The Stabilationists: The Animating Force Behind Food Shortages in the Soviet Union & Bubbles on Wall Street

Review: In last week's article, the 'stabilationists' and their ideas were introduced. The original stabilationists included some of the world's leading economists like Irving Fisher. They believed great benefits would be achieved if prices remained constant. This week's article shows how this silly idea was behind enormous economic chaos and suffering in both the Soviet Union and the United States.

DISCUSSION:

The Soviet Union - with the benefit of an all-powerful police state that central planners of the past and central bankers of today can only dream about - rigorously enforced and controlled prices for all sorts of goods, especially food. Even the tyrants running police states understand that if the people can't get enough to eat, then their days in power - along with the days their heads remain attached to their body - can be numbered with increasingly smaller digits. The Soviet government used all its awesome power to keep food prices from rising. The Soviet commissars earnestly believed that if they kept the price of food low, then people could always afford to pay for food.

What these commissars - and their kindred spirits in central planning, the stabilationists - didn't understand is by not allowing prices to adjust to what is occurring in the economy, valuable information is lost. Because prices didn't change, the Soviet economy could never adjust its production to more efficiently produce the goods the hard-working and long-suffering Soviet people were clamoring for. The most obvious manifestation of this inefficient production was dozens of people waiting outside of a bakery that only had six loaves of bread for sale. The commissars who dominated the Soviet Union were largely ruthless tyrants. If they ever stopped to consider the awesome power they wielded over hundreds of millions of people with such awful consequences, they might have defended their policies from the standpoint of advancing some larger, greater good of the collective. "You can't make an omelet without breaking a few eggs" remains the classic defense of tyrants and central planners the world over.

However, what sort of defense could the stabilationists ever offer for their completely nutty doctrine? They were supposed to be economists. Irving Fisher was supposedly the greatest American economist alive! Yet not only did the stabilationists accept the economic rationale of stable prices, they ardent believed there were huge economic benefits to prices that never changed! Somehow, the economy would be able to adjust to constantly changing production and shifting demand without the benefit of information provided by prices.

Of greater consequence than exposing a host of the supposedly brightest economists as a bunch of charlatans, the stabilationist doctrine greatly impacted the 1920's era Fed. The theories of the stabilationists gave the Fed the intellectual justification for continuing to interfere in the market long after warning flags started to go up. The Fed of the 1920's embarked on a completely unprecedented peacetime expansion of credit. The term 'expanding credit' simply means increasing the reserves in the banking system. The increased reserves then allow banks to make more loans. The credit expansion was affected via the Fed's Open Market Committee (FOMC) - which only began operation in April 1923 - and not by consumer or business savings. The Fed simply decided the economy needed more credit and proceeded to create this credit out of thin air.

The leading members of the Fed at the time - and their apologists ever since - routinely cite the fact consumer prices were not rising during the 1920s as evidence the Fed did not over-expand credit. Indeed, just before the Depression broke, John Maynard Keynes praised the "successful management of the dollar by the Federal Reserve Board from 1923" as a "triumph" of currency management. (1) Much later, Milton Friedman claimed that the "high tide" of the Fed was its success in maintaining stable prices throughout the 1920s. (2) To put Keynes' and Friedman's praise of the 1920's Fed another way, how could anyone accuse the Fed of overstimulating the economy when consumer prices didn't move for years on end?

The answer to this question is quite simple. The simple fact of the matter is a central bank's irresponsible monetary policies don't have to show up as rising prices for consumer goods. Indeed, in the case of the 1920's Fed, there was a very good reason the Fed's disastrous monetary policies didn't show up as higher prices for consumer goods. At the time the United States and much of the world was in the middle of something called the Industrial Revolution.

The industrial revolution was a revolution in productivity. The increased productivity of the Industrial Revolution puts the productivity increases of today's 'high tech' era to shame. As a result of harnessing different forms of energy - first steam, later the chemical energy in gasoline and then electricity - man's physical burdens became much lighter. A few machines could do the work of hundreds of people. Heavy items could be loaded onto a steam-powered locomotive and moved effortlessly across the country. Trucks could then distribute these same items to individual homes and businesses. Electric motors drove pumps to provide irrigation to formerly barren lands or powered machines in factories to make production easier. As early as 1887, the Bureau of Statistics in Berlin, Germany noted that steam engines alone were doing the work of 1-billion men; three-times the working population of the earth at the time! (3)

By harnessing all this mechanical and electrical energy and directing it toward productive ends, the production of goods exploded. Not only did the production of formerly existing goods explode, but all sorts of inventions led to goods that never existed before. All this increased production put a downward pressure on prices. Because it was so much easier to produce goods and the quality of goods increased so quickly, it made perfect sense for the price of these goods to go down. However, economists of today believe there is nothing worse for an economy than falling prices. However, as the example provided by the Industrial Revolution proves, a healthy, growing economy that is experiencing large gains in productivity should produce falling prices for all types of goods.

Regrettably, the downward pressure on prices from the Industrial Revolution was almost completely counteracted by the monetary policy of the Fed. Instead of prices falling - which the productivity gains of the Industrial Revolution should have produced - prices for goods generally stayed the same because of the Fed's credit inflation. In essence, the price decreases produced by the Industrial Revolution were matched by the price increases created by the Fed via its inflationary monetary policies.

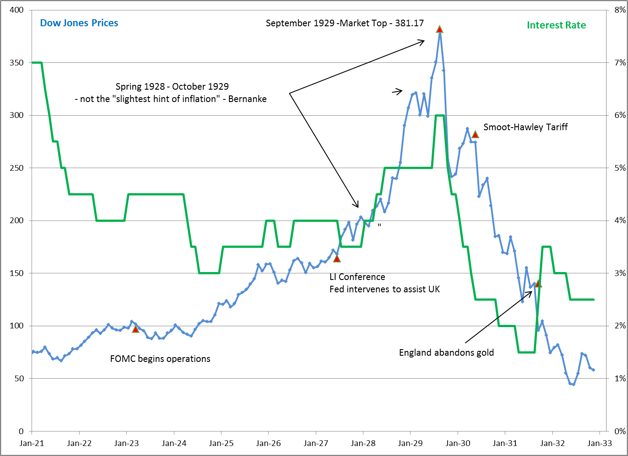

The Fed's credit inflation most obviously manifested itself in the price of assets like stock and real estate. The productivity gains of the Industrial Revolution could do nothing to mask or mitigate the rise in asset prices during the 1920s. From April 1923 - the start of the Fed actively intervening in the economy via the FOMC - through September 1929 - the eve of the stock market crash - stock prices rose from 101 to 381; an average annual gain of nearly 23%. The rise in stock prices was being fueled - almost exclusively - by the Fed's disastrous monetary policies; the July 1927 conference of central bankers in particular. (4)

Writing in 1934, the great British economists, Lionel Robbins, was fully aware of how the Fed's apparent success in 'currency management' and holding the price level constant had actually set the stage for an enormous, world-altering economic disaster. Robbins wrote,

"From the point of view of the historian of the recent crisis, nothing can be more important than the propaganda for a managed currency. It encouraged the belief that the stable-price level was the be-all and end-all of monetary policy...It led to an extravagant admiration of the policy of the Federal Reserve System at a time when the policy of the Federal Reserve System was sowing the seeds of the slump." (5)

John Wayne famously said, 'life is hard; it's even harder if you're stupid.' Sadly, the Fed would prove itself stupid and repeat the exact same mistakes from the 1920s during the Greenspan and Bernanke eras. Under the disastrous leadership of Greenspan and Bernanke, the Fed myopically focused on the relatively stable consumer price level and ignored the enormous run up in asset prices; first tech stocks and then housing. The best evidence of this blindness to asset prices is provided by a speech Ben Bernanke gave on November 08, 2002. The occasion of the speech was Milton Friedman's 90th birthday, and Bernanke spoke about the Great Depression. In his speech, (6), Bernanke criticizes the 1920s Fed for raising interest rates in the spring of 1928. Not only does Bernanke fail to mention the Fed's disastrous policies in the wake of the July 1927 conference of central bankers, which lit a fuse under the stock market, he claims in the spring of 1928 there wasn't the 'slightest hint of inflation.'

As the chart below shows, Bernanke's assessment of inflation in the spring of 1928 - even with the benefit of hindsight - is completely wrong. Sure consumer prices weren't going anywhere, but look at stock prices shooting straight up! What better evidence of the Fed's massive contribution to today's bubbles could there possibly be than for Ben Bernanke to fail to see the exact same contribution the Fed made to the bubble that led to the Great Depression. Don't let Ben Bernanke's Harvard degree or MIT PhD fool you; this man is hugely ignorant and his misdiagnosis of the Fed's contribution to the 1920s stock bubble completely proves it!

Peter Schmidt

Sugar Land, Texas

July 14, 2019

PS - As always if you like what you read, please consider registering with the site. It just takes an e-mail address, and I don't share this e-mail address with anyone. The more people who register with the site, the better case I can make to a publisher to press on with publishing my book! Registering with the site will give you access to the entire Confederacy of Dunces list as well as the Financial Crisis timeline. Both of these are a treasure trove of information on the crisis and the long-running problems that led to it.

Follow me on Twitter @The92ers

ENDNOTES:

(1) Murray Rothbard, America's Great Depression, Mises Institute, Auburn, AL. 2005, p. 173

(2) William Greider, Secrets of the Temple, Touchstone Books, New York. 1987, p. 183

(3) Henry Hazlitt, Economics in One Lesson, Three Rivers Press, New York. 1979, p. 51

(4) The92ers.com, "The Federal Reserve and the Fatal Conceit of Economics - Necessary and Sufficient Conditions to Cause Enormous Economic Damage," September 30, 2018

(5) Lionel Robbins, The Great Depression, Transaction Publishers, New Brunswick, NJ. 2009, p. 77

(6) Remarks by Governor Ben S. Bernanke at the Conference to Honor Milton Friedman, University of Chicago, Chicago, IL. November 08, 2002 https://www.federalreserve.gov/boarddocs/Speeches/2002/20021108/default.htm