ownership. These steps now read like detailed instructions on how to destroy the US economy.

- June 05, 1995 - President Clinton comments on his home ownership strategy, "I want to say this one more time....Our home ownership strategy will not cost the taxpayers one extra cent. It will not require legislation. It will not add more Federal programs or grow the Federal bureaucracy. It's one-hundred specific actions that address the practical needs of people...."

- December 1995 - In accordance with the Federal Housing Enterprises Financial Safety and Soundness Act of October 1992, HUD Secretary Cisneros boosts the percentage of GSE mortgages that must go to low and moderate income borrowers from the present percentage of 30-35% to 42% by 1999. (Lending standards will be radically altered to meet this 'affordable housing' mandate.)

- April 06, 1998 - HUD Secretary Cuomo comments on how his department is now forcing banks to issue mortgages they would not have otherwise issued. As part of these comments, he cavalierly dismisses the increased defaults these HUD influenced lending policies will surely produce. "With the $2.1-billion, lending that amount in mortgages - which will be a higher risk - and I'm sure there will be a higher default rate on those mortgages than on the rest of the portfolio."

- March 02, 2000 - Cuomo proposes a HUD rule that would require 50% of GSE mortgages to go to low and moderate income borrowers. Cuomo claimed the rule would 'greatly expand the supply of affordable homes across the country, giving millions of families the opportunities to buy homes...."

- March 03, 2000 - Franklin Raines - a Clinton political crony and the CEO of Fannie Mae - discusses the consequences of Cuomo's 50% affordable housing mandate from the day before. Raines concludes, "We (Fannie Mae) have not been a major presence in the sub-prime market, but you can bet that under these goals we will be."

- October 31, 2000 - HUD Secretary Cuomo seals the fate of the United States. On this date, Cuomo followed through on his proposal to require Fannie and Freddie issue 50% of their mortgages to low and moderate income borrowers. Cuomo crows, "These new regulations will greatly enhance access to affordable housing for minorities, urban residents, new immigrants and others left behind, giving millions of families the opportunity to buy homes or to move into apartments with rents they can afford..."

- October 01, 2002 - Paul Krugman celebrates the 'boom' in housing as economically beneficial. "...So the Fed cut rates early and often; those eleven interest rate cuts 'fueled a boom both in housing purchases and mortgage financing...'

- April 2004 - Home ownership peaks at just over 69% while Andrew Cuomo's 50% affordable housing mandate is the law of the land. Home ownership will fall from here without interruption through 2015.

- October 06, 2004 - Congressional dunces Maxine Waters and Barney Franks leap to the defense of GSEs and Fannie CEO Franklin Raines. Waters says of a report critical of the GSEs...."Mr. Chairman, we don't have a crisis at Freddie Mac and particularly at Fannie Mae, under the outstanding leadership of Franklin Raines....What we need to do today is to focus on the regulator (of the GSEs, author), and this must be done in a manner so as not to impede the affordable home mission. That mission as you noted has seen innovation flourish from desktop underwriting to 100% (no down-payment) loans." Barney Frank says of the same report, "I don't see anything in your report that raises safety or soundness concerns (of the GSEs, author)."

- December 21, 2004 - Clinton crony and mortgage neophyte Franklin Raines is forced to resign from Fannie. The report - which Waters and Franks criticized on October 06 - uncovered approximately $6-billion in completely fictitious profits at Fannie. The scale of these fictitious profits dwarfs anything that occurred at Enron.

- September 05, 2008 - Fannie and Freddie effectively declared bankrupt and placed in conservatorship. The chickens of the government's massive interference in the mortgage market via the GSEs have come home to roost. The Treasury authorizes $100-billion of capital to be injected into both Fannie and Freddie to make up for the massive losses that the lending policies of Clinton, Cisneros and Cuomo have created.

- October 18, 2008 - New York Times profiles Henry Cisneros, now a private home-builder and board member of Countrywide Financial, and his 'flawed American dreams.' Cisneros' signature real estate development in his hometown of San Antonio, Lago Visto - is a spectacular failure and leads to dozens of defaults.

- December 24, 2009 - Treasury Department authorizes additional capital injections into Fannie and Freddie. Recall that in September 2008, a total of $200-billion was injected into the two GSEs. As these subsequent injections indicate, the initial $200-billion wasn't enough! Note also the day chosen to make these capital injections - a day chosen to virtually eliminate any public scrutiny!

The Housing Bubble in Chart Form (home ownership rates from the St. Louis Fed)

As this list indicates, there is a very easy trail to follow that connects the government's massive interference in the mortgage market via Fannie and Freddie with the enormous losses Fannie and Freddie later incurred. In spite of the relative ease with which this is done, neither President Clinton nor HUD Secretary Cuomo (especially) have ever been taken to task for the enormous damage they have done to this country. HUD Secretary Cisneros at least had the good sense to abandon a public profile after playing a major role in the largest economic calamity to befall the United States since the 1930s.

Peter Schmidt

Sugar Land, TX

May 19, 2019

PS - As always if you like what you read, please consider registering with the site. It just takes an e-mail address, and I don't share this e-mail address with anyone. The more people who register with the site, the better case I can make to a publisher to press on with publishing my book! Registering with the site will give you access to the entire Confederacy of Dunces list as well as the Financial Crisis timeline. Both of these are a treasure trove of information on the crisis and the long-running problems that led to it.

Also, follow me on Twitter @The92ers

ENDNOTEs:

(1) Economics and the Public Welfare - A Financial and Economic History of the United States, 1914-1946, Benjamin M. Anderson, Liberty Press, Indianapolis, IN, 1979, p. 176