Normalization of Deviance and Central Banks: What They Were and What They've Become - Part IV

Over the past three weeks, the Federal Reserve's metamorphosis from the traditional and passive 'lender of last resort to today's central planning leviathan has been described. Recall that the founding basis for a central bank was to only serve as an emergency lender of last resort. This basis was famously described by Walter Bagehot as, "in a crisis a central bank can lend freely but only against good collateral and only at high rates of interest." For the purpose of this discussion, the Fed's metamorphosis from what it was to what it has become was separated into four eras; three of which have already been discussed.

- ERA I - The Great Depression: The NY Fed's Ben Strong went far beyond any mandate the Fed had to intervene in credit markets to advance the UK's interest. The result? The Great Depression and, amazingly, even more power for the Fed in the Future

- ERA II - The End of Bretton Woods (15 AUG 1971): The dollar's - and thus the financial system's - only link to gold is 'temporarily' suspended. This was a crossroads moment and the United States took the wrong fork in the road. Without any restraint on the Fed's ability to create credit money, it was a foregone conclusion that too much credit money would be created. All the economic chaos to come would be the result of central banks creating too much credit money.

- ERA III - The Greenspan/Bernanke Era at the Fed: This era was a financial reign of terror, and the financial equivalent to the political reign of terror unleashed by the Jacobins in revolutionary France. Exactly like the Jacobins, the Greenspan/Bernanke Fed had no respect for (financial) history, or - what G.K. Chesterton was fond of calling 'the democracy of the dead' - tradition. Without this healthy respect for the past, Greenspan and Bernanke would take the Fed into places it had never been; (and would be unable to escape from).

This brings the discussion to what is likely to be the Fed's final act - at least as it would apply to anything remotely resembling the financial system of the post-Bretton Woods era.

ERA IV - QE and the Everything Bubble: Control is Lost

Alan Greenspan and Ben Bernanke oversaw the most crisis -riddled period in US economic history and the emergence of three enormous bubbles; all of which dwarf the 1920s stock bubble. The three bubbles are the tech stock bubble (peaked in March 2000), housing bubble (homeownership peaked in April 2004) and the everything bubble (seemingly peaked in February 2020). The US economy has never experienced three bubbles of this size in such a short period of time. In fact, the last asset bubble of any consequence outside of the Greenspan/Bernanke era was the one Ben Strong blew up in the 1920s in ERA 1.

The most dire consequence of these bubbles isn't their number or even the relatively brief period in time over which they occurred. Instead, the most dire consequence is each bubble was much larger than the one which preceded it. It is this factor that is completely attributable to the Greenspan/Bernanke Fed and provides clear evidence the Fed has now completely lost control of events. With the benefit of a few charts, it is this loss of control that will be discussed.

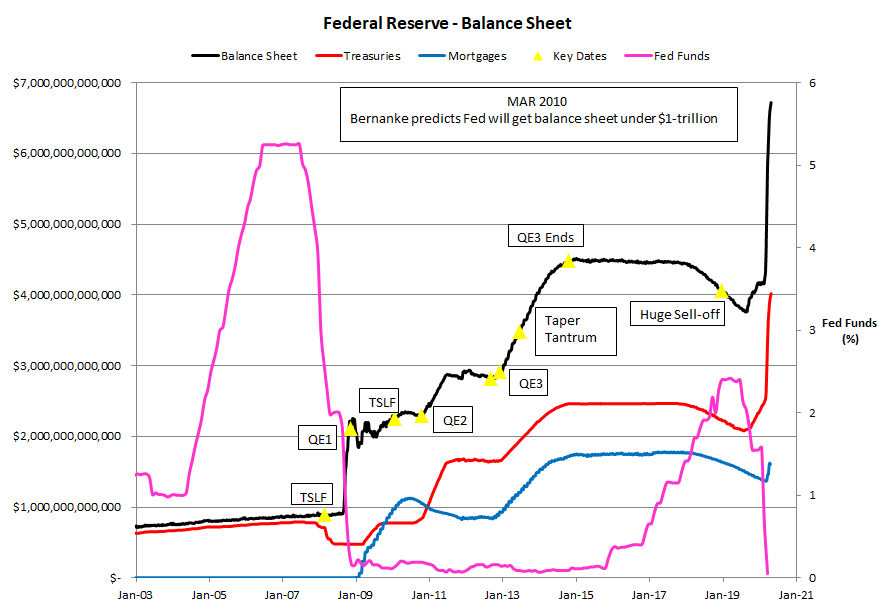

CHART 1

Chart 1 is a plot of the Fed's balance sheet and the Fed Funds rate from January 2003 to the present. The Fed's balance sheet is broken out into its two main components - Treasuries and mortgage backed securities (MBS). Note that prior to 2008, the Fed's balance sheet didn't include MBS. Note also the sharp drop in Treasury holdings in 2008. This was the result of the Fed's Term Securities Lending Facility (TSLF). The Fed implemented TSLF to exchange the liquid Treasury securities it held with the illiquid securities held by Wall Street banks. The chart also includes several 'key events' that provide context to what was occurring with the Fed's balance sheet and interest rates. For example, the implementation of each of the three rounds of quantitative easing, (QE), had an immediate and obvious impact on the Fed's balance sheet.

KEY Events:

- 11 MAR 2008: Term Securities Lending Facility (TSLF) - Fed trades Treasuries for toxic debt

- 24 NOV 2008: QE 1 Begins - Fed purchases hundreds of billions of mortgage securities

- 01 FEB 2010: TSLF Ends - with large scale asset purchases underway, TSLF is redundant

- 01 NOV 2010: QE2 Begins - Fed to purchase at least $600-billion of Treasury securities

- 13 SEP 2012: QE3 Begins - Fed to purchase $40-billion in bonds per month, w/ no end date

- 12 DEC 2012: QE3 Expands - Fed expands monthly purchases to $85-billion per month

- 29 JUN 2013: Taper Tantrum - Treasury rates soar as Fed hints at tapering asset purchases

- 29 OCT 2014: QE3 Ends

- 01 JAN 2019: Nasdaq Bottoms

The explosion in the size of the Fed's balance sheet was completely unprecedented. Prior the collapse of the housing bubble, the Fed's balance sheet was under $1-trillion. Indeed, when Barney Frank asked Ben Bernanke where he got the $85-billion he used to first bailout AIG - much more would ultimately be needed - Bernanke shrugged, "We (the Fed) have $800-billion." The reason the Fed's balance sheet had increased so much was the Fed's QE programs. In these programs, the Fed created trillions (!!) of dollars out of thin air to purchase Treasury securities and MBS. The Treasuries and MBS went on the asset side of the Fed's balance sheet while all the money the Fed created - which ended up as reserves held by banks at the Fed - became a liability to the Fed.

The Fed was completely unperturbed by the explosion in its balance sheet. On multiple occasions leading Fed officials expressed complete confidence in returning the Fed's balance sheet to pre-crisis levels. In March 2010 Congressman Ron Paul - one of a mere handful of legislators who understands the Fed - asked Ben Bernanke where he expected the Fed to have its balance sheet after the crisis was over. Bernanke answered, "I think we would like to bring the balance sheet back to something consistent where it was before the crisis, which was enough to accommodate Americans' demand for currency plus a modest amount of reserves in the banking system. That would suggest something under $1-trillion." (1) In January 1, 2014, economists for the St. Louis Fed wrote, "The FOMC has stipulated that the expansion of the Fed balance sheet is temporary (emphasis in the original) and that holdings will return to normal as the recovery progresses." (2)

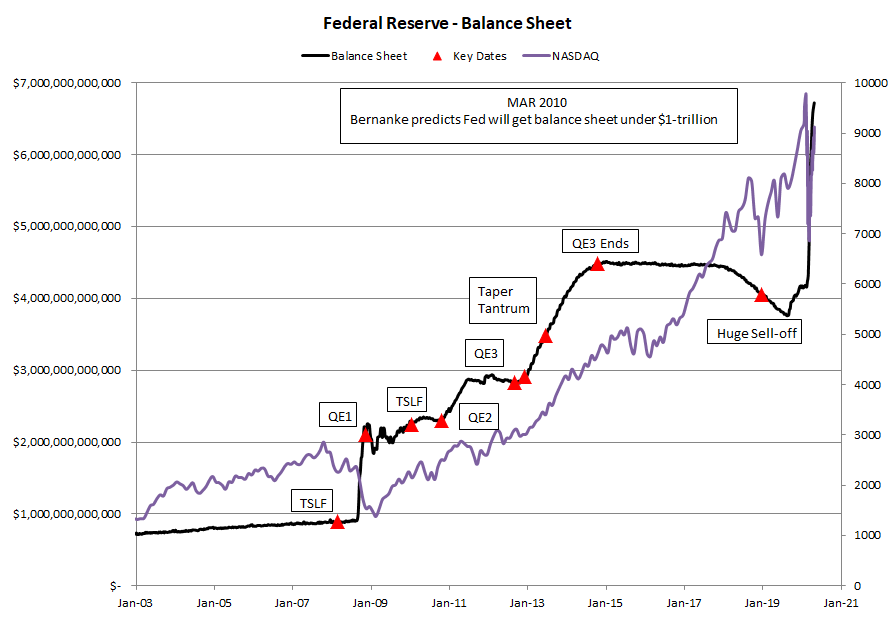

As shown in Chart 2, the Fed's only attempt at reducing its balance sheet ended in ignominious failure. See in particular the period between the end of QE3 and the Nasdaq's bottom from January 2019. It was no coincidence that the Nasdaq's huge sell-off - the December 2018 sell-off was the worst December since 1931, not exactly a good year for stocks - coincided with the Fed's only attempt at reducing the size of its balance sheet. Clearly, the stock market couldn't stay anywhere remotely close to its elevated level if the Fed continued with 'normalizing' its balance sheet.

CHART 2

Recall that in his March 2010 testimony to Congress, Bernanke said he wanted to get the Fed's balance sheet to 'something under $1-trillion.' The Fed couldn't get its balance sheet much under $4-trillion without threatening to bring the entire financial house of cards it had built up to come crashing down! By March 2019, the Fed said it was unlikely that rates would be raised during the year and it would also stop reducing the size of its balance sheet by September. All of this occurred long before anyone had ever heard of bat soup or the Corona virus. The evidence was in; the Fed couldn't reduce the size of its balance sheet and was now a prisoner of all its past profligacy. The Fed was a prisoner of its past.

CONCLUDING REMARK

The Corona virus has nothing to do with the Fed's inability to reduce the size of its balance sheet. While the Fed's balance sheet has exploded even more in response to the Corona virus, any notion that the Fed would reduce the size of its balance sheet had vanished in December 2018. The Corona virus merely accelerated the speed at which the Fed was traveling on the road to ruin; a road which the Fed itself had paved. The huge increase in the Fed's balance sheet as a result of the housing bubble bursting - which the Fed had a huge role in creating in the first place - was never going to be temporary. The debts - public and private - that have been accumulated as the balance sheet expanded can never be paid back with real production. The only thing that can dispense these debts is a massive inflation or some sort of accounting artifice (e.g. a debt holiday). Moving forward, all that remains to be seen is what will be the financial system that takes the place of the one Greenspan, Bernanke and their successors frittered away and squandered?

Peter Schmidt

Sugar Land, TX

May 10, 2020 - Mother's Day

PS - As always, if you like what you read, please register with the site. It just takes an e-mail address and I don't share this e-mail address with anyone. The more people who register with the site, the better case I can make to a publisher to press on with publishing my book. Registering with the site will give you access to the entire Confederacy of Dunces list as well as the financial crisis timeline.

Help spread the word to anyone you know who might be interested in the site or my Twitter account. I can be found on Twitter @The92ers

ENDNOTES:

1. See the video, starting around the 1:04 mark; https://www.youtube.com/watch?v=v4He1m2a5jg

2. Christoper J. Waller and Lowell J. Ricketts, "The Rise and (Eventual) Fall of the Fed's Balance Sheet," Federal Reserve Bank of St. Louis, January 1, 2014

https://www.stlouisfed.org/publications/regional-economist/january-2014/the-rise-and-eventual-fall-in-the-feds-balance-sheet