Is This Your Homework Larry? Lawrence Summers' Congressional Testimony on Derivatives

INTRODUCTION:

In May 1998, the Commodities Futures Trading Commission, (CFTC), proposed regulating over-the-counter, (OTC), derivatives. This modest proposal prompted an extraordinary reaction from Wall Street and the Clinton White House. Within just two months a congressional hearing was scheduled to address the proposal. President Clinton's Treasury Secretary - and former Goldman Sachs CEO - Robert Rubin, and his assistant, Lawrence Summers, immediately argued against the CFTC's proposal. In the discussion below, excerpts of Summers' congressional testimony is reviewed. (1)

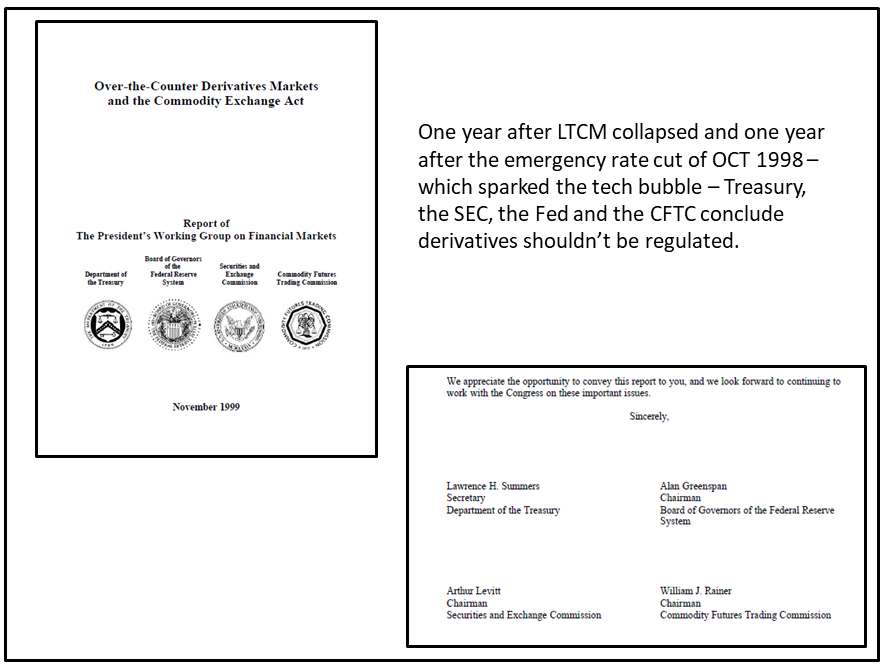

Taking Summers at his word, a review of his testimony reveals Summers was completely ignorant of the enormous danger derivatives posed to the financial system. Moreover, even with the benefit of knowing the enormous role derivatives played in the spectacular collapse of LTCM in October 1998, Summers never changed his mind on the wisdom of regulating derivatives. The failure of Summers to learn the obvious lessons of LTCM's collapse is confirmed by the report he wrote for the President's Working Group on Financial Markets in November 1999. In this report, Summers whitewashed the LTCM affair and recommended leaving derivatives unregulated. Summers' failure to learn the obvious lessons provided by LTCM's collapse would then play a leading role in the 2008 financial crisis. Indeed, derivatives were a larger source of losses in the 2008 crisis than mortgages going bad.

DISCUSSION:

Below, are portions of Summers' July 1998 testimony to congress. This testimony didn't age very well.

- "We believe that the uncertainties created by the release posed risks to the American OTC derivatives market. This is not a possibility to be taken lightly when one considers the critical importance of these activities to the growth and efficiency of our economy." (Comment: derivatives - like most of what passes for 'financial engineering' today - is parasitic to the nation's economy and contributes nothing to the generation of real wealth.)

- "The OTC derivatives market is a vast, increasingly global industry. By some estimates, the market now has a notional value of around $26-trillion, with contracts of more than $4-trillion undertaken in 1997 alone. The dramatic growth of the market in recent years is testament not merely to the dynamics of modern financial markets, but to the benefits that derivatives provide for American businesses." (Comment: for some evidence of the self-evident absurdity of the derivative market at this time, US GDP in 1998 was just $9-trillion. How could it make sense for the 'notional value' of derivatives contracts to be 200% larger than the US economy? Well, it didn't make sense.)

- "By helping participants manage their risk exposures better and lower their financing costs, derivatives facilitate domestic and international commerce and support a more efficient allocation of capital across the economy...OTC derivatives directly and indirectly support higher investment and growth in living standards in the United States and around the world." (Comment: from the beginning, derivatives lacked transparency and parties to the same derivatives contract often disagreed wildly on the prevailing derivative price at any one time; hardly a hallmark of efficiency. (2))

- "Any disruption to this market brings two potential costs. First, it could inhibit the use of an important risk management tool, thus reducing the efficiency of our financial markets in channeling capital to its most effective use." (Comment: During the Global Financial Crisis, derivative products greatly increased systemic risk. Far more money was lost in derivative products than in mortgages. (3))

- "Treasury responded to the CFTC's concept release, because it poses risks to the continued strength and stability of the American OTC derivatives market." (Comment: within ten years of Summers July 1998 testimony, derivatives would play a leading role in two enormous financial crashes - the collapse of LTCM in October 1998 and the September 2008 financial crisis. So much for stability.)

- Summers gave two reasons derivatives didn't need to be regulated; (i) the parties to derivatives contracts are sophisticated financial institutions that can look after their own interests, and (ii) derivative markets can't be manipulated. (Comment: both reasons were proved wrong. The collapse of LTCM and AIG both prompted Fed bailouts, and derivative markets have proven to be easily manipulated. (4))

- "To date there has been no clear evidence of a need for additional regulation of the institutional OTC derivatives market, and we would submit that proponents of such regulation must bear the burden of demonstrating that need." (Comment: just two months after his testimony, the collapse of LTCM would prompt the Fed to organize a bailout and cut rates between regularly scheduled open market committee meetings. By almost anyone's definition - but not Larry Summers' - LTCM's collapse was 'clear evidence' of the need for additional regulation. In spite of this, Summers never revisited his position on derivatives. In fact, when he prepared the official report on derivatives for the President's Working Group on Financial Markets, he completely whitewashed the LTCM affair. The report which whitewashed the LTCM affair was also signed by Alan Greenspan of the Federal Reserve and Arthur Levitt of the SEC. See Figure 1)

FIGURE 1

CONCLUDING REMARKS:

Paul Volcker's insights into financial engineering products like derivatives provide an interesting contrast to those of Lawrence Summers. While Summers is an indefatigable and uncritical supporter of complicated products like derivatives, ex-Fed chair Paul Volcker is deeply skeptical of them. Evidence of this skepticism is provided by a speech he gave in December 2009 to the Wall Street Journal Future of Finance Initiative in the United Kingdom. In this speech he said,

"I was listening to this and found myself sitting next to one of the inventors of financial engineering who I did not know, but I knew who he was and that he had won a Nobel Prize, and I nudged him and asked what all the financial engineering does for the economy and what it does for productivity. Much to my surprise he leaned over and whispered in my ear that it does nothing. I asked him what it did do and he said that it moves around the rents in the financial system and besides that it was a lot of intellectual fun." (5)

As Paul Volcker makes clear, derivatives don't provide any of the efficiency or capital allocation benefits that Summers ascribes to them. Summers' failure to see this obvious truth - even after the collapse of LTCM in 1998 - can only be described as willful.

Peter Schmidt

September 05, 2021

Sugar Land, TX

PS - As always if you like what you read, please consider registering with the site. It just takes an e-mail address, and I don't share this e-mail address with anyone. The more people who register with the site, the better case I can make to a publisher to press on with publishing my book! Registering with the site will give you access to the entire Confederacy of Dunces list as well as the Financial Crisis timeline. Both of these are a treasure trove of information on the crisis and the long-running problems that led to it.

Help spread the word to anyone you know who might be interested in the site or my Twitter account. I can be found Twitter @The92ers.

ENDNOTES:

1. "Treasury Secretary Lawrence H. Summers Testimony Before the Senate Committee on Agriculture, Nutrition, and Forestry on the CFTC Concept Release," July 30, 1998

https://www.treasury.gov/press-center/press-releases/Pages/rr2616.aspx

2. From the first, derivative products were controversial, even in the banking industry. Many bankers expressed great concern about the risks that derivative products would introduce into the financial system. In January 1992, Gerald Corrigan, the Governor of the Federal Reserve Bank of New York, cautioned Wall St. banks about the dangers of derivatives by telling them to 'take a very hard look at off-balance sheet activities' and later adding, 'I hope this sounds like a warning because it is.' Later that year, in September, Allan Taylor, Chairman of the Royal Bank of Canada, likened the market for derivatives as a 'time bomb that could explode just like the Latin American debt crisis (LDC) did, threatening the world financial system." Finally, Felix Rohatyn of Lazard Freres characterized the market for derivatives as "26-year olds with computers creating financial hydrogen bombs."

3. See Michael Lewis, The Big Short, Penguin Books, New York, 2010, p. 143;

'...Now he (Steve Eisman) got it: The credit default swaps, filtered through the CDOs, were being used to replicate bonds backed by actual home loan loans. "There weren't enough Americans with shitty credit taking out loans to satisfy investors' appetite for the end product...'They (Wall Street) weren't satisfied getting lots of unqualified borrowers to borrow money to buy a house they couldn't afford. They were creating them out of whole cloth - one-hundred times over! That's why the losses in the financial system are so much greater than just the subprime loans."'

4. John Meriwether was the managing partner of LTCM. After it collapsed he ruefully remarked,

"A hurricane is not more or less likely to occur because hurricane insurance has been written. In financial markets this is not true. The more people write hurricane insurance the more likely it is that the disaster will happen because the people who know you have sold the insurance can make it happen." (See James Grant, Mr, Market Miscalculates, Axios Press, Mount Jackson, VA, 2008, p. 348)

5. "The Only Thing Useful Banks Have Invented in 20-Years is the ATM," New York Post, December 13, 2009

https://nypost.com/2009/12/13/the-only-thing-useful-banks-have-invented-in-20-years-is-the-atm/