"You're Only as Smart as Your Dumbest Nobel Laureate Economist:" Paul Krugman and the Housing Bubble - Part I

Gordon Bethune, the former CEO of Continental Airlines, famously said of the airline industry, "you're only as smart as your dumbest competitor." The point being, any airline - no matter how well run - can be completely undermined by a competitor dedicated to increasing market share at the cost of profitability.

The exact same dynamic was seen during the housing bubble with the mortgage market. In this case, the dumbest competitor was the government sponsored enterprises (GSEs), Fannie Mae and Freddie Mac. Fannie and Freddie weren't just any competitors, they were the driving force in the mortgage market. Fannie Mae was created in 1938 as an 'emergency' response during the Great Depression. Like all emergency interventions by government, Fannie Mae long outlasted the emergency that spawned it. In 1968, Freddie Mac was conjured into existence to serve as an ersatz competitor to Fannie. The fact that the GSEs had been around so long begs the question, if Fannie and Freddie have been around for decades, how could they have been a driving force of the housing bubble? What changed?

The answer is quite simple and a direct consequence of President Clinton's 'strategy' to increase homeownership to 67.5%. The only way to achieve Clinton's goal for homeownership was for the GSEs to abandon their lending standards and to greatly expand the pool of borrowers who could qualify for a GSE mortgage. Prior to the Clinton administration fatal meddling with GSE lending standards, about 30% of GSE mortgages went to low and moderate income borrowers. However, Clinton's two HUD secretaries - Henry Cisneros and Andrew Cuomo - increased these amounts to 42% and 50% respectively. The most obvious manifestation of what an enormous mistake this was is, of course, the enormous losses the GSEs suffered on their mortgage portfolio when the housing bubble burst. In September 2008, both GSEs were essentially bankrupt and placed into conservatorship. They then received hundreds of billions in capital injections to make up for their enormous losses.

This obvious chain of causality between President Clinton's strategy to increase homeownership, the radical change in GSE lending standards required by this strategy and the housing bubble is lost on PhD economist and Nobel Laureate, Paul Krugman. Krugman estabilshes the housing bubble's 'point of maximum inflation' as the middle years of the 'naughties,' 2005. At this time, the share of mortgage securitization by the GSEs was falling. Because the GSE's market share was falling at the time the housing bubble was (supposedly) at its worst, Krugman argues the GSEs couldn't have had much to do with the housing bubble. (1)

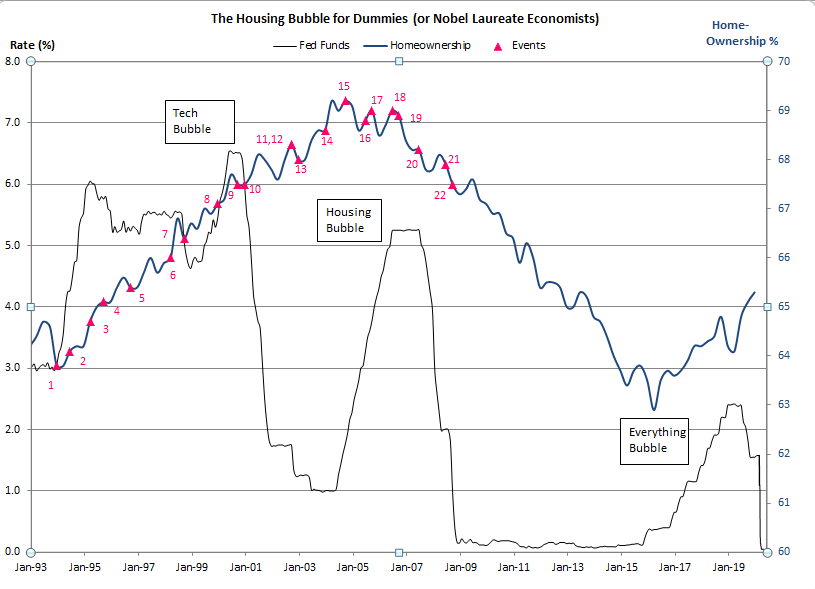

In this week's discussion, a brief overview of the government's and the Fed's enormous roles in fueling the housing bubble will be described in timeline fashion. With this established, next week's article will describe everything Paul Krugman gets wrong in dismissing the role the GSE's had in contributing to the enormity of the housing bubble.

Timeline and Chart

Key Events:

- 17 JAN 94 - President Clinton begins his 'strategy' to expand homeownership by signing Executive Order 12892 to 'affirmatively further fair housing' and establishing the President's Fair Housing Council.

- SEP 94: Mortgage banks sign 'best practices agreements' with the Department of Housing and Urban Development (HUD). The first mortgage bank to sign a best practices agreement, Countrywide Financial.

- 02 MAY 95: President Clinton announces the "National Homeownership Strategy: Partners in the American Dream." The strategy identifies one-hundred 'specific actions' to "lower the barriers that prevent American families from becoming homeowners." The strategy now reads like step-by-step instructions on how to destroy the US economy.

- DEC 95: The 'Affordable Housing' (AH) mandate is greatly increased. As a result of legislation from 1992, HUD has the authority to direct Fannie and Freddie to issue a certain amount of their mortgages to low and moderate income borrowers. Before President Clinton's 'strategy' to increase homeownership, about 30% of GSE mortgages went to low and moderate income borrowers. Here, President Clinton's HUD secretary, Henry Cisneros, directed the GSEs to increase this percentage to 42% by 1999.

- 05 DEC 96: Alan Greenspan delivers his 'Irrational Exuberance Speech."

- 06 APR 98: HUD secretary, Andrew Cuomo - now governor of New York - sues Accubanc Mortgage for discrimination in mortgage lending. He cavalierly dismisses the risk associated with the suit's outcome, "I'm sure there will be a higher default rate on those mortgages than on the rest of the portfolio." (3)

- 15 OCT 98: The 'most irresponsible act in Fed history,' Alan Greenspan cuts rates between FOMC meetings after LTCM collapses.

- 03 MAR 00: Fannie CEO Franklin Raines speculates on the prospect of HUD Secretary Cuomo increasing the GSE affordable housing mandate to 50%; "We have not been a major presence in the sub-prime market, but you can bet under these goals we will be." (See #4 above, December 1995, for description of the AH.)

- 30-31 OCT 00: On 30 OCT, Fannie's Jamie Gorelick pleads with bankers to make 'tough loans;' "some people have assumed we don't buy tough loans.....Let me correct that impression right now." The next day, HUD secretary Cuomo directs the GSEs, Fannie and Freddie, to have 50% of their mortgages go to low and moderate income borrowers by 2004. This decision guarantees a massive housing collapse. (3)

- 27 DEC 00: Paul Krugman, reduces the enormously complex US economy to the function of a single variable - the interest rate. "The point is recessionary tendencies can usually be effectively treated with cheap, over-the-counter medication: cut interest rates a couple of percentage points, provide plenty of liquidity, and call me in the morning." (4)

- 01 OCT 02: Paul Krugman celebrates the 'boom' in housing and the slashing of interest rates that was fueling it. "...So the Fed cut rates early and often; those eleven interest rate cuts fueled a boom in both housing purchases and mortgage financing, both of which helped keep the economy from experiencing a much more severe recession." (5)

- 24 DEC 02: Dr. Kurt Richebacher dismisses the US economy as a house of cards; "The US financial system today hangs in a precarious position. It's a house of cards built on nothing but financial leverage, credit excess, speculation and derivatives."

- 04 FEB 03: Countrywide's Angelo Mozilo delivers the prestigious John T. Dunlop lecture to Harvard's Joint Center for Housing Studies. In this lecture he cites downpayments as the "perhaps the greatest barrier to homeownership" and calls for eliminating them. Mozilo goes on to thank Franklin Raines and the "entire team at Fannie Mae" for supporting Countrywide's goal of issuing hundreds of billions of dollars in mortgages to "previously underserved Americans." (6)

- 20 FEB 04: Ben Bernanke delivers a speech where he claims central banks have been a "source of moderation." He makes this speech just two-months before the housing bubble - which is being fueled by the Fed's low interest rates - peaks.

- 21 DEC 04: Politically-connected heavyweight Franklin Raines is forced to resign as Fannie Mae CEO. His resignation was prompted by Fannie Mae overstating profits by at least $6-billion.

- 27 JUN 05: Barney Frank delivers a speech in congress where he contemptuously dismisses the prospect of a housing bubble and promises to continue to 'push for homeownership.' (7)

- 07 OCT 2005: Two Fed economists look into whether there is a housing bubble. Their conclusion? Home prices are 'high but not yet out of line.' (8) In terms of homeownership, the housing bubble peaked in April 2004.

- 08 SEP 06: Grant's Interest Rate Observe judges trillions of dollars of asset-backed securities as overvalued. In a subsequent issue, Grant's describes the features to look for in a mortgage bond that make it likely to collapse and thus short.

- 13 NOV 06: Peter Schiff delivers a speech to mortgage bankers and predicts the "bottom will drop out of the sub-prime market." (9)

- 03 AUG 07: CNBC's Jim Cramer delivers his 'they know nothing tirade' against the Fed and screams at the Fed to "open the darn Fed window." Perhaps the best example of the financialization of the US economy and its total dependence on Fed succor and support.

- 14-16 JUL 08: Barney Frank claims "Fannie and Freddie are fundamentally sound....They are not in danger of going under...Looking at the financials they are solid." Bernanke says of the GSEs, "They will make it through the storm and in no danger of failing."

- SEP 08: Fannie and Freddie collapse (05 SEP) and Lehman fails (15 SEP)

Concluding Remark:

As indicated here, it wasn't a coincidence that there was an enormous housing bubble shortly after the Clinton administration pursued a goal to increase homeownership to 67.5%. In next week's article, Paul Krugman's complete ignorance of this obvious causality will be discussed.

Peter Schmidt

Sugar Land, TX

August 02, 2020

PS - As always if you like what you read, please consider registering with the site. It just takes an e-mail address, and I don't share this e-mail address with anyone. The more people who register with the site, the better case I can make to a publisher to press on with publishing my book! Registering with the site will give you access to the entire Confederacy of Dunces list as well as the Financial Crisis timeline. Both of these are a treasure trove of information on the crisis and the long-running problems that led to it.

Help spread the word to anyone you know who might be interested in the site or my Twitter account. I can be found on Twitter @The92ers

ENDNOTES:

1. "Things Everyone in Chicago Knows," New York Times, June 03, 2010 https://krugman.blogs.nytimes.com/2010/06/03/things-everyone-in-chicago-knows/?_php=true&_type=blogs&_r=0

2. See the 45-second mark; https://www.youtube.com/watch?v=9TWOPDN5Va0

3. HUD News Release 00-317, October 31, 2000 https://archives.hud.gov/news/2000/pr00-317.html

4. Paul Krugman, "Reckonings; We're Not Japan," New York Times, December 27, 2000 http://www.pkarchive.org/column/122700.html

5. Paul Krugman, "Dealing with W," New York Times, October 01, 2002, https://www.nytimes.com/2002/10/01/opinion/dealing-with-w.html

6. Angelo Mozilo, Presentation to the Joint Center for Housing Studies of Harvard University, February 04, 2003, see pages 8 and 13. https://www.jchs.harvard.edu/sites/default/files/m03-1_mozilo.pdf

7. https://twitter.com/The92ers/status/1283003732087775237

8. Jonathan McCarty and Richard W. Peach, "Is there a Bubble in the Housing Market Now," https://papers.ssrn.com/sol3/papers.cfm?abstract_id=923867

9. Start at the 7:40 mark; https://www.youtube.com/watch?v=xNKs8lBnd2U