Normalization of Deviance and Central Banks: What They Were and What They've Become - Part II

In last week's article, the founding basis for central banks was described in terms of Bagehot's dictum. Namely, that "in a crisis a central bank can lend freely but only against good collateral and only at high rates of interest." In a word passive and the proverbial lender of last resort. Also discussed was the concept of "normalization of deviance." Normalization of deviance describes how formerly rare or even proscribed events first occur, and, over time, come to be accepted as normal and acceptable. The 2003 Space Shuttle Columbia disaster was used as an example of normalization of deviance. In previous launches, the shuttle's heat resistant tiles - which are the shuttle's only line of defense against the heat of re-entry, were damaged. At first this damage was a source of great concern. However, over time, the damage came to be considered acceptable and unavoidable. That mindset then played a major role in the space shuttle breaking apart over Texas on February 01, 2003

In this week's article, the manner in which the Federal Reserve - supposedly created to serve as a passive lender of last resort - has metastasized into the all-powerful, unaccountable leviathan it has obviously become will be described. The Fed's metamorphosis occurred across four distinct eras and key events from each of these eras will be briefly discussed. In total, the description of this metamorphosis will show how the Fed gradually and irresistibly came to exercise the enormous power it currently, and disastrously, does The eras are as follows;

- Era I - The Great Depression: Foundation for all Economic Idiocy to Come

- Era II - The End of Bretton-Woods and Nixon's Cowardice: The Fork in the Road

- Era III - The Greenspan/Bernanke Era: The Die is Cast

- Era IV - QE and the Everything Bubble: Control is Lost

This week's article will discuss Eras I and II.

ERA I - The Great Depression: Foundation for all Economic Idiocy to Come

The conventional wisdom around the Great Depression - which is promulgated by the economic establishment - is the Fed "caused" the Great Depression by being passive. Specifically, the Fed simply stood by as the economy crashed all around it. This conventional wisdom argues the Fed should have created huge volumes of credit money out of thin air. The central bank created credit would have then found its way into the economy, and the economy would have recovered.

Despite the Harvard and MIT PhD pedigrees this argument is regularly given - (Ben Bernanke is among the most ardent disciples of this theory) - it's an argument that makes no logical sense whatsoever. After all, if the Fed caused the Great Depression by not taking a variety of actions after stocks crashed, then how could the explanation for the length and depth of the Depression be inadequate intervention by a central bank, when prior to 1913 there wasn't even a central bank to intervene as the Fed's modern critics insist it should have in the 1920s? In other words, if inaction by the Fed caused the Great Depression, how could the US have avoided anything remotely as bad as the Great Depression when the US didn't even have a central bank? As discussed last week, the Panic of 1907 - presumably the impetus for the Fed's founding in 1913 and representative of the worst thing that could happen without a central bank - wasn't remotely as bad as the Great Depression was.

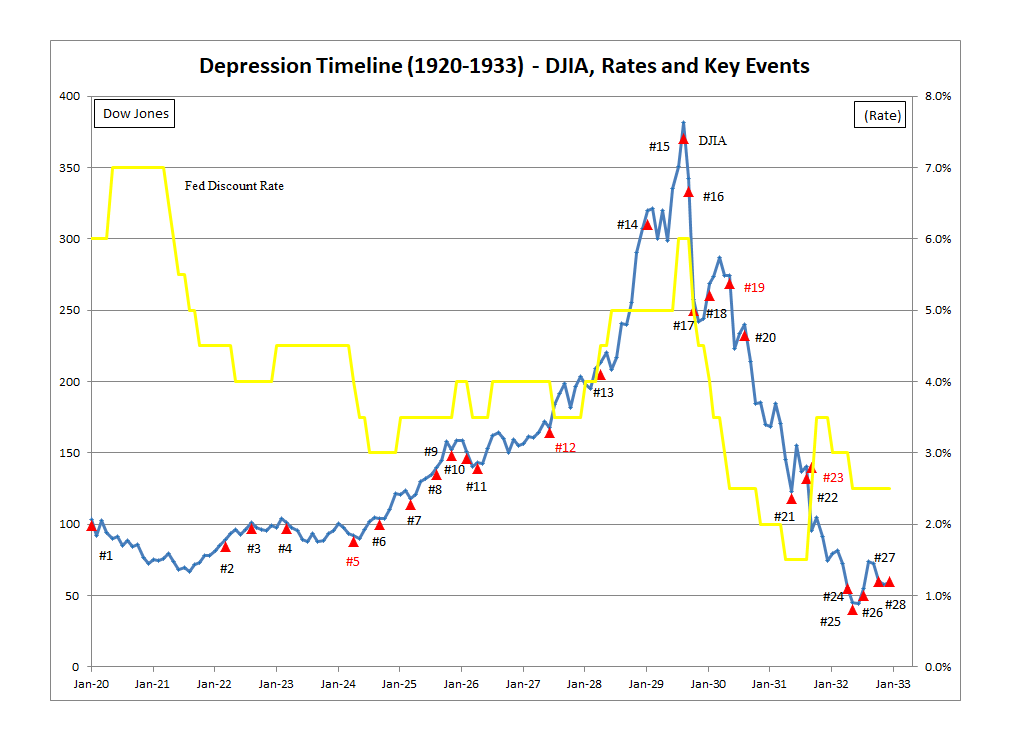

Rather than taking too little action and causing the Great Depression, it makes much more logical sense to search for actions the Fed took to cause the Depression. (In other words, it is no coincidence that we only had a Great Depression after we had a Federal Reserve!) It is a search that doesn't take much effort to bear fruit and these actions are best described by referencing the timeline chart below. (1)

The items of specific interest are;

- #4 - The Fed holds its first Open Market Committee Meeting (April 13, 1923)

- #5 - The NY Fed's Ben Strong admits to Treasury Secretary Mellon that the Fed's loose money policy is to benefit the UK, not the US (May 27, 1924)

- #6 - The Bank of England's Montagu Norman encourages Strong to continue with 'easy money' (October 16, 1924)

- #12 - The Long Island Conference of Central Bankers

All these actions have a common motive - to improve the post-war position of the Bank of England and its chief, Montagu Norman. After World War I, England was awash in debt. It had borrowed heavily to purchase armaments from the US and the value of the pound had plummeted as a result. The only way to return the pound to its pre-war parity was to raise rates and 'soak up' all the extra money created to support all the wartime spending. As this would have likely caused a recession in England, Norman wanted no part of it. In addition, the war had seen New York supplant London as the world's financial capital and Norman wanted to return London to its pre-war position of prominence. (During the war, New York, not London, was where the money was.)

Ben Strong, an ardent Anglophile and chief of the NY Fed, endeavored to help England in any way he could. What Strong and Norman came up with was a plan to keep rates as low as possible in the US. Low rates in the US would allow England to avoid raising rates as much as the free market would have otherwise demanded. See the chart, Items #4 through #6, and note interest rates, plotted in yellow, plummeting. After England suffered the economically ruinous Great Strike - May 1926, #11 on the chart - England's financial position was greatly undermined and rates were again marching higher. It was all this that motivated Strong to invite the leaders of the US, British, French and German central banks to meet in July 1927 on Long Island. Strong wanted to coordinate an international policy of low rates to benefit the UK.

When Strong asked the assembled bankers to lower rates to benefit the UK, the leaders of the French and German central banks balked. The head of the German central bank, Hjalmar Schacht reportedly said, "Don't give me a low rate. Give me a true rate, and then I shall know how to keep my house in order." French and German resistance to his entreaties notwithstanding, Strong pressed on and pursued a policy to benefit England with great vigor. In fact, Strong dismissed the concerns expressed by France and Germany with the retort, that the interest rate cuts he had in mind would amount to little more than "un petit coup de whiskey for the stock exchange."

Regrettably, the repercussions of the policy would be far more damaging than a few hungover stockbrokers. Adolph Miller of the Federal Reserve and a contemporary of Strong's called the 1927 credit expansion engineered to benefit the Bank of England, "the father and mother to the subsequent 1929 collapse." He also called this policy "the greatest and boldest operation ever undertaken by the Federal Reserve System, and in my judgment, resulted in one of the most costly errors committed by it or any other banking system in the last 75-years.” Note from the chart how stocks, plotted in blue, soar in the immediate aftermath of the July 1927 conference and the ensuing interest rate cut. As is always the case, speculators were getting in front of, or 'front running,' the Fed, and stocks were sent soaring. It was a speculative mania that will be duplicated in every conceivable detail during the tech bubble of Era III.

While central banks are powerful, they can't indefinitely suspend the laws of economics. Any false boom created with cheap central bank credit is destined to come crashing back to the earth. The 1920s stock market bubble was no different in this respect. Where the 1920s bubble did differ from all other central bank fueled bubbles was in the unprecedented damage the stock market crash led to. Nowhere is this damage more telling than in Germany. The stock market crash and the Depression this crash engendered were a lifeline for the fledgling Nazi party. In May 1928, #13 on the chart, Nazi candidates gained about 3% of the popular vote in German elections. In a little over two years, September 1930, the Nazis polled 18% of the popular vote; six-times what they had in 1928, #20 on the chart. It is no stretch to say that without Fed meddling to benefit the UK there never would have been a Great Depression, and without a Depression the Nazis wouldn't even have merited an asterisk in a history text.

ERA II - The End of Bretton-Woods and Nixon's Cowardice: The Fork in the Road

In spite of the Fed's massive role in creating both the Great Depression and the ensuing world war the Depression spawned, the Fed gained enormous power during the Depression. The best example of this is the Glass-Steagall Act. The act allowed the Fed to use government bonds, not just commercial paper, as collateral for its notes. (Recall the inherently passive nature of 'real bills' doctrine from Part I.) Allowing the Fed to back its notes, (currency), with government bonds guaranteed an explosion in both the size of government and government debt.

While the world war spawned in large part because of the Fed's fecklessness was still raging, a meeting was held to establish the world's post-war financial order. In July 1944, the Bretton-Woods conference was held at the Mount Washington Hotel in New Hampshire. This meeting established the dollar as the world's international reserve currency and established the value of the dollar on the basis of gold, with $35 equal to 1-oz of gold. While paper currency wasn't redeemable for gold by private citizens, Bretton-Woods directed that any central bank could present $35 to the Fed, and the Fed would exchange this currency for gold.

By the time the 1970's rolled around, the Bretton-Woods structure was groaning under the increasing size of US government debts and a large trade deficit. The government debts were fueled by the Great Society programs at home and the war in Vietnam. As more and more dollars accumulated overseas, foreign creditors began to question the wisdom of holding such large dollar balances. What gives any currency its value is its scarcity. The fact that so many more dollars were being accumulated overseas indicated dollars weren't quite as scarce as they used to be. To protect themselves from this inflation, overseas creditors with increasing frequency started to exchange their dollars for gold; the US gold reserve plummeted.

While the deficits had started under LBJ, Richard Nixon was president when the country came to the financial crossroads. Nixon was on his way to winning an enormous landslide victory in 1972 and had considerable political capital. Nixon could have fought to reign in government spending and to keep the dollar tied to gold. It wasn't the easy thing to do, but the right thing - especially in politics - rarely is. Another president, Grover Cleveland, was faced with exactly the same dilemma Nixon was and Cleveland chose the hard road.

During Cleveland's second term - he's the only president to serve non-consecutive terms - the country entered a severe recession, the Panic of 1893. Cleveland, correctly, identified the Sherman Silver Purchase Act of 1890 as a major cause of the panic. The act was passed as a result of agitation by progressives and agrarian interests. The act authorized the creation of huge amounts of paper money that would then be used to purchase silver. Basically the act was legislation to authorize an enormous credit inflation to support debtors at the expense of creditors. Instead of being backed by gold, the dollar would essentially be backed by gold and silver (bi-metallism). The paper money created to purchase the silver could then be exchanged for silver or gold. Exactly as Gresham's Law would predict, the bad money (silver) drove out the good money (gold). Gold in the banking system plummeted and credit dried up. Cleveland fought against 'bi-metallism' and vowed to return the dollar to a purely gold backing. His party, Cleveland was a Democrat, was slaughtered in the 1894 elections because of the short-term hardships this policy required. However, history has since vindicated Cleveland's policy as the correct one. The hard money that Cleveland's policy produced set the foundation for the enormous economic growth the US would enjoy for the next two decades.

However, Nixon was no Grover Cleveland. He was a pure politician and viewed issues exclusively through a short-term, political lens. Rather than recognizing the US' plummeting stockpile of gold as a direct consequence of US profligacy and reigning in government spending, Nixon came up with every politician's proverbial ace in the hole; a foreign bogeyman. Nixon blamed plummeting gold reserves not on a reckless federal government but - the "gnomes of Zurich." His solution, to 'temporarily' end the convertibility of the dollar into gold.

Here is President Nixon in his own words on that fateful Sunday night, August 15, 1971;

"In recent weeks, the speculators have been waging an all-out war on the American dollar. The strength of a nation's currency is based on the strength of that nation's economy - and the American economy is by far the strongest in the world. Accordingly, I have directed the Secretary of the Treasury to take action to defend the dollar against the speculators. I have directed Secretary Connally to suspend temporarily the convertibility of the dollar into gold or other reserve assets, except in amounts and conditions to be determined to be in the interest of monetary stability and in the best interest of the United States. Now what is this action - which is very technical - what does it mean for you? Let me lay to rest the bugaboo of what is called devaluation. If you want to buy a foreign car or take a trip abroad, market conditions may cause your dollar to buy slightly less. But if you are among the overwhelming majority of Americans who buy American-made products in America, your dollar will be worth just as much tomorrow as it is today. The effect of this action will be to stabilize the dollar."

Almost everything Nixon claimed about suspending the Bretton-Woods agreement would be proved untrue; it wasn't temporary, the dollar wouldn't buy as much tomorrow as it did today and the dollar wouldn't stabilize. Of course, because Nixon was unshackling the dollar from its gold backing, the academic and media establishments - no fans of Nixon generally - praised Nixon for casting the barbarous relic aside. On August 16, 1971, the New York Times published an editorial which praised Nixon. "We unhesitatingly applaud the boldness with which the President has moved on all economic fronts." (2) As it is in nearly all issues of any consequence, the New York Times' assessment of Nixon's great act of shame and national cowardice was completely wrong.

CONCLUDING REMARKS - PART II

Writing in his classic book, Economics of a Free Society, Wilhelm Ropke wrote,

"If in the production of goods the most important pedal is the accelerator, in the production of money it is the brake. To insure that this brake works automatically and independently of the whims of government and the pressure of parties and groups seeking 'easy money' has been one of the main functions of the gold standard. That the liberal should prefer the automatic brake of gold to the whims of government in its role of trustee of a managed currency is understandable." (3)

As a result of the power it usurped in the years leading up to the Great Depression and as a consequence of the collapse of the Bretton-Woods agreement the Federal Reserve had accumulated power while freeing itself from the only constraint on the exercise of that power, (the gold backing of the dollar). After the collapse of Bretton-Woods, there wasn't an effective brake on the Fed's ability to create money out of thin air. The deleterious effects from this were immediate and manifested themselves in the enormous inflation of the 1970s. It would then take Paul Volcker, the only Fed chairman of the last 50-years who didn't cause great damage to this country, and 20% interest rates to break the back of the inflation the 1970s vintage Fed unleashed on the country.

Following Volcker's relative brief reign of monetary sanity, the country was then forced to suffer from the appallingly long reign of financial terror of the Greenspan/Bernanke era at the Fed (1987-2014). These 27-years would be among the most crisis-ridden years in US economic history. The era would produce, among other things, three enormous assets bubbles - with each one being much larger than the one which preceded it - an enormous concentration of political and economic power, and an unprecedented concentration of wealth. All of this will be discussed in Part III of this series.

Peter Schmidt

Sugar Land, TX

April 26, 2020

PS - As always, if you like what you read, please register with the site. It just takes an e-mail address and I don't share this e-mail address with anyone. The more people who register with the site, the better case I can make to a publisher to press on with publishing my book. Registering with the site will give you access to the entire Confederacy of Dunces list as well as the financial crisis timeline.

Help spread the word to anyone you know who might be interested in the site or my Twitter account. I can be found on Twitter @The92ers

ENDNOTES:

1. Great Depression Timeline: The Fed and the Bank of England Had a Baby, and They Called it the Great Depression. This article discussed these Era I issues in considerably more detail. http://www.the92ers.com/blog/great-depression-timeline-fed-and-bank-england-had-baby-and-they-called-it-great-depression

2. New York Times, "Call to Economic Revival," August 16, 1971,

https://www.nytimes.com/1971/08/16/archives/call-to-economic-revival.html

3. Wilhelm Ropke, Economics of a Free Society, Ludwig von Mises Institute, Auburn, AL, 2008. p. 100