Rock, Paper, Scissors it Ain't; Exactly Why is it so Much Better to Own Assets?

In last week's article, the hierarchy of economic prices was discussed. (1) There it was described that in an economy ravaged by a monetary inflation, wealth would best be preserved by owning assets. On the other hand, people whose wealth was measured in goods and wages would fare much worse. A simple equation was introduced which summarized this result;

assets > goods > wages

One of the seminal moments in mankind's technical and economic advancement was the barter system giving way to a system of exchange based on money. The use of money, allowed for widespread division of labor and this led to enormous increases in physical production. A person could earn a living by simply contributing to production of a good; they no longer needed to produce a complete good themselves. All the benefits of a common means of exchange and the division of labor notwithstanding, they can't obscure the fact that consumers, even today, still trade their production for the production of other consumers.

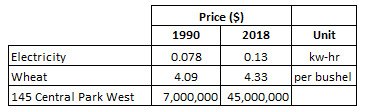

It is this notion of trading your production for the production of other consumers that completely exposes the ruinous impact of inflation. The discussion here will be based on several of the prices that were discussed in last week's article; the price of electricity, the price of wheat and the price of the triplex apartment in the south tower of the San Remo building in New York City. These prices can all be seen in Table 1;

The prices in Table 1 are all measured in dollars. If the dollar was a constant standard of value - which it isn't - then it might be possible to glean what is occurring by looking at these prices in dollars. However, because the dollar is constantly shedding value, and because of the hierarchy of goods in any inflation, it is not clear to see exactly what is going on. Sure, the price of wheat has gone up a lot less than electricity or trophy New York real estate, but what does this really mean and does it have any implications for how inflation might fertilize the rich man's field with the sweat of the poor man's brow?

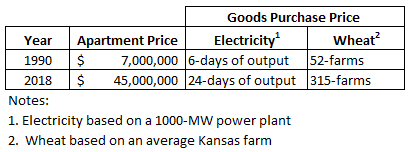

In Table 2, the price of the apartment is 'converted' to its equivalent value in electricity and wheat for the years 1990 and 2018. (For anyone interested in the math - which is completely straightforward - see the calculations below.) Table 2 makes it clear to see how much better it is to hold assets instead of goods or wages when inflation is running amok. In 1990, the apartment could be purchased with 6-days of output from a 1000-MW power plant or the output of 52 Kansas wheat farms. By 2018, the cost had risen to 24-days of power plant output or the output of 315 Kansas wheat farms. In terms of electricity, the apartment was 300% more valuable, while in terms of wheat it was 500% more valuable! Food and energy aren't insignificant prices; they are the most important goods prices in any economy!

Table 2

CONCLUDING REMARKS:

The brief discussion here couldn't be more important. The discussion demonstrates the ruinous impact of inflation on an economy and a society. Anyone whose wealth is related to the prices of things like electricity or wheat is falling behind those whose wealth is captured in assets. Indeed, spare a thought for the Kansas wheat farmers depicted here; they aren't just falling behind, they are being run over! Their wheat is only 20% as valuable as it was 30-years ago when that value is based on trophy real estate.

To be sure, in capitalism the fact that a good is required in society doesn't mean that everyone can make a profit selling it, nor does it mean that wheat farmers should make more money than movie stars. (The San Remo building is a celebrity favorite in New York and this apartment was once owned by Bruce Willis and Demi Moore.) However, a society that allows wealth to concentrate among an asset owning class at the expense of impoverishing those doing the actual production that society relies on, has a fatal flaw in its economic system. This flaw - which is clearly demonstrated here - has nothing to do with capitalism or free markets. Instead, it has everything to do with the system of crony capitalism the Federal Reserve has - with hardly any opposition - foisted upon the United States.

Peter Schmidt

Sugar Land, TX

June 28, 2020

PS - As always, if you like what you read, please register with the site. It just takes an e-mail address and I don't share this e-mail address with anyone. The more people who register with the site, the better case I can make to a publisher to press on with publishing my book. Registering with the site will give you access to the entire Confederacy of Dunces list as well as the financial crisis timeline.

Help spread the word to anyone you know who might be interested in the site or my Twitter account. I can be found on Twitter @The92ers

ENDNOTES:

1. http://www.the92ers.com/blog/rock-paper-scissors-it-aint-more-how-fed-fertilizes-rich-mans-field-sweat-poor-mans-brow

CALCULATIONS

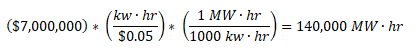

Purchasing the Apartment with Electricity:

The figures for electricity costs are for electricity delivered to a customer. A significant fraction of these costs are for distribution for the electricity, not the generation of it. If we assume that approximately 60% of the total cost of electricity is with the generation than the costs become $0.05 per kw-hr (1990) and $0.08 per kw-hr (2018).

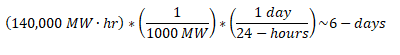

In 1990:

In 2018:

![]()

![]()

Purchasing the Apartment with Wheat:

The average yield of a Kansas wheat farm for the past ten years was 42.1-bushels per acre and the average Kansas wheat farm was 781-acres - both figures from the Kansas Department of Agriculture. Use these figures to convert the wheat production into the equivalent number of Kansas farms.

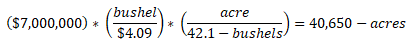

In 1990

At 781 acres per farm, it would have taken the output of approximately 52-Kansas wheat farms to purchase the apartment in 1990.

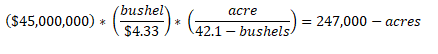

In 2018

At 781 acres per farm, it would have taken the output of approximately 315-Kansas wheat farms to purchase the apartment in 2018.