PhD Economists and Central Bankers - Missing the Inflationary Forest for the Trees, Part I

"Economists look at inflation through the wrong end of the telescope and deflation through a magnifying glass."

Wilhelm Ropke

One of the biggest victories achieved by modern economists and modern central bankers is changing the definition of inflation. Inflation used to mean an increase in the money supply - full stop. For the most part, it was accepted that it wasn't always possible to know what prices would increase as a result of the money supply increasing first. At times, consumer prices might increase, but consumer prices could also remain constant while asset prices soared. Over the next two weeks, two of the primary ways ways in which central bankers, (and economists more generally), obscure the ruinous impact of their inflationary policies will be discussed:

- There can't be any inflation, consumer prices are flat.

- Rising prices are a consequence of shortages, not anything central banks do.

There can't be any inflation, consumer prices are flat (Milton Friedman's Theory of the Great Depression):

A leading cause of the Great Depression was the stable consumer prices of the era blinded people to the enormous asset bubble the Fed was blowing up. Included among those people blinded by the stable goods prices of the 1920s masking an enormous inflation is Ben Bernanke. On November 08, 2002 Ben Bernanke gave a speech in honor of Milton Friedman’s ninetieth birthday. (1) In this speech, Bernanke provides his – and Friedman’s - theory of the Great Depression. Friedman concluded the Fed caused the Great Depression by allowing the money supply to collapse during the 1930s. In his analysis, Friedman first attempts to show those times – Bernanke calls them “monetary policy episodes” - during the Depression era when the money supply changed for reasons “plausibly unrelated to the state of the economy.”

With these episodes identified, Friedman reasoned it would then be possible to determine how changes in the money supply caused changes in the economy. The Friedman thesis purports to show the Great Depression can “reasonably be described as having been caused by monetary factors,” or changes in the money supply drove changes in the economy. When the money supply fell the economy slumped. When the money supply increased, the economy recovered. (2)

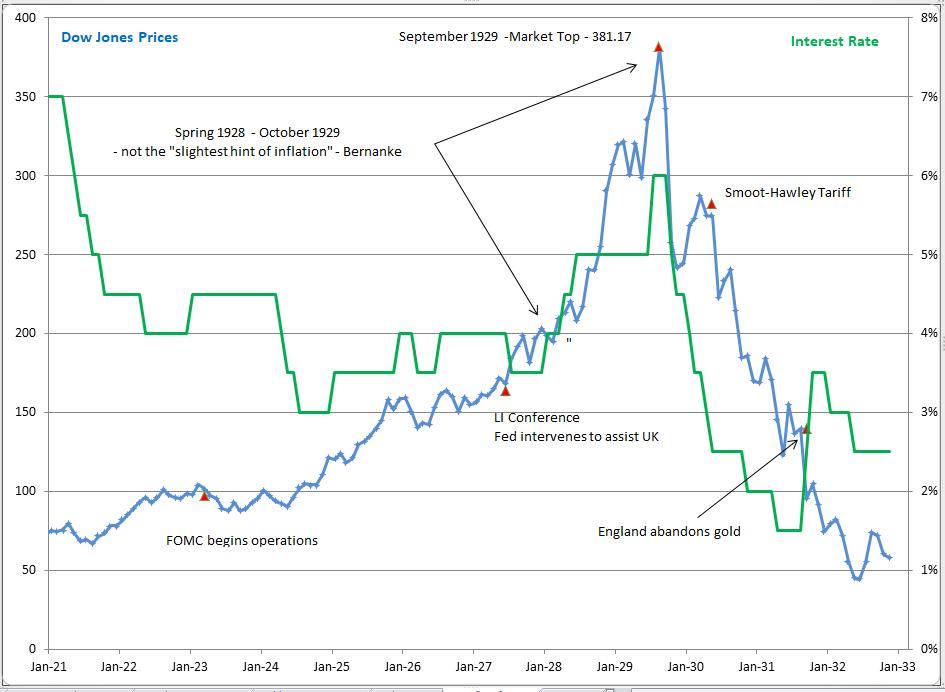

What the Friedman analysis of the Great Depression – and Ben Bernanke’s endorsement of it in November 2002 – really shows has nothing to do with the Depression. Instead, the analysis and Bernanke’s endorsement of it exposes what is the Fed’s overarching blunder of the Greenspan/Bernanke era – the failure to understand one word, inflation. The first “monetary policy episode” Bernanke cites as proof that the Fed caused the Great Depression was the policy tightening that began in the spring of 1928. Bernanke criticizes the Fed for raising interest rates during this period because – in his opinion – there wasn’t “the slightest hint of inflation.” Yet, see Figure 1 below and note the vertical ascent of stock prices when Ben Bernanke says there was no inflation.

FIGURE 1:

As the chart makes clear, even with the benefit of hindsight Ben Bernanke completely misdiagnoses the 1920s stock bubble. Ben Bernanke relies on an artificially narrow definition of inflation that is confined to consumer prices, and this makes him blind to inflation as measured by even huge increases in asset prices. Stable consumer prices are no proof that credit is not being expanded too liberally or the risk of a financial bubble is low. As discussed in last week's article - which detailed the enormous productivity gains associated with technological advances - a healthy economy should produce falling prices. There is nothing natural about an economy producing constantly higher prices. (3)

The economic establishment's dismissal of "inflation" as being an impossibility when consumer prices are flat is transparently absurd and Figure 1 demonstrates this. Indeed, financial bubbles are most likely to occur when goods prices are relatively stable – the Great Depression and the Financial Crisis of 2008 provide ample evidence of this. So the discussion here is not an exercise in parsing of words or demonstrating - again - the comprehensive intellectual bankruptcy that forms the foundation upon which today's all-powerful central banks are built. Instead, the discussion here demonstrates that the enormous damage done to the United States by the Great Depression and the housing bubble are a direct consequence of the Fed, supposedly staffed by the smartest economists in the world, failing to understand the definition of a single word – inflation.

In Part II, the role 'shortages' play in obscuring the inflation created by central banks will be discussed.

Peter Schmidt

September 26, 2021

Sugar Land, TX

PS - As always, if you like what you read, please consider registering with the site. It just takes an e-mail address, and I don't share this e-mail address with anyone. The more people who register with the site, the better case I can make to a publisher to press on with publishing my book! Registering with the site will also give you access to the entire Confederacy of Dunces list as well as the Financial Crisis timeline. Both of these documents are a treasure trove of information on the crisis and the long-running problems that led to it.

ENDNOTES:

1. https://www.federalreserve.gov/BOARDDOCS/SPEECHES/2002/20021108

2. Friedman and Bernanke both get cause and effect backward. The money supply collapsing during the Depression wasn't a cause. Instead it was an effect. See this article for details.

http://www.the92ers.com/blog/take-it-ben-bernanke-ben-bernanke-knows-nothing-about-depression

3..http://www.the92ers.com/blog/making-simple-things-complex-economists-and-notion-increased-productivity-cant-produce-lower